Owning a vacation home in South Lake Tahoe could become more expensive if residents approve a ballot measure that imposes a tax of up to $6,000 on housing units that are left vacant for more than half a year.

The measure, called “South Lake Tahoe Vacancy Tax”, aims to penalize owners who leave thousands of empty homes in the mountain tourist city; tax penalties would go toward affordable housing, road repair and public transportation. The move is an attempt to incentivize landlords to rent properties rather than leave them empty.

Locals for Affordable Housing, the nonprofit leading the initiative, said it collected nearly 2,500 signatures to place the tax measure on the November ballot, more than the 1,159 needed.

“Since January, we have connected with thousands of community members outside of local grocery stores and in neighborhoods across the city and received widespread support and gratitude that something was being done to address the skyrocketing cost of housing,” said Nick Speal, co-founder of the nonprofit organization. “The housing crisis has reached a tipping point, and locals have been forced to leave the community due to a critical shortage of affordable housing.”

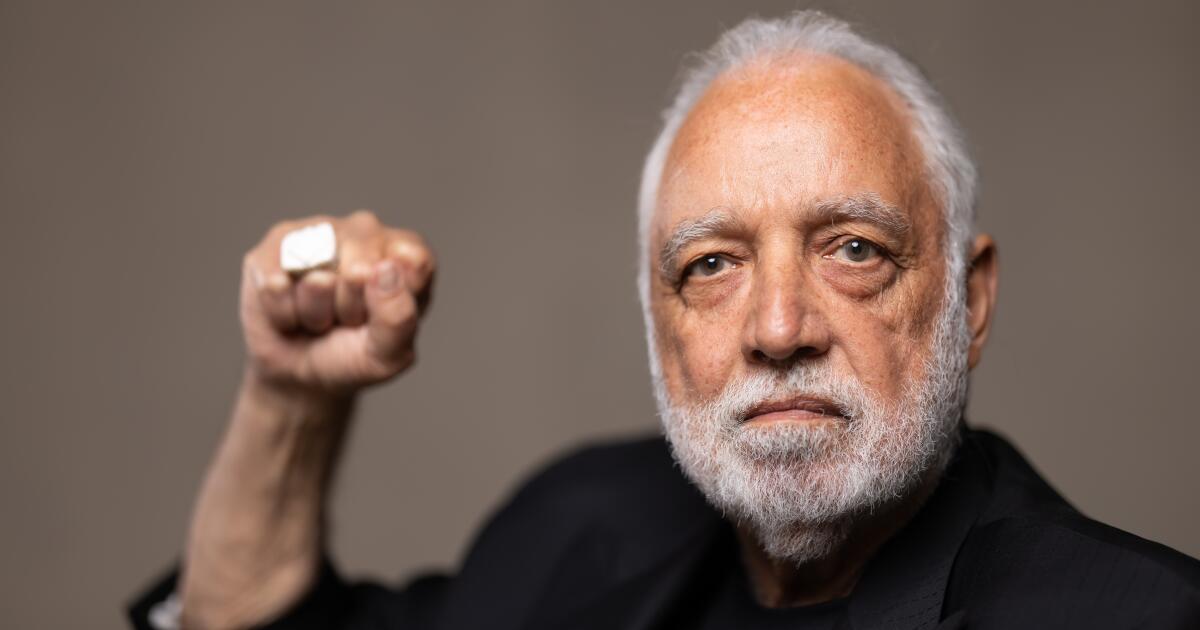

In South Lake Tahoe, Locals for Affordable Housing collected more than 2,000 signatures to place a vacant housing tax measure on the November ballot. If approved, the city will tax between $3,000 and $6,000 on housing units that remain empty for more than half a year.

(Courtesy of Locals for Affordable Housing)

South Lake Tahoe is the latest California city to consider a tax on vacant homes as a way to address the housing shortage. Oakland, San Francisco and Berkeley have approved similar initiatives; Santa Cruz voters rejected one two years ago. Los Angeles considered a vacancy tax four years ago, but it got nowhere.

Amelia Richmond, who founded Locals for Affordable Housing with Speal, said the tax proposal in South Lake Tahoe is modeled after the Berkeley initiative. If approved, the city would impose a $3,000 tax on homes left vacant for more than six months in a year, and $6,000 each year thereafter for repeat offenders. The law, which would take effect in 2026, would exempt properties undergoing renovation, seasonal cabins, homeowners in senior care facilities, those working as wildland firefighters and residents on deployments military.

In South Lake Tahoe, just over 40% of housing units are used as vacation homes or rentals. In total, there are 16,275 units and 7,150 remain empty for most of the year, according to the 2022 American Community Survey and city records.

Proponents say that if 20% of those homes were sold or rented to local residents for six months or more, about 1,430 housing units would be added, while taxes on the remaining vacant homes would generate more than $34 million each year to affordable housing, road repair and essential services.

A 2022 survey conducted by the Tahoe Prosperity Center, a nonprofit that conducts economic and development research in the Lake Tahoe Basin, found that median home prices had tripled in nine years, from $345,000 in 2012 to $950,000 in 2021, well above what people in the region can pay.

In South Lake Tahoe, the median household income is $67,686, below the state's $91,905, according to the U.S. Census Bureau.

Researchers at the center noted in 2021 that the region had seen a drop in the number of year-round residents and school enrollment, and a younger workforce. They correlated these decreases with the real estate crisis.

But the proposed tax measure has created a wedge between townspeople, especially second-home owners and young workers who say the lack of housing options, low wages and high costs of living are shutting them out of the economy. region.

In an effort to defeat the measure, a coalition of residents, small business owners and real estate agents have formed a coalition called Stop the vacancy tax in South Tahoe.

“After all the promises from supporters of this measure, voters will be surprised to hear that nothing in this proposal requires the city to produce a single new unit of affordable housing, or even spend a single penny on affordable housing.” the group's website says. “We all want to address housing affordability in South Tahoe, but this measure is not the answer and will likely make things worse.”

Steve Teshara, co-founder of the coalition, said construction of affordable housing in South Lake City has been limited by development standards that dictate where and how much of the area the city can build.

Teshara said a 248-unit affordable housing project now under construction was only possible because of a executive order by Gov. Gavin Newsom that opened some types of state land for affordable housing development.

Teshara believes city leaders are doing everything they can to provide housing.

“But just throwing money at the problem when there's not enough zoned land or not enough density allowed in certain areas is not going to solve the problem, and that's our main concern,” he said.

He and others say the measure is a form of taxation without representation, because homeowners who don't live in South Lake Tahoe won't be able to vote on the measure in November. Opponents also question the city's ability to enforce the new law.

Richmond said she is concerned that second home owners will try to register to vote using their South Lake Tahoe addresses even if they do not live there full time, which is a violation of election laws.

The division over the measure was visible when residents spoke during a three-hour City Council meeting in February.

“This city has been and always will be 40% owned by second home owners,” Dan Brown, a longtime resident, told the council. “This is what this town has been for. [a long] time.”

Dan May, another longtime resident, said he supported the initiative because he thought it was fair.

“It gives homeowners a choice, a choice to live here and participate in our community or pay additional taxes to help support the community they love,” he said. “And if they don't agree with them, they have the ability to sell them to someone who does agree with those options.”

Some speakers said the measure placed an unfair burden on them to solve the region's housing crisis. They urged city leaders to find alternative options, such as loans and turning to state programs to renovate abandoned buildings.

Christopher Rowe, a buyer for an outdoor department store who has lived in South Lake Tahoe for more than 30 years, said that while he understood both sides, he supported the measure.

“The Tahoe Property [bought] 30 or 50 years ago, if the vacant home tax passes, which I hope it does, it will cost you a little more to keep it empty,” Rowe said. “But if you really care about South Lake Tahoe, you should be fine contributing a little, because you have an empty house, and there's no real way to deny that keeping an empty house is undermining the community and causing a slight disservice. .

“When you get 40% of the houses to do that, it makes a difference,” he added.

Richmond said the move is not intended to divide the city, but rather is an effort to preserve what she considers a more livable mountain resort than others where residents and workers have been excluded, such as Aspen, Colorado, and Jackson Hole. Wyoming.

“It's not about residents versus second home owners,” he said. “It's about making it a community for all of us and making it sustainable and not following the trajectory of these other tourist cities.”