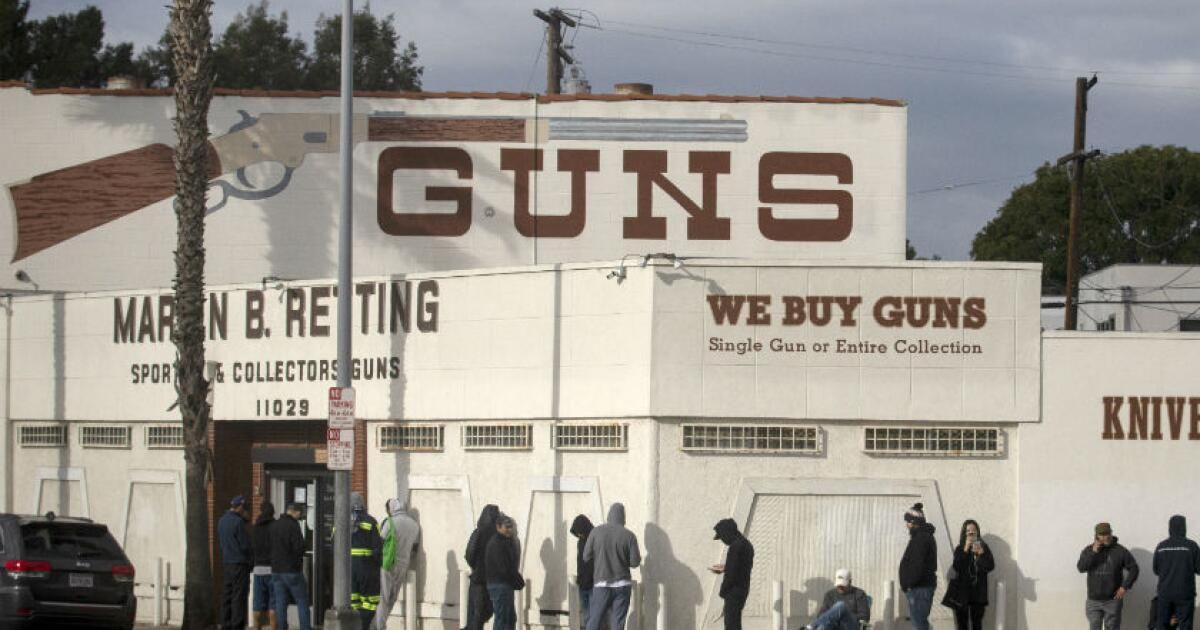

Gun rights groups on Tuesday filed a Second Amendment challenge to a new California law that imposed an additional tax on firearms and ammunition sales in an attempt to reduce gun violence.

The Firearms Policy Coalition said it filed the complaint on behalf of its members in San Diego County Superior Court. Other plaintiffs included the National Rifle Assn., the California Rifle & Pistol Assn. and the Second Amendment Foundation.

The new tax law (Assembly Bill 28), which took effect Monday, imposes an 11% excise tax on the sale of firearms, firearm parts and ammunition. It is expected to generate $159 million in its first year to help fund state gun violence prevention and gang intervention programs.

The lawsuit, which seeks to block the new law, argues that the excise tax violates the Second Amendment because it is a special tax on gun owners. It claims that the U.S. Supreme Court “has repeatedly held that constitutional rights cannot be subject to excise taxation.”

“Here, California effectively seeks the power to destroy the exercise of a constitutional right by singling it out with an excise tax,” the complaint reads. “If this tax is permitted, nothing will prevent California from imposing a 50% or even 100% tax on a constitutional right it disapproves of, whether it be the right to keep and bear arms, the right to the free exercise of religion, or any other right.”

The California Department of Tax and Fee Administration, a defendant in the case, said it does not comment on pending litigation.

Brandon Combs, president of the Gun Policy Coalition, said that “the gun tax is a modern Jim Crow law that targets people and rights hated by tyrants like Gov. Gavin Newsom.”

“California’s gun excise tax is a blatant and egregious attack on the rights of Californians and a calculated move to dismantle the Second Amendment,” said Randy Kozuch, executive director of the NRA’s Institute for Legislative Action.

Daniel Villaseñor, a spokesman for the governor's office, said the cost of gun violence far exceeds the cost of the tax.

“This is a modest investment in gun violence prevention programs that have been proven to work,” she said. “There’s a reason California ranks number one in gun safety, and we will not back down from advocating for common-sense policies like this that help save lives.”

The lawsuit was also filed on behalf of two licensed gun owners: Danielle Jaymes, a San Diego County resident, and Joshua Gerken, an Orange County resident.

“The individuals are probably members of all the associations that are also plaintiffs,” said CD Michel, a lawyer for the plaintiffs.

The couple purchased mostly ammunition for training and self-defense hours after the law went into effect on July 1, according to the complaint.

The suit claims Jaymes also planned to buy a handgun — a Sig Sauer P365 XMacro, a subcompact semi-automatic pistol — but put it off because of the increased cost from the tax. He is now saving money to buy it.

“Ms. Jaymes would purchase this gun in the next few weeks if it did not cost 11% more,” the complaint reads.

Gerken, an NRA member and occasional firearms instructor at local shooting ranges, said he buys ammunition once a month but may have to cut back because of the new tax, according to the complaint.

The U.S. Supreme Court on Tuesday rejected a group of Second Amendment challenges to an Illinois state law banning the sale of rapid-fire assault weapons. Had the court accepted the appeals, it would also have threatened California’s longstanding ban on most rapid-fire assault rifles.

The justices' decision means that challenges to the Illinois ban will continue to be heard in lower courts.

Separately, the 9th U.S. Circuit Court of Appeals in San Francisco is considering a Second Amendment challenge to California’s ban on assault weapons. A federal judge in San Diego declared the ban unconstitutional last year, saying assault rifles are “commonly owned and kept for lawful purposes,” and the 9th Circuit agreed to hear the state’s appeal.