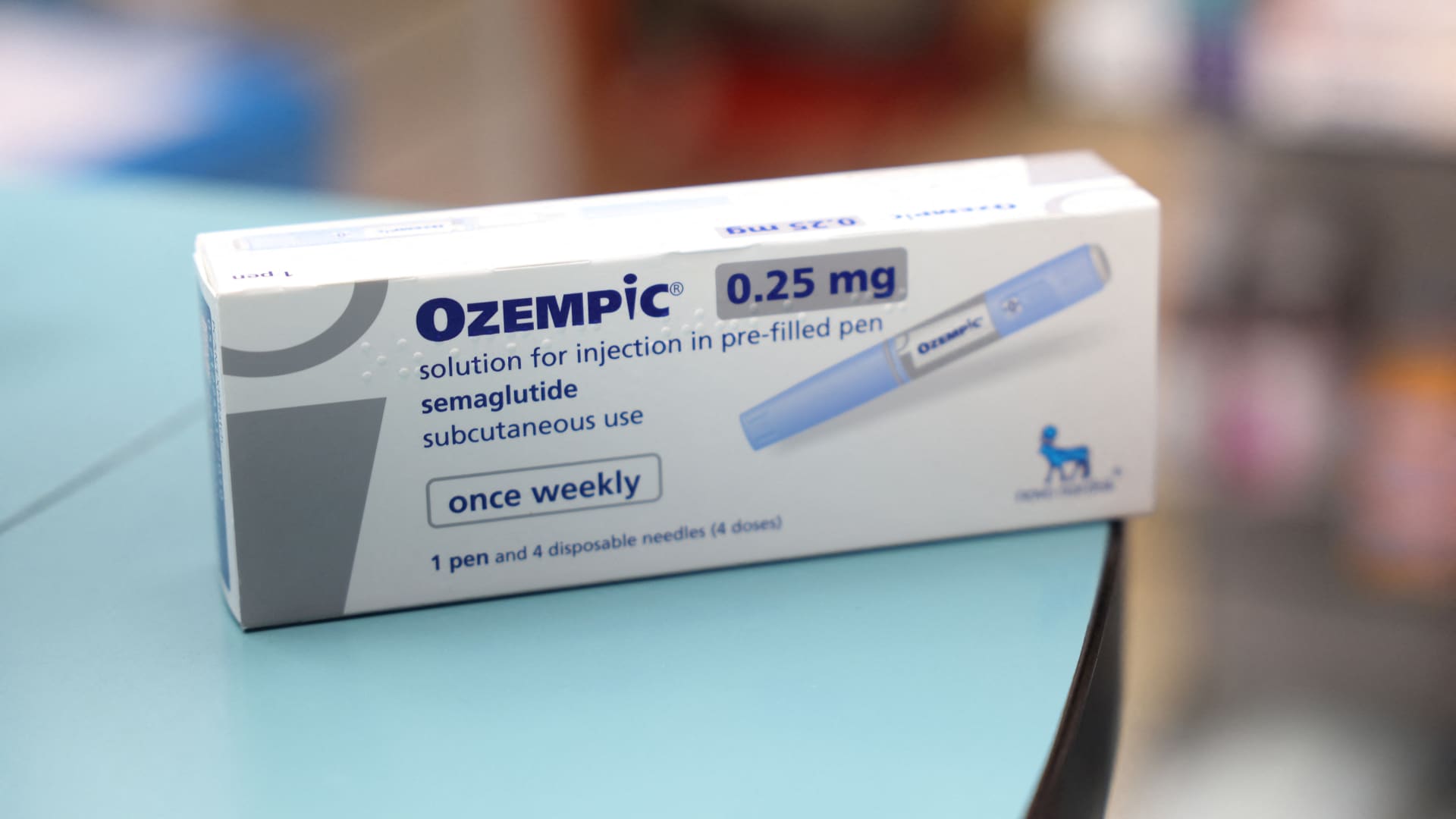

If you want to understand how different the human and animal drug and vaccine industries have historically been, you don't need to look much further than weight loss drugs.

On the human side, Nordisk and Eli Lilly struggled to meet demand for Ozempic, Wegovy, Mounjaro and Zepbound, respectively, since their introduction, as the popularity of these diabetes treatment and weight loss drugs increased in 2023. Other drug manufacturers, such as Pfizer and AstraZenecahave outlined their strategies for entering a market that could be worth tens of billions of dollars over the next decade, as small pharmaceutical companies try to get a piece of what has become the hottest part of healthcare. .

Comparatively, the first drug designed to combat obesity in dogs was eventually withdrawn from the market in 2014 due to lack of interest.

“I think I had one of the only dogs that were there, and I'm going to sound really bad when I explain why,” he said. zoetis CEO Kristin Peck, named CEO in 2020 and named to the inaugural CNBC Changemakers list on Wednesday. “I don't think a lot of people would want to give their dogs weight-loss medication because if your dog is overweight, you have to admit that the reason is probably because he's not walking it and he's feeding it too much.”

As the saying goes, dogs, and pets in general, have long been considered man's best friend. But pet pharmaceuticals haven't always matched that, and often a tick or flea collar was the only preventive medication many pets saw, aside from necessary vet visits.

But Peck said he has seen a change in the mindset of pet owners, as well as a change in the pharmaceutical pipeline, which is bringing animal medicine closer to human medicine.

“New generations view their pets very differently than older generations,” Peck said. “Fifty or sixty years ago, your dog was in the backyard; now it has moved into your house, often into your bed, and sometimes replaced your children: your dog or cat has a stroller, a backpack, and a suit”.

When Pfizer spun off its animal health business in 2013 and created Zoetis, about 65% of the company's business was related to livestock. That has now changed, as 64% of the company's revenue comes from products for companion animals such as dogs and cats.

Peck has maintained the company's emphasis on innovation, developing products in pet categories that did not exist before.

For example, the company earned more than $1.3 billion in revenue from dermatology-related medications for dogs and cats in 2022, compared to less than $1 million for products in that same category in 2013. The company's top product company in that category is Apoquel, which is designed to treat dogs suffering from allergic itch and dermatitis.

“When we said we were going to have dermatology, [the reaction] was that dogs don't need dermatology, they take a little Benadryl if they get itchy,” Peck said. “But we said we think we can create a market, and now have over $1.3 billion in dermatology sales, if I told you that “It was even remotely possible five or six years ago you would have said it was crazy.”

Peck credits the Pfizer spinoff with allowing Zoetis to better balance what the company wanted to do in animal health and human health. “We only have one customer, and we only think about that every day and with every dollar we spend, whether it's R&D, commercial or manufacturing,” he said.

This approach has led to the next product that Zoetis and Peck are banking on becoming a billion-dollar franchise: treating osteoarthritis pain in dogs and cats.

In May, the FDA approved Librela, which is a monoclonal antibody treatment that can provide long-term control of OA pain symptoms in dogs, improving their mobility and overall quality of life. According to Zoetis, 40% of dogs show signs of OA, which can make it difficult for them to go up or down stairs, hesitate when jumping, limp after exercise, and become more withdrawn.

A similar product was approved for cats, marking the first time that monoclonal antibody treatments, which have become increasingly popular to treat human diseases, have been used to treat osteoarthritis pain in pets.

“You can't make a monoclonal antibody for dogs in a human health facility, so you have to be willing to spend capital during clinical trials, and that's a bold, capital-intensive decision,” Peck said. “We've shown that pet owners will pay if they find a product that has value.”

While Zoetis is focused on bridging the gap between human and animal health products, Peck said the company also aims to address some of the unique differences, such as the diagnostic process.

“People with osteoarthritis go to the doctor, they get medications so they can live healthier, longer, better-quality lives,” Peck said. “But if my hip is killing me but no one knows because I don't limp, it's like assuming your dog doesn't have osteoarthritis because he doesn't limp.”

In June 2022, Zoetis spent more than $50 million to acquire pet care genetics company Basepaws, which produces DNA tests for dogs and cats focused on health and early detection of disease risks.

“We will be able to prolong life by looking at genetics and biomarkers to make diagnoses,” Peck said. “We will be able to improve our predictions, which will greatly improve the quality of life for animals that can't speak and can't say they feel some of the things they feel.”

Artificial intelligence is also helping with that. Cats generally receive less medical care than dogs because of the difficulty many owners face in taking them to the vet, Peck said, so Zoetis has invested in artificial intelligence technology that will allow cat owners to record their cats' movements. , upload those videos and have the AI analyze them. to see if the cat has any osteoarthritis problems.

Peck said Zoetis will continue to focus on innovative approaches to animal health, taking some cues from human health but also forging its own path to address the unique challenges that arise from caring for dogs and cats.

Unlike 2014, could there now be a working Ozempic for dogs and cats? Peck said the company is looking to address challenges related to cardiology, diabetes and weight loss in pets.

“Many of the same technologies will work in both humans and animals,” Peck said. “And from animals to humans.”