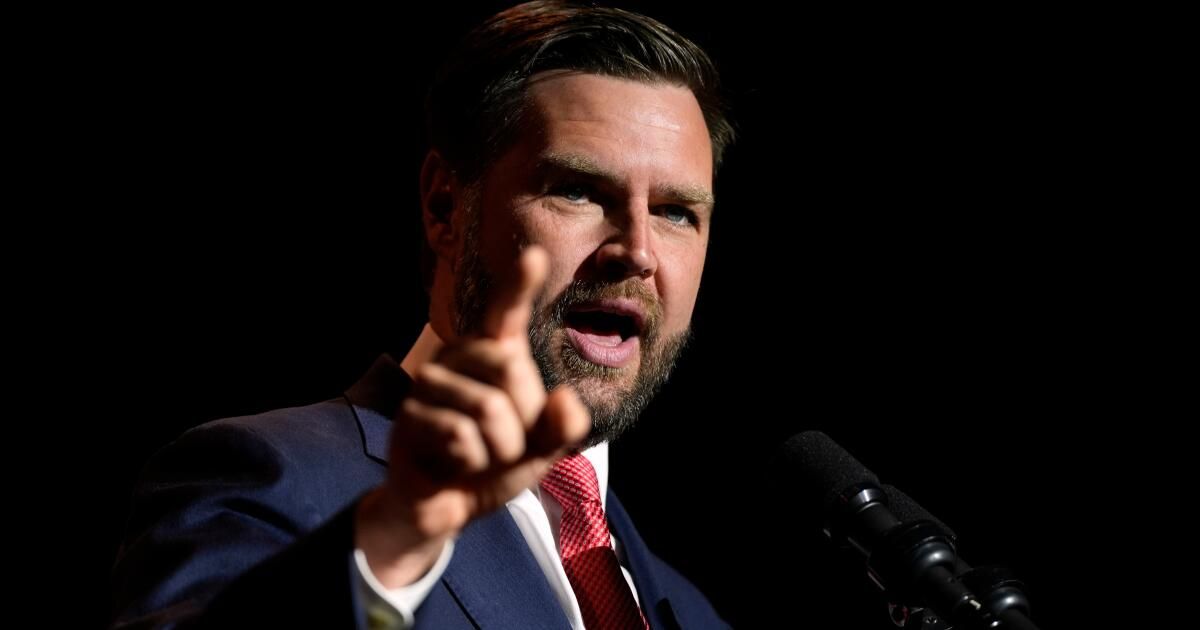

Republican vice presidential candidate JD Vance told Megyn Kelly last month that Democrats are calling for an end to the Child Tax Credit because they are “anti-family and anti-children.” Vance, who has sparked controversy for calling Democrats the party of “childless cat ladies,” said, “We should be sending a signal to the culture that we are the pro-family party and we’re going to back that up with real policies. We are the party of parents, we are the party of children.”

Republicans are using Vance's rhetoric on children and families to convince voters to elect them in November, but they are failing to get behind it. In fact, they are actively opposing important legislation to help children and parents.

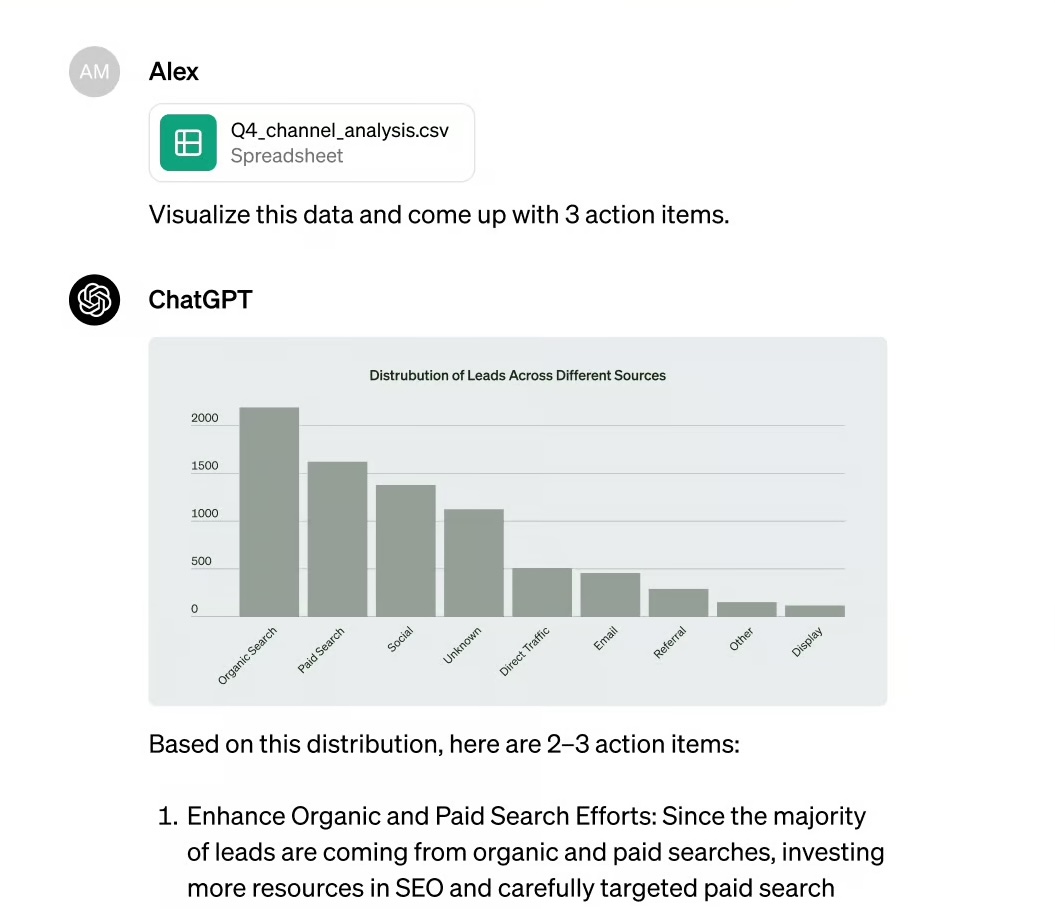

Thursday, Senate Republicans blocked a bill that would expand the Child Tax Credit —the same policy that Vance has advocated and has just accused Kamala Harris opposed it. Vance did not show up for the vote. Rejecting the proposal was a loss for an estimated 16 million children from low-income working families, who would have benefited from roughly $700 in tax relief this year. Dear Data from the Center on Budget and Policy Priorities show the proposal would have lifted at least 500,000 children out of poverty and increased the family incomes of at least another 5 million poor children.

The Child Tax Credit is not only the most effective policy tool for lifting children out of poverty, it is also one of the most popular legislative proposals in the country right now. The current bill had bipartisan support when it passed the House of Representatives in a 357-70 vote in January. Vote Sixty-nine percent of Americans supported the proposal, including 80 percent of Democrats, 59 percent of Republicans and 63 percent of independents. The legislation even included tax cuts for some companies' research and development activities, as well as investments that Republicans have long sought.

Influential business groups succeeded clear who wanted the bill to pass, but Republican leaders managed to prevent it from coming to a vote, even with a Senate majority in favor, because 60 votes are needed to break the filibuster.

The main reason Republicans killed the Child Tax Credit measure appears to have little to do with politics. Iowa Senator Charles E. Grassley said the silent part out loud in January when he said: noted that could “make Biden look good.”

Republicans also fought the larger temporary expansion of the Child Tax Credit that passed in 2021. That legislation was historic and poverty among children was reduced Tax increases on big businesses have been cut by 44%, their lowest level on record during his tenure. But over the past three years, the party has shown it remains committed to an economic program that prioritizes tax cuts for big corporations over the well-being of children and families.

At the same time, the Republican Party has blocked legislation to build a universal preschool systemenact paid family and medical leaveexpand child care subsidies and get better home care For seniors and people with disabilities.

Republicans want to have it both ways: promote their pro-family agenda while blocking pro-family legislation.

Democrats should not simply mock Vance’s “childless cat lady” comments or rely on legal cases, including felony convictions, to make their case in the final months of this election campaign. The party’s candidates should make clear who is standing up for children and who is standing up for parents.

Increasingly, Republicans are framing the issue of parenting as an existential question. They say focusing on policies for children and families demonstrates a commitment to the future.

This is a debate that Democrats should welcome and can easily win.

Justin Talbot Zorn is a senior advisor at Center for Economic and Political Research. Marco Weisbrot He is co-director.