The United States addresses a critical situation. Many provisions of the 2017 tax and job cuts law will expire this year. The Congress could leave them lagar, but that would mean a large and economically harmful tax increase for most Americans. Legislators could cause all cuts to be permanent, but without income compensation that deepened the disastrous debt load of the nation.

There is a more specific and responsible way to deal with this fiscal dilemma.

It is a common mistake and politically fed on reducing taxes without also talking about our fiscal situation. We have a debt of $ 37 billion, with $ 59 billion in a decade, and after years of alarming growth, the annual expenditure deficit is approximately $ 2 billion. We must also deal with the imminent rights crisis, and interest payments on government debt are the fastest growing budget. The times are changing, making fiscal responsibility more crucial than ever.

While the initial cost of tax cuts in 2017 was $ 1.5 billionOn paper, to make them permanent it could cost $ 4.6 billion. The real cost must be cheaper, since projections underestimate a probable increase in taxable income, investment and growth. But we must not deny that there is a significant cost.

There are also many lessons to learn from the 2017 reform. The first is that not all tax cuts are equally pro-recess. As such, we must make the most permanent progressive provisions and allow others to expire or extend in the short term.

To the extent that the 2017 cuts stimulated growth and the highest income, that was mainly the product of the permanent reduction of the corporate tax rate from 35% to 21%. This provided companies with long -term certainty, encouraging investment, capital formation and salary growth. Unlike temporary tax cuts, which lead to short -term increases, but create uncertainty, a lower permanent rate allows companies to plan, expand operations and increase productivity.

Paired with the soon to expel provision that allows companies Totally expense Its investments, permanent corporate cuts attracted more national and foreign investments, which led to greater economic production and employment creation over time.

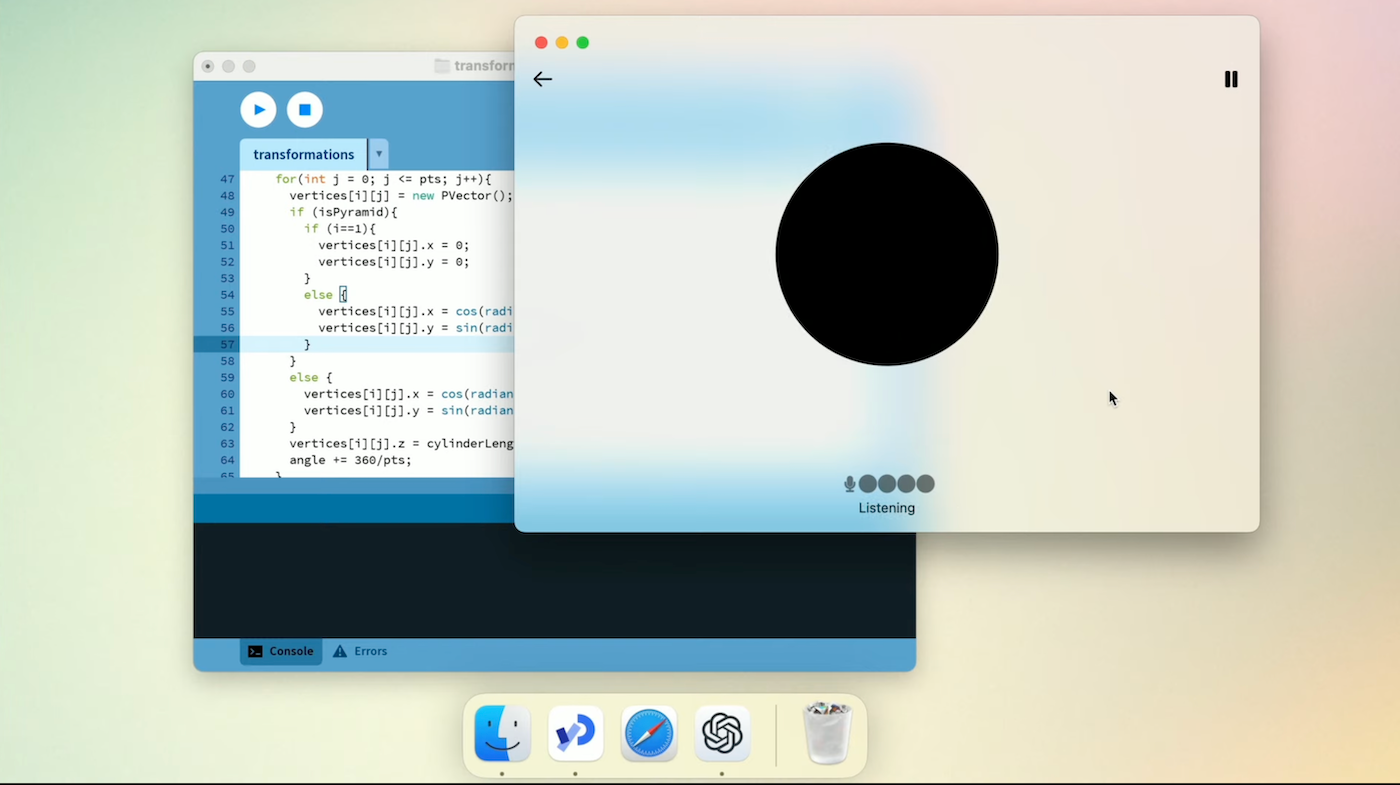

A new HOOVER institution study It reveals that companies respond more to corporate taxes than was previously thought. Analyzing the 2017 cuts, Kevin Hassett (the new director of the National Economic Council), Jon Hartley and Josh Rauh, discovered that a single percentage reduction in the cost of capital can boost investment rates of up to 2.4% , overcoming the previous estimates.

The Congress should, therefore, prioritize the total spending of permanent capital investment. It could also extend it to investments in structures.

Similarly, cuts to the tax rates of individuals must be made permanent. This provision encourages work, savings and investments, especially for high income, promoting a more dynamic and resistant economy. Recent investigation By Rauh and Ryan Shyu on California's tax increases, it shows how much more sensitive are high -income filing archivators to qualify changes in what most of the investigation generally implies. Economists analyzed taxpayers' responses after proposition 30 increased marginal tax rates by up to three percentage points for high -income households. As a result, an additional 0.8% of these taxpayers left the State, and those that remained reduced from taxable income, eroding up to 61% of the expected income within two years. This sensitivity to high tax rates and our progressive The Federal Fiscal Code means that letting the individual tax cuts expire will have a greater impact than the projected, and extend them will have an impact of deficit less than most fears.

While the economy is direct, the rules of Congress are not. Budget conciliation is a special process that allows Congress to approve taxes, expenses and debt related to a simple majority of the Senate, without going through the filibuster. But it is limited to budgetary matters by the Byrd rule and cannot increase the deficit beyond a 10 -year window without compensation.

That leads us to the second lesson: legislators should make permanent provisions of increased revenue of the 2017 measure and reduce some expenses as well.

Extend the limits placed in the deduction of the state and local tax (salt) and the deduction of mortgage interests, and the elimination of personal exemption (an exclusion of $ 4,050 per home of taxable income) would generate significant income, rather than cover the cost of the most growth oriented tax cuts. The Congress also needs to eliminate other tax exemptions, such as the deduction of corporate salt, energy subsidies and incentives for stadiums, just to name a few and reduce other expenses for it to work.

Finally, all other provisions, more expensive and less growth (although popular) must be extended temporarily. These include the expansion of child tax credit, the largest standard deduction and minimal tax reductions, which could expire in a few years instead of being permanent. That would help manage the deficits while it gives time for Congress to debate to each one.

A similar approach could be applied to the new tax exemptions proposed by Trump on tips, payment of overtime and social security benefits, which are not growth and could Cost $ 5 billion for a decade.

A majority of a vote of the Republican Chamber makes the process of extending tax cuts even through challenging reconciliation. Establishing priorities and strict guidelines should help do the job. However, the key to success will be to support the growth of the economy without balancing the deficit and debt.

Veronique de Rugy He is a senior research member at the Mercatus Center of the George Mason University.