The pair rose to 0.6650 on Wednesday following the release of Australian economic data. Australia's consumer price index (CPI) accelerated to 3.6% year-on-year in April, up from 3.5% in March. This slight rise in inflation could cast doubt on the Reserve Bank of Australia's (RBA) future interest rate decisions.

Despite the pick-up in inflation, it is unlikely to significantly affect the RBA's interest rate plans. According to official forecasts, the RBA does not plan to cut rates before May next year. The minutes of the last RBA meeting indicated that while the Board was considering the possibility of a rate hike in May, it ultimately decided to maintain a stable monetary policy.

The RBA has expressed concern that recent statistical data could keep inflation above the target level for an extended period. However, the central bank's current stance is wait and see, suggesting that no immediate changes to its policy are planned in response to the latest inflation figures.

Additionally, recent retail sales data showed a marginal improvement of 0.1% month-on-month in April from a 0.4% decline in March. Despite this positive change, the figures fell short of the expected 0.3% increase, disappointing the economic outlook.

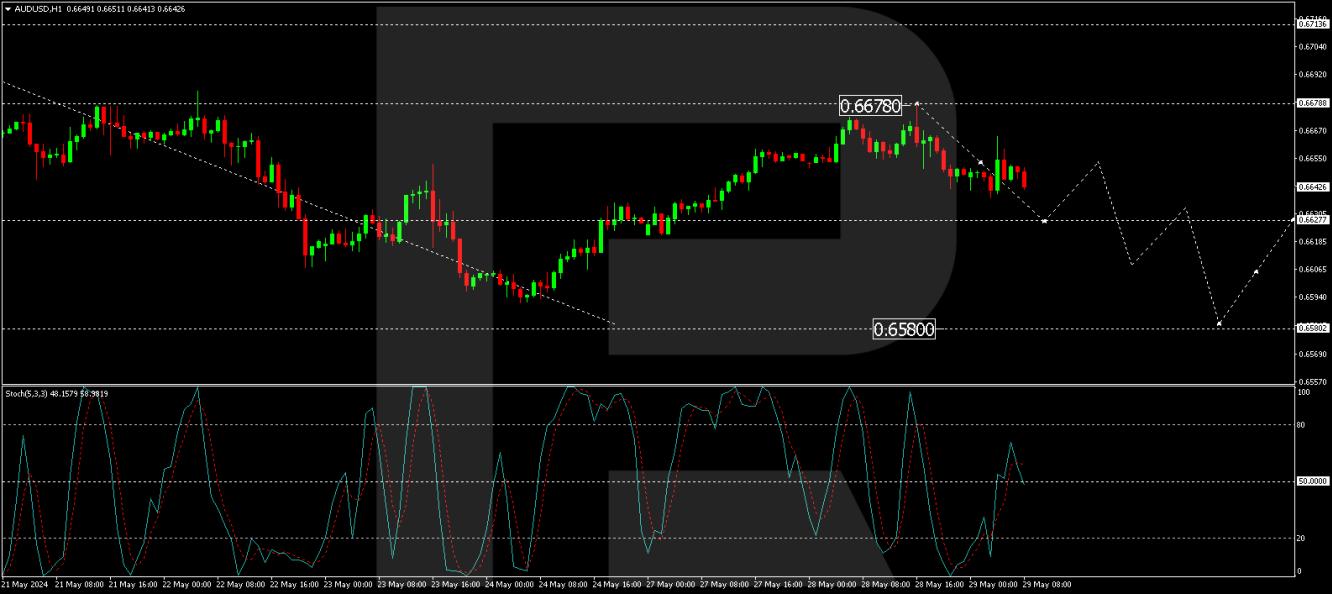

AUD/USD Technical Analysis

According to the H4 chart, AUD/USD has completed a correction and is forming a new wave of decline towards the 0.6620 level. A consolidation range is expected to form once this level is reached. A downward break from this range could lead to a further decline to 0.6580, the local target. A corrective move to 0.6626 (testing from below) and then a drop to 0.6547 could follow. The objective of the downtrend is the first. The bearish indicator technically supports this MACD scenario, with its signal line above zero but directed downwards.

On the H1 chart, AUD/USD is forming a descending structure to 0.6627. After reaching this level, there could be a possible rise to 0.6650. A further decline to 0.6620 is also possible, and a break below this level could open the possibility of a decline to 0.6608, with the possibility of extending the trend to 0.6580. This scenario is technically confirmed by the stochastic oscillator, whose signal line is currently above 50, but is expected to fall to 20, indicating a possible continuation of the downtrend.

Summary

Despite mixed economic indicators, the appreciation of the Australian dollar highlights the complex dynamics affecting the currency. The RBA's cautious stance appears to be an important factor in stabilizing the AUD, even as inflation rises slightly. Technical analyzes suggest a short-term bearish outlook, with the possibility of corrective movements. It is critical that investors and traders closely monitor these levels and stay abreast of global economic developments so they can adjust their strategies accordingly.

By RoboForex Analysis Department

Disclaimer

Any forecast contained herein is based on the author's personal opinion. This analysis cannot be considered trading advice. RoboForex assumes no responsibility for trading results based on the trading recommendations and reviews contained herein.