NEWNow you can listen to Fox News articles!

First in Fox: The Texas representative, Nathaniel Moran, is turning tariffs into a debt reduction tool, presenting legislation that would channel billions in new commercial income in a fiduciary fund only intended to reduce the amazing national debt of $ 37 billion of $ 37 in the United States.

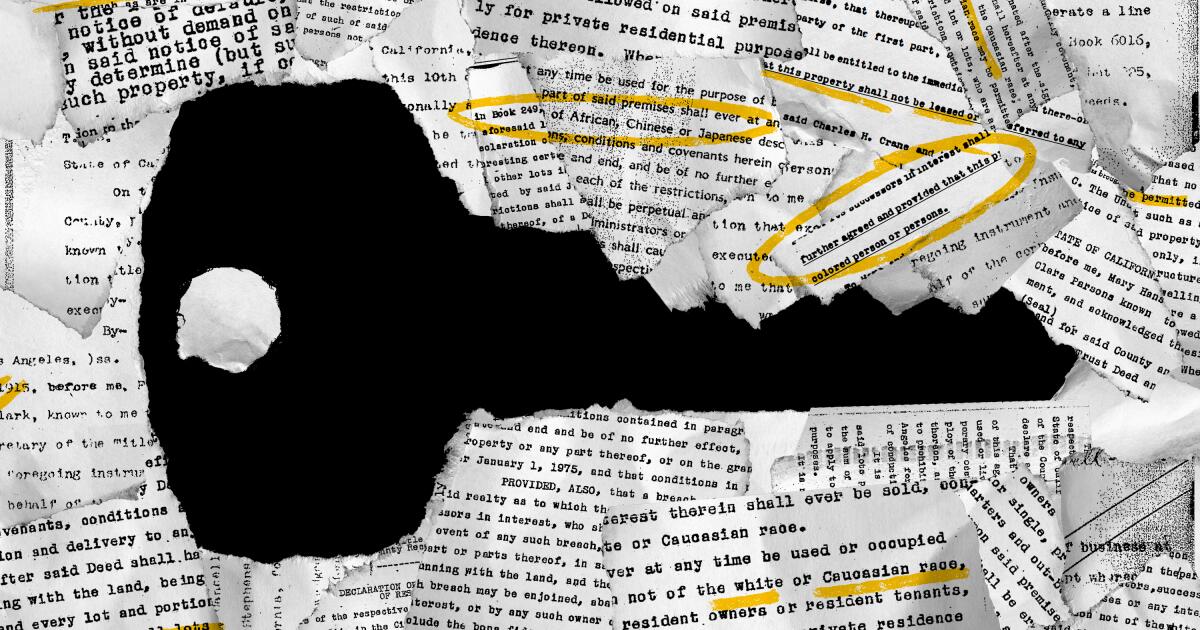

The tariff income used to ensure tomorrow's law (trust) would establish a special account in the Treasury Department called Trust Fund. From fiscal year 2026, any tariff money collected above the reference level 2025 would automatically enter this fund. By law, that money could only be spent in a way: reduce the federal deficit as long as the government is running in red.

Trump says that “destroys” without tariff income

“The bold use of President Trump of rates has already proven to be effective to bring foreign nations back to the negotiating table and ensure better trade agreements for the United States. That short -term success has produced record income, and now we need to make sure that Washington does not waste them,” Moran told Fox News Digital.

“The Trust Law ensures that those dollars are going where they need more, which reduces our national debt and protects the financial future of our nation.”

The representative Nathaniel Moran, Republican of Texas, walks through the steps of the camera after the final votes in the Capitol before the Congress recess on Wednesday, September 25, 2024. (Bill Clark/CQ-Roll/Getty Images)

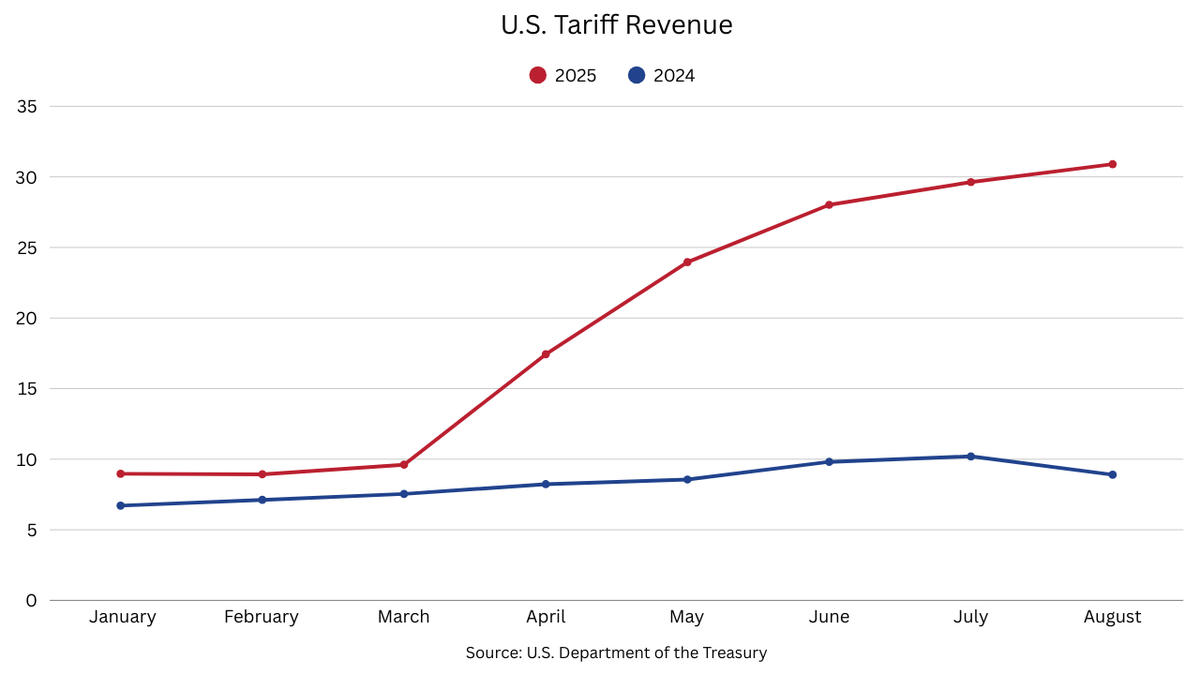

Moran's legislation occurs after the United States raised more than $ 31 billion in Tariff income In August, the highest monthly total so far by 2025. Total tariff revenues for 2025 have reached more than $ 183.6 billion, according to “customs data and certain special taxes” published on August 29 by the Department of the Treasury.

Trump calls the unexpected rate “so beautiful to see” while navigating cash in

Tariff revenues constantly increased from $ 17.4 billion in April to $ 23.9 billion in May, before climbing at $ 28 billion in June and reaching $ 29 billion in July. To the current rhythm, the United States could raise as many tariff income in just four months to five months as it did throughout the previous year. At this point, in fiscal year 2024, tariff income was $ 86.5 billion.

A comparison year after year of rates collections. (Treasury of the United States)

The increase in income coincides with a ruling of the Federal Court of Appeals that the President Donald Trump He exceeded his authority using emergency powers to impose radical global tariffs.

In its decision of August 29, the Court said that the power to establish such tariffs rests directly with the Congress or within the existing commercial policy frameworks. The ruling does not affect the rates imposed by other legal authorities, such as Trump's taxes on steel and aluminum imports.

Attorney general Pam Bondi He announced that the Department of Justice will appeal the decision before the Supreme Court. Meanwhile, the court allowed the rates to remain in place until October 14.

Treasury Secretary Scott Besent He previously said the Trump administration could apply part of tariff income to reduce national debt.

The Secretary of the Treasury, Scott Besent, during an audience of the Media and Media Committee of the House of Representatives in Washington, DC, on June 11, 2025. (Eric Lee/Bloomberg/Getty Images)

The nation's debt, which is the amount of money that the US. $ 37.4 billion As of September 3, according to the Treasury Department.

Click here to get the Fox News application

The amazing figure has intensified the long data debate in Washington on government spending, taxes and efforts to control the balloon deficit.

“Complacency is no longer an option. We must act urgently and start reducing our national debt immediately,” Moran added in a statement.

Besent has also said that tariffs could generate more than $ 500 billion in income for the federal government. American companies pay these import taxes to the federal government, but the cost often falls on consumers, since companies increase prices to compensate for economic burden.