Since insurance premiums seem to increase frequently, it's no wonder that consumers are looking for ways to lower their rates. Most auto insurance companies offer some type of discount for safer driving that the insurance company records.

That's why we were interested in exploring the question posed by Mary about the pros and cons of allowing your insurance company to track your driving in exchange for potentially lower premiums.

“State Farm… provided me with a 'tracker' so they can offer discounts for safe drivers. Am I giving out too much information? I started filling out [out] “Information about the app, but it stopped. I will be given driving tips and suggestions based on the tracker. What is your opinion on this type of tracker?” — Mary, St. Louis, MO

While most car insurance companies offer some form of vehicle tracking in exchange for rewarding safe driving, the question most drivers have is whether the benefits outweigh potential privacy concerns.

RECEIVE SECURITY ALERTS, EXPERT TIPS: SUBSCRIBE TO KURT'S NEWSLETTER – THE CYBERGUY REPORT HERE

A woman at the wheel of a car (Kurt “CyberGuy” Knutsson)

What are car insurance privacy devices?

Although Progressive was the first to introduce a driving and savings program, Snapshot, in 1998, many insurance companies have followed suit. Instead of connecting a telematics device to collect driving data, insurance companies are using OnStar and apps on drivers' mobile devices.

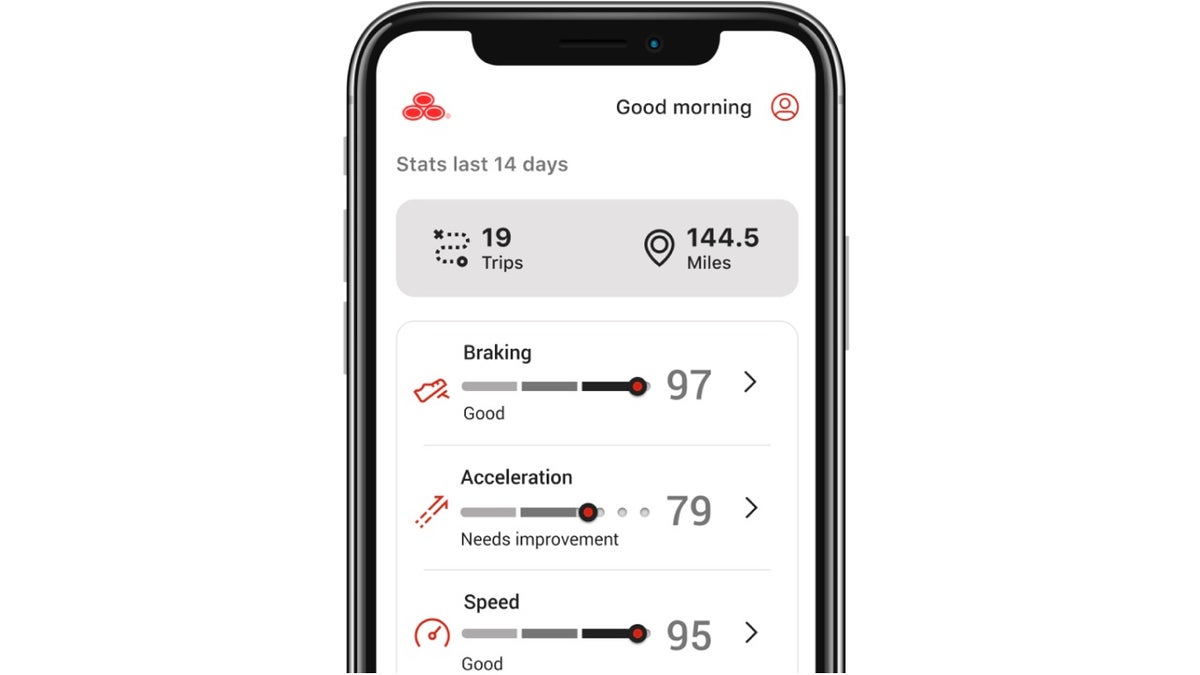

In the specific case of State Farm, you have the option of a Bluetooth beacon in conjunction with the mobile app or Drive Safe & Save Connected Cars. State Farm is phasing out OnStar for new enrollees.

It's important to note that there is no one set of parameters that all insurance companies collect or use to determine what they consider safe driving. So, if you're considering what information is collected and how your driving will be evaluated, it's important to know the specifics for your particular insurance company.

State Farm Drive Safe & Save App (State farm)

WHAT YOUR CAR KNOWS ABOUT YOU AND COULD TELL THE WORLD

What information is collected?

While each auto insurance company collects different data points, common types of data collected include, but are not limited to:

- Acceleration rate

- Driving speed

- Braking speed

- Taking curves

- Distraction by phone

- Total miles traveled

HOW TO DELETE YOUR PRIVATE DATA FROM THE INTERNET

How do usage-based insurance programs work?

Usage-based insurance (UBI) programs, also known as telematics or “pay-as-you-drive” insurance, have gained popularity among major insurers as a way to offer personalized premiums based on individual driving behavior. These programs typically work as follows:

Inscription: Drivers opt into the program, usually in exchange for an initial discount.

Data collection: The insurance company provides a plug-in device for your car's OBD-II port or a smartphone app to track your driving.

Follow-up period: Your driving is monitored for a specified period, usually 3 to 6 months.

Data analysis: The insurer analyses the data collected to evaluate your driving habits.

Premium adjustment: Depending on the analysis, your premium may be adjusted. Safe drivers often see a reduction in their rates.

Different insurers offer different programs with unique features:

Drive Safe and Save from State Farm: Use a mobile app with a Bluetooth beacon or built-in telematics on select vehicles.

Progressive Snapshot: One of the pioneers in UBI, offering both a plug-in device and a mobile app option.

Allstate Drivewise: Use a mobile app to track driving behavior and offer rewards.

Geico DriveEasy: A mobile app-based program that monitors driving habits.

Liberty Mutual's Right Path: It offers the possibility of choosing between a plug-in device or a mobile application.

It's important to note that while these programs can result in significant savings for safe drivers, they may result in higher premiums for those considered higher risk. Additionally, availability and specific features may vary by state due to varying insurance regulations.

Before signing up for any UBI program, carefully review the terms and conditions, paying particular attention to what data is collected, how it is used, and how it could affect your premiums both in the short and long term.

HOW TO BEAT CAR THIEVES WITH THESE SMART AIRTAG TACTICS

What are the concerns?

It's not just the type of information collected that raises privacy concerns. Many insurance companies have privacy policies that allow them to share your data with third parties. While State Farm says it won't sell your Drive Safe & Save data, it does share some information with third parties.

Data sharing associated with Accident Assistance for Drive Safe & Save is done with the driver's consent and is intended to improve the customer experience. For example, if necessary, State Farm may share vehicle location with a towing company and law enforcement if you are in a disabled vehicle. Additionally, if you are in a car accident, your insurance company may use your tracking data to assist with a claim.

Your idea of safe driving may be different than your insurance company's. Some drivers have even seen their rates go up after using driver tracking programs. It's not just the insurance company that can have access to your driving information. With State Farm, designated policyholders can view all recorded trips on all devices for the past 30 days.

CLICK HERE FOR MORE US NEWS

Illustration of an insurance policy and how you should analyze it (Kurt “CyberGuy” Knutsson)

HOW YOUR CAR COULD BE SELLING TO INSURANCE COMPANIES

What are the benefits?

While the specific amount of the discount depends on the insurance company and the driver, State Farm, for example, claims that those enrolled in its Drive Safe & Save program can initially save 10% upon enrolling in the program with up to a 30% possible discount.

It's important to note that the percentage you can save may be capped in certain states, such as New York, where the discount is limited to 30%. This program is not available in states such as California, Massachusetts, and Rhode Island. If you don't drive much and you drive safely, it can be a way to reduce your payments to your auto insurance company. By recording data about your driving safety, it can be a great learning tool to accurately assess your driving habits.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Illustration of drivers on the road (Kurt “CyberGuy” Knutsson)

Kurt's key takeaways

Mary was right to pause and reflect on the benefits and potential problems of allowing an insurance company to monitor your driving. It is important to weigh the potential benefits, such as potential discounts, against these privacy concerns. If you have any discomfort or concerns about the data they collect and how it is used, this program offered by your insurance company may not be right for you. If you already use a tracker and are uncomfortable with it, you should contact your insurance provider for guidance on how to remove the feature or app and its associated data.

CLICK HERE TO GET THE FOX NEWS APP

Remember that it is always essential to read and understand the terms and conditions before using any application, especially those that collect personal data. It is your data and you have the right to know how it is used.

Are you part of any insurance tracking programs? Do you feel the benefits outweigh privacy concerns? Let us know by writing to us at Cyberguy.com/Contact

For more tech tips and security alerts, subscribe to my free CyberGuy Report newsletter by heading to Cyberguy.com/Newsletter

Ask Kurt a question or tell us what stories you'd like us to cover.

Follow Kurt on his social channels

Answers to CyberGuy's most frequently asked questions:

Copyright 2024 CyberGuy.com. All rights reserved.