Protecting your financial future goes beyond smart investing and saving. It's critical to protect your retirement accounts from cyber threats. Although many believe that using public wifi to verify that your 401(k) or IRA is harmless, the reality is that without proper protection, you could be putting your hard-earned savings at risk. Let's explore why using a VPN (virtual private network) is essential for protecting your retirement accounts and how you can implement this extra layer of security.

1 WEEK LEFT! GIFT A $500 GIFT CARD FOR THE HOLIDAYS

enter by registering for my free newsletter.

A woman using a VPN on her tablet (Kurt “CyberGuy” Knutsson)

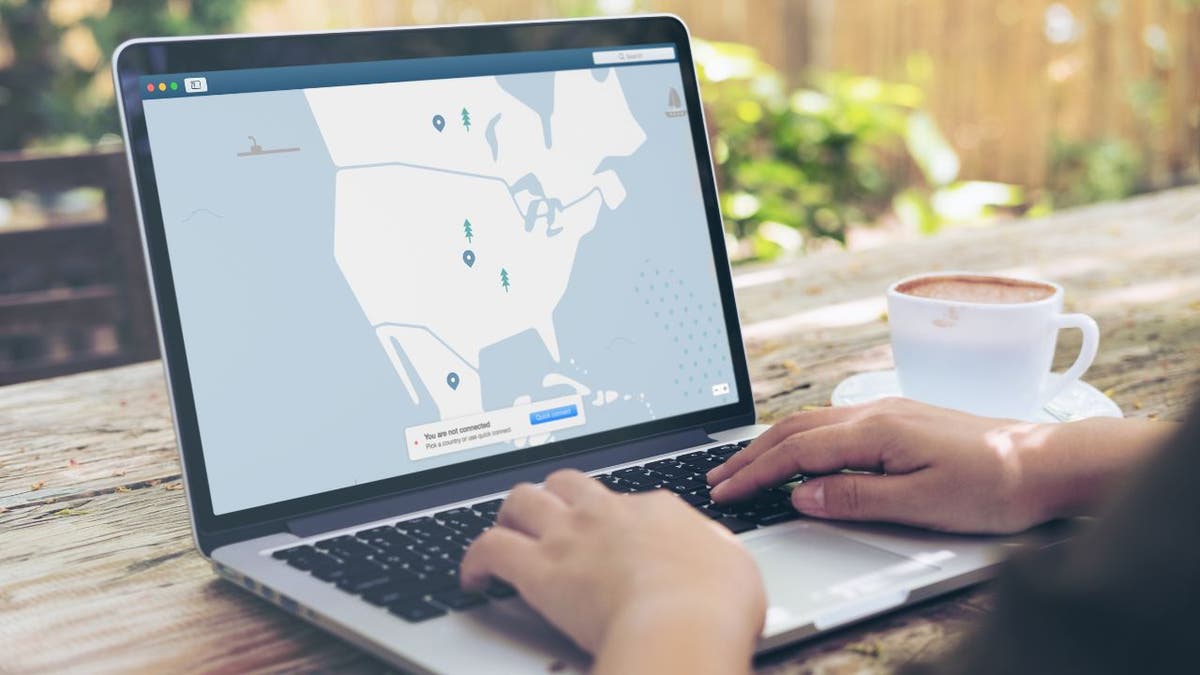

How VPNs work

VPNs work through two main mechanisms: IP address masking and data encryption. When you connect to a VPN, it hides your real IP address by assigning you a new one from its network of servers, effectively preventing websites and cybercriminals from tracking your location or identifying you based on your IP address.

At the same time, VPNs encrypt all data transmitted between your device and the Internet, making it unreadable to anyone trying to intercept it. This encryption process ensures that sensitive information, such as credit card details, remains confidential throughout all your online activities. By combining these two powerful features, VPNs create a secure tunnel for your Internet traffic, significantly improving your online privacy and security.

A woman using a VPN on her cell phone (Kurt “CyberGuy” Knutsson)

Understand the risks

When you access your retirement accounts online, especially over public Wi-Fi networks, you are potentially exposing sensitive financial information to cybercriminals. These hackers can intercept your data, steal your login credentials, and potentially drain your accounts. What's more concerning is that retirement accounts are typically monitored less frequently than regular bank accounts, making them an attractive target for cybercriminals.

A woman using a VPN on her cell phone and laptop (Kurt “CyberGuy” Knutsson)

THE BEST ANTI-VIRUS FOR PCS, MACS, IPHONES AND ANDROIDS – CYBERGUY SELECTIONS

Why a VPN is crucial to protecting your retirement accounts

By creating an encrypted tunnel for your Internet traffic, a VPN makes it extremely difficult for hackers to intercept your sensitive data. Here's a deeper dive into why VPNs are essential for protecting your retirement accounts:

1) Strong encryption

VPNs use military-grade encryption protocols, such as AES-256, to encrypt your data. This means that even if a cybercriminal manages to intercept your information, it will appear as an indecipherable jumble of characters. For your retirement accounts, this translates to an extra layer of security for your login credentials, account numbers, and financial transactions.

2) Improved anonymity

By masking your IP address and replacing it with one of their servers, VPNs make it much harder for malicious actors to track your online activities. This anonymity is crucial when accessing financial accounts, as it prevents cybercriminals from identifying you as a high-value target based on your browsing habits or the financial institutions you visit online.

3) Secure remote access

The ability to verify your accounts while traveling or using public wifi It is convenient but risky. A VPN provides a secure connection, essentially creating a protected tunnel between your device and the financial institution's servers. This is particularly important for retirement accounts, which may not have the same level of fraud protection as checking or savings accounts. However, check if your retirement fund platform allows the use of VPNs, as some may flag this as unusual activity.

4) Protection against man-in-the-middle attacks

VPNs are great protections against man-in-the-middle attacks, where hackers put themselves between you and the website you're trying to access. By encrypting your data end-to-end, VPNs make it nearly impossible for attackers to insert themselves into your connection and steal your information.

5) Safely bypass geo-restrictions

If you travel abroad and need to access your U.S. retirement accounts, some financial institutions may block access from foreign IP addresses. A VPN allows you to connect through a US-based server, ensuring you can manage your accounts securely from anywhere in the world.

A woman using a VPN on her laptop (Kurt “CyberGuy” Knutsson)

THINK TWICE BEFORE USING A PUBLIC COMPUTER – HERE'S WHY

7 steps to secure your retirement accounts

To ensure the security of your retirement accounts, follow these steps:

1) Choose a reliable VPN: Select a reliable VPN service with strong encryption protocols. For the best VPN software, check out my expert review of the best VPNs for private web browsing on your Windows, Mac, Android and iOS devices.

2) Always use VPN on public Wi-Fi: Never access financial accounts on public networks without first activating your VPN.

3) Enable two-factor authentication (2FA): Add an extra layer of security to your accounts by enabling 2FA.

4) Use strong and unique passwords: Create complex passwords for each of your accounts and consider using a password manager. Consider using a password manager to generate and store complex passwords.

5) Regularly monitor your accounts: Review your retirement accounts frequently for any suspicious activity.

6) Keep software updated: Make sure your devices and apps are always up to date with the latest security patches.

7) Beware of phishing attempts: Do not click on suspicious links or provide personal information in response to unsolicited emails. The best way to protect yourself from malicious links that install malware and potentially access your private information is to have powerful antivirus software installed on all your devices. This protection can also alert you to phishing emails and ransomware scams, keeping your personal information and digital assets safe. Get my picks for the best antivirus protection winners of 2024 for your Windows, Mac, Android, and iOS devices.

HOW TO DELETE YOUR PRIVATE INTERNET DATA

Kurt's Key Takeaways

Securing your retirement accounts isn't just about protecting your current savings; It's about safeguarding your future. By implementing a VPN and following security best practices, you're taking proactive steps to ensure the savings you've worked so hard to earn remain safe and secure. Remember, the small investment in a quality VPN service pales in comparison to the potential losses from a compromised retirement account.

Have you ever experienced a security breach? If so, what happened and how did you respond? Let us know by writing to us at Cyberguy.com/Contact.

For more tech tips and security alerts, sign up for my free CyberGuy Report newsletter by heading to Cyberguy.com/Newsletter.

Ask Kurt a question or tell us what stories you'd like us to cover..

Follow Kurt on his social channels:

Answers to CyberGuy's most frequently asked questions:

New from Kurt:

KURT'S CHRISTMAS GIFT GUIDES

Offers: The best unbeatable Black Friday deals | laptops | Desks | Printers

The best gifts for Men | Women | Children | Teens | Pet lovers

Copyright 2024 CyberGuy.com. All rights reserved.