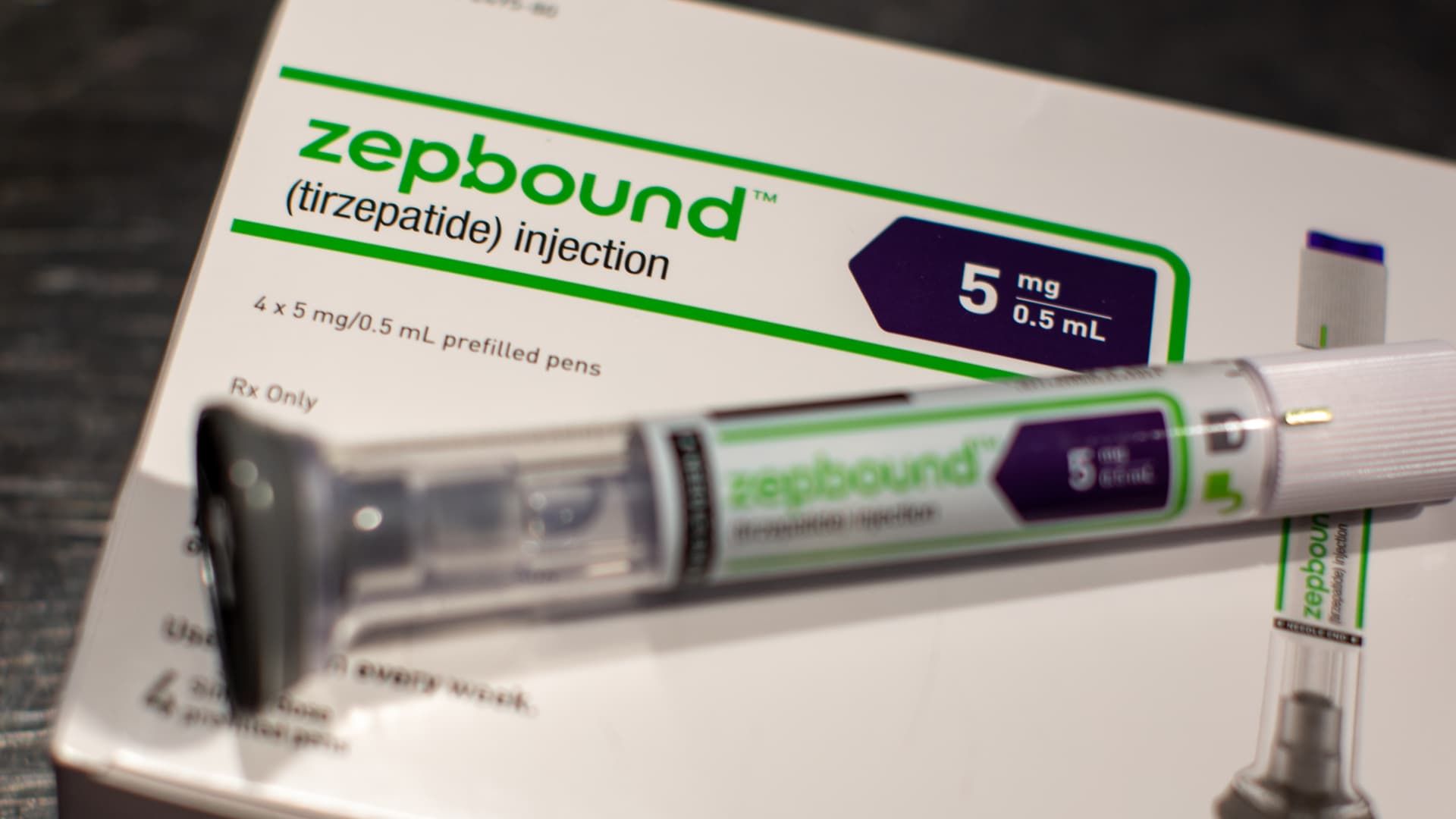

Shortly after the opening bell, we will sell 10 shares of Eli Lilly at approximately $958 each. Following Monday's trade, Jim Cramer's Charitable Trust will own 100 shares of LLY, reducing its weighting to 2.85% from approximately 3.13%. Now that we are no longer restricted, we are selling some Eli Lilly shares. We downgraded Lilly stock to our 2 rating last Tuesday on its rally to a new all-time high. We previously upgraded Lilly to our 1-equivalent buy rating in July in the mid-$800s when the stock fell on concerns about competition in the fast-growing GLP-1 class of diabetes (Mounjaro) and weight loss (Zepbound) drugs. Those concerns quickly proved to be overbought following its second-quarter earnings report, which cemented its GLP-1 lead through improved supply. LLY 1Y mountain Eli Lilly YTD This short, however, is all about discipline. We've let the stock run for almost a full year. Our previous sale was at $591 in September 2023. Since Lilly stock is up over 60% since then, we don't want to get too greedy. We'll make a fantastic 288% gain on shares purchased in January 2022. (Jim Cramer's Charitable Trust has a long position in LLY. See here for a full list of stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you'll receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust's portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE FOREGOING INVESTMENT CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY, ALONG WITH OUR DISCLAIMER. NO FIDUCIARY OBLIGATION OR DUTY EXISTS OR IS CREATED BY VIRTUE OF THE RECEPTION OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTMENT CLUB. NO SPECIFIC RESULTS OR EARNINGS ARE GUARANTEED.