The Pfizer logo is seen outside the manufacturing plant of the pharmaceutical company, in Newbridge, Ireland, on February 10, 2025.

Clodagh Kilcoyne | Reuters

Pfizer On Tuesday, he extended his cost reduction efforts and reported profits from the first quarter that exceeded the estimates, even when the company's sales fell, in large part due to the decrease in the income of its antiviral poxlovid pill.

The company said previously that its cost reduction program would deliver a general net cost savings of approximately $ 4.5 billion by the end of 2025. On Tuesday, Pfizer said that it now expects additional savings of approximately $ 1.2 billion, mainly in sales expenses, informative and administrative, at the end of 2027.

The company said that this will be propelled largely by the “improved digital qualification”, including artificial automation and intelligence and the rationalization of commercial processes.

The extended cuts also include expected Reorganization and Development Reorganization Cost Savings of around $ 500 million by the end of 2026, the company added. Those savings will be reinvested in the Pfizer product pipe.

Pfizer has a separate multiple initiative to reduce costs, with the first phase of the scheduled effort to deliver $ 1.5 billion in savings for the end of 2027. With the additional cuts announced on Tuesday, Pfizer now hopes to deliver around $ 7.7 billion in savings for the end of that year from the two cost reduction efforts.

The cuts are aimed at helping the pharmaceutical giant to recover from the rapid decrease in their Covid business and the price of shares in recent years, and seems to be paying off.

This is what the company reported for the first quarter compared to what Wall Street expected, based on a LSEG analysts survey:

- Profit per action: 92 tight cents against 66 expected cents

- Revenue: $ 13.72 billion compared to $ 13.91 billion expected

'Volatile external environment'

The results occur when drug manufacturers prepare for the planned rates of President Donald Trump about the pharmaceutical products imported to the US. UU., The commitment of their administration to boost the manufacture of medicines in the United States.

Unlike other companies that fight with evolving commercial policy, Pfizer did not review their perspective.

The company maintained its full -year 2025 perspective, forecasting sales from $ 61 billion to $ 64 billion, with a similar yield of its Covid products as seen in 2024, however, Pfizer pointed out in its profits of profits that the guide “does not include any potential impact related to future rates and changes in commercial policies, which we cannot predict at this time.”

But in the earning call on Tuesday, Pfizer executives said the guide reflects $ 150 million in costs of Trump's existing rates.

“Including in our guide we really don't talk about is that there are some rates in its place today,” said Pfizer Dave Denton's financial director in the call.

“We are contemplating that within our guidance range and we continue to tend to the upper end of our guidance range even with those costs to incur this year,” he said.

In the call, the Pfizer CEO, Albert Bourla, said the company established a team to analyze a variety of potential results and develop strategies to help mitigate the potential impact of tariffs on its business in the short and long term. This team is managing the current inventory levels in certain jurisdictions and taking advantage of Pfizer's national manufacturing footprint, among other efforts.

“If we are affected by more rates in the future, we will evaluate the impact of promulgated policies and provide information at the appropriate time,” Bourla said.

He added that the uncertainty about Trump's pharmaceutical rates is determining the company to invest even more in the manufacture and development and development of the United States.

Pfizer still expects changes in the Medicare program resulting from the inflation reduction law to harm sales by $ 1 billion, damping growth by approximately 1.6% compared to 2024.

Disassembling unique items, the company expects the profits of 2025 to be in the range of $ 2.80 to $ 3 per share.

“With the underlying strength of our business, we believe that we can be agile to navigate an uncertain and volatile external environment,” Bourla said in a statement.

For the first quarter, the company reserved a net income of $ 2.97 billion, or 52 cents per share. That is compared to the net income of $ 3.12 billion, or 55 cents per share, during the same period of the previous year.

Excluding certain articles, including restructuring charges and costs associated with intangible assets, the company recorded profits per action of 92 cents for the quarter.

Pfizer reported revenues of $ 13.72 billion for the first quarter, 8% less than the same period of the previous year.

COVID Sales

The company said that the decrease in sales was mainly driven by a decrease in income for Paxlovid, which registered $ 491 million in sales during the first quarter, 76% less than the same period a year ago, partly due to lower COVID infections worldwide and a reduction in international purchases of the government of the Government.

The fall in sales also reflects an impulse that Pfizer obtained in the first quarter of 2024 from a final adjustment related to a reversal of income previously registered for Paxlovid.

Analysts expected Paxlovid to generate $ 769.7 million in sales for the first quarter, according to Streetacount estimates.

Meanwhile, the company's COVID Shot, Lation, reserved $ 565 million in revenues, 60% more than the same period of the previous year. According to Streetacount, that is above the $ 352 million that analysts expected.

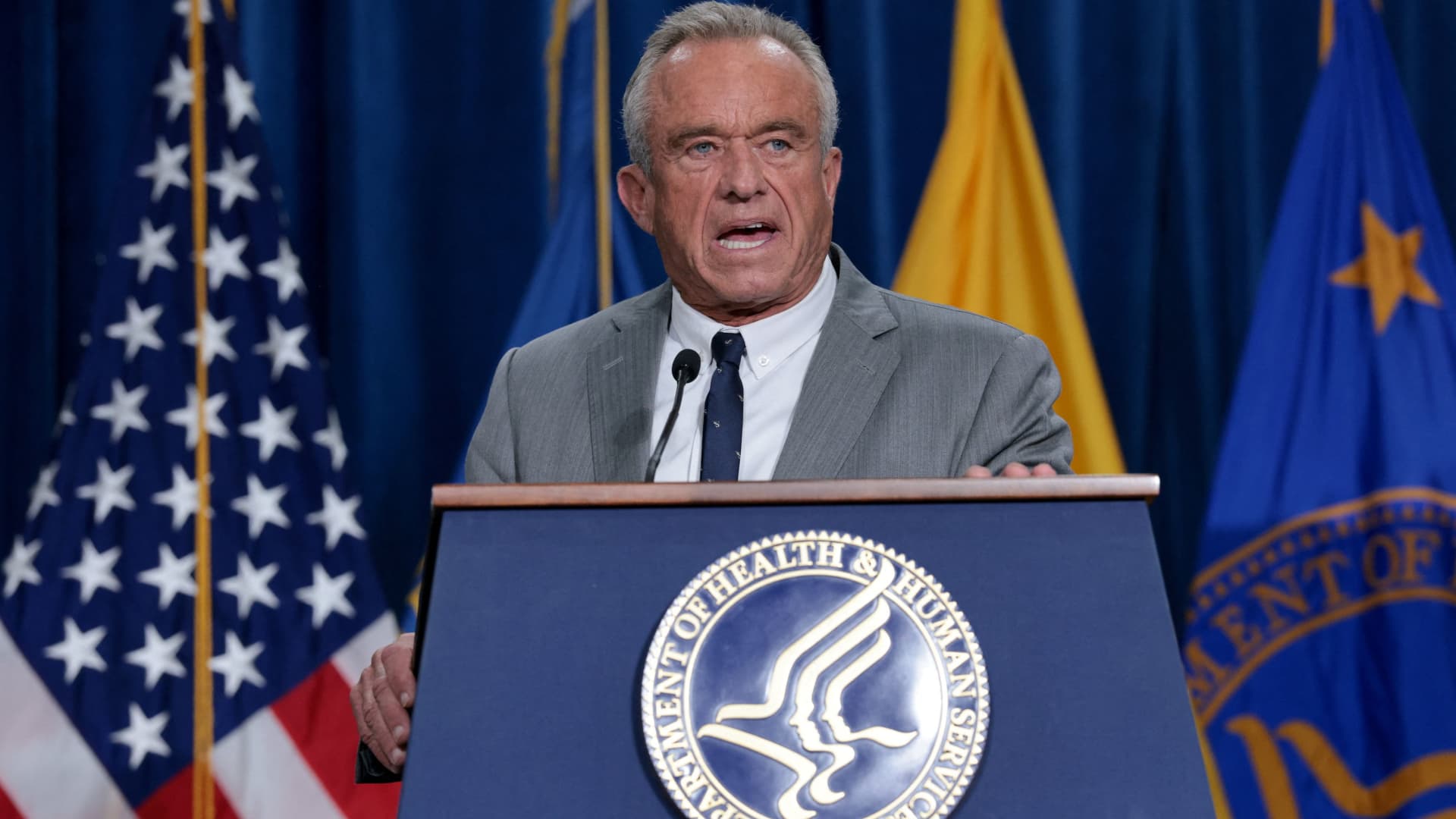

The results occur when the creators of shooting such as Pfizer face uncertainty about the policy and regulation of immunization under Robert F. Kennedy Jr., an outstanding vaccine skeptic that now supervises federal health agencies of the nation.

As secretary of the Department of Health and Human Services, Kennedy has carried out a radical review of different agencies, cutting the staff, consolidating or eliminating offices and taking actions that could finally undermine vaccines.