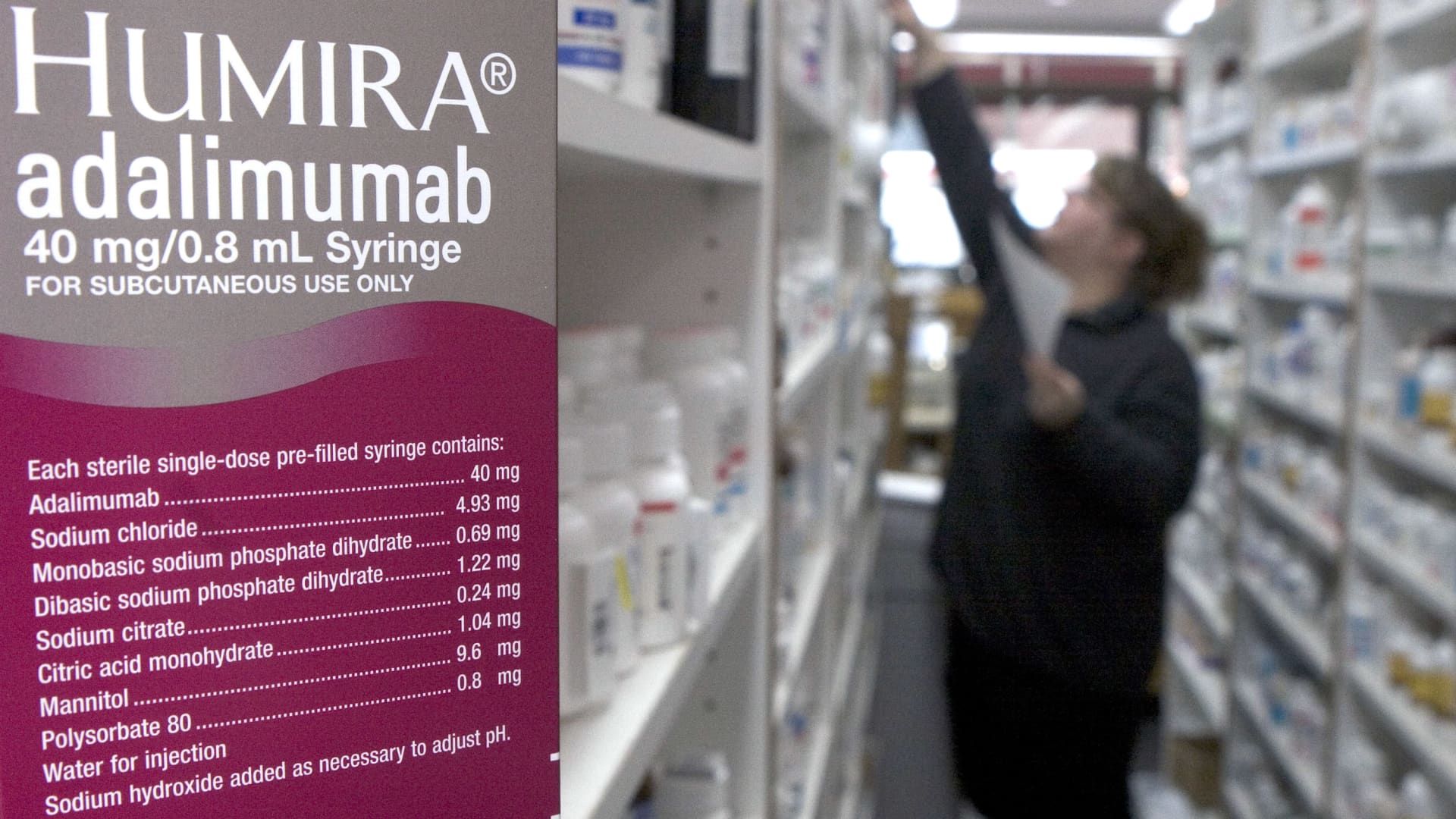

Humira, the injectable treatment for rheumatoid arthritis, appears at a pharmacy in Cambridge, Massachusetts.

JB Reed | Bloomberg | fake images

Do you think a friend or colleague should receive this newsletter? Share this link with them to register.

Good day! Sales of AbvieHumira is plummeting as the once best-selling drug fights competition from cheaper biosimilars in the United States and abroad.

But AbbVie has two key drugs that treat many of the same conditions as Humira, and they are proving to be worthy successors to the company's flagship drug.

That became clear after AbbVie reported on Friday that first-quarter revenue and adjusted earnings beat Wall Street expectations, partly driven by the strength of the drugmaker's immunology business. The pharmaceutical giant also raised its annual profit forecast.

Humira's revenue fell more than 30% to $2.3 billion during the first quarter, according to AbbVie.

For years, AbbVie has built a wall of patent protection around the drug, effectively extending its market exclusivity well beyond the expiration of its main US patent in 2016. But Humira lost US exclusivity . last year amid the launch of nine biosimilars, some of which have been available in Europe since 2019. A tenth biosimilar was launched in February.

However, biosimilars barely took a bite out of AbbVie's monopoly. In February, biosimilars captured about 4% of AbbVie's share of the Humira market, according to a quarterly report from Samsung Bioepis.

But that changed later CVSCaremark's pharmacy benefits manager removed Humira from some of its major national formularies for health plans on April 1 and recommended biosimilar versions of the drug instead. The formularies are lists of preferred medications for reimbursement.

Humira biosimilars' market share rose from 5% to 36% a week after the change, according to data cited by Axios. In April, Swiss company Sandoz's biosimilar, known as Hyrimoz, contributed to the majority of new Humira biosimilar prescriptions. That product is being jointly marketed by a CVS affiliate called Cordavis.

But AbbVie is still “successfully navigating” the Humira patent chasm, the company's CEO Rick Gonzalez said on the earnings call last week.

The data indicates that “not all Humira prescriptions are switching to a biosimilar,” chief commercial officer Jeffrey Stewart added during the call. He said 20% of patients are switching to new medications, including immune treatments from AbbVie, Skyrizi and Rinvoq.

Skyrizi made $2 billion in revenue during the first quarter, which was roughly in line with Humira's revenue during the period. Meanwhile, Rinvoq generated $1.1 billion in sales during the first quarter.

Those newer drugs are growing rapidly: Skyrizi's sales were up 48% from the same period a year earlier, while Rinvoq's revenue was up 59%.

Skyrizi is the “clear market leader” among U.S. biologics for psoriasis, with 35% market share, AbbVie executives said during the conference call. The company plans to launch the drug in patients with ulcerative colitis, which executives said they expect to be a “strong” market after potential approval later this year.

In the case of inflammatory bowel disease, Skyrizi takes a “significant share” of sales of J&J's blockbuster drug Stelara, according to AbbVie executives. Stelara is expected to lose exclusivity in the United States in 2025.

Meanwhile, Rinvoq is seeing increased use among patients with inflammatory bowel disease, ulcerative colitis and Crohn's disease, among other indications.

Still, CVS's decision to exclude Humira from some of its formularies raises some questions about how well sales of the drug will hold up in the U.S., especially if other pharmacy benefit managers eventually follow suit.

Humira competition could intensify in other ways, too: Health insurer Cigna announced April 25 that it plans to make certain Humira biosimilars available with no out-of-pocket payment to eligible U.S. patients using its specialty pharmacy business starting in June. .

Alvotec and Teva Pharmaceuticals also announced a deal with an unspecified company to boost access to its biosimilar Simlandi, which mimics Humira's most popular formulation and can be substituted directly at the pharmacy.

We will continue to watch how Humira's competitive landscape develops this year.

Feel free to send any tips, suggestions, story ideas, and facts to Annika at [email protected].

The latest in health technology

UnitedHealth CEO to testify on Capitol Hill

Bloomberg | Bloomberg | fake images

This is Ashley, reporting from Washington, DC.

I'm here to watch UnitedHealth Group'CEO Andrew Witty testified on Capitol Hill this week about the cyberattack on the company's subsidiary, Change Healthcare. On Wednesday morning, Witty will speak in front of the Senate Finance Committee and then go to speak in front of the House Energy and Commerce subcommittee in the afternoon.

It's sure to be an eventful day and both hearings will be live-streamed if you're interested in tuning in.

This is where things are now.

In late February, UnitedHealth revealed that part of Change Healthcare's information technology network was breached by a cyber threat actor. UnitedHealth took the affected systems offline and has been working to bring them back online in recent weeks.

Change Healthcare offers tools for revenue and payment cycle management, among other solutions such as e-prescribing software. It performs 15 billion billing transactions a year and one in three patient records passes through its systems, according to the company.

Given the scale of the enterprise, the disruption of the cyberattack has caused widespread consequences across the healthcare sector. For example, many doctors were temporarily unable to fill prescriptions or receive payment for their services.

On February 29, UnitedHealth said the Blackcat ransomware group was behind the attack. Blackcat, also called Noberus and ALPHV, steals sensitive data from institutions and threatens to publish it unless a ransom is paid, according to a December statement from the US Department of Justice.

UnitedHealth told CNBC on April 22 that it paid a ransom to protect patient data. It also confirmed that files containing protected health information and personally identifiable information were compromised in the breach, according to a statement.

The company said its investigation into the attack is still ongoing, so it could be months before it can notify affected people. UnitedHealth has been working with authorities, regulators and cybersecurity experts to evaluate the breach.

I expect lawmakers at hearings this week will want to know more details about what happened and what the attack means for providers and patients.

I'll bring you all the updates as they develop! Stay tuned.

Please feel free to send any tips, suggestions, story ideas, or information to Ashley at [email protected].