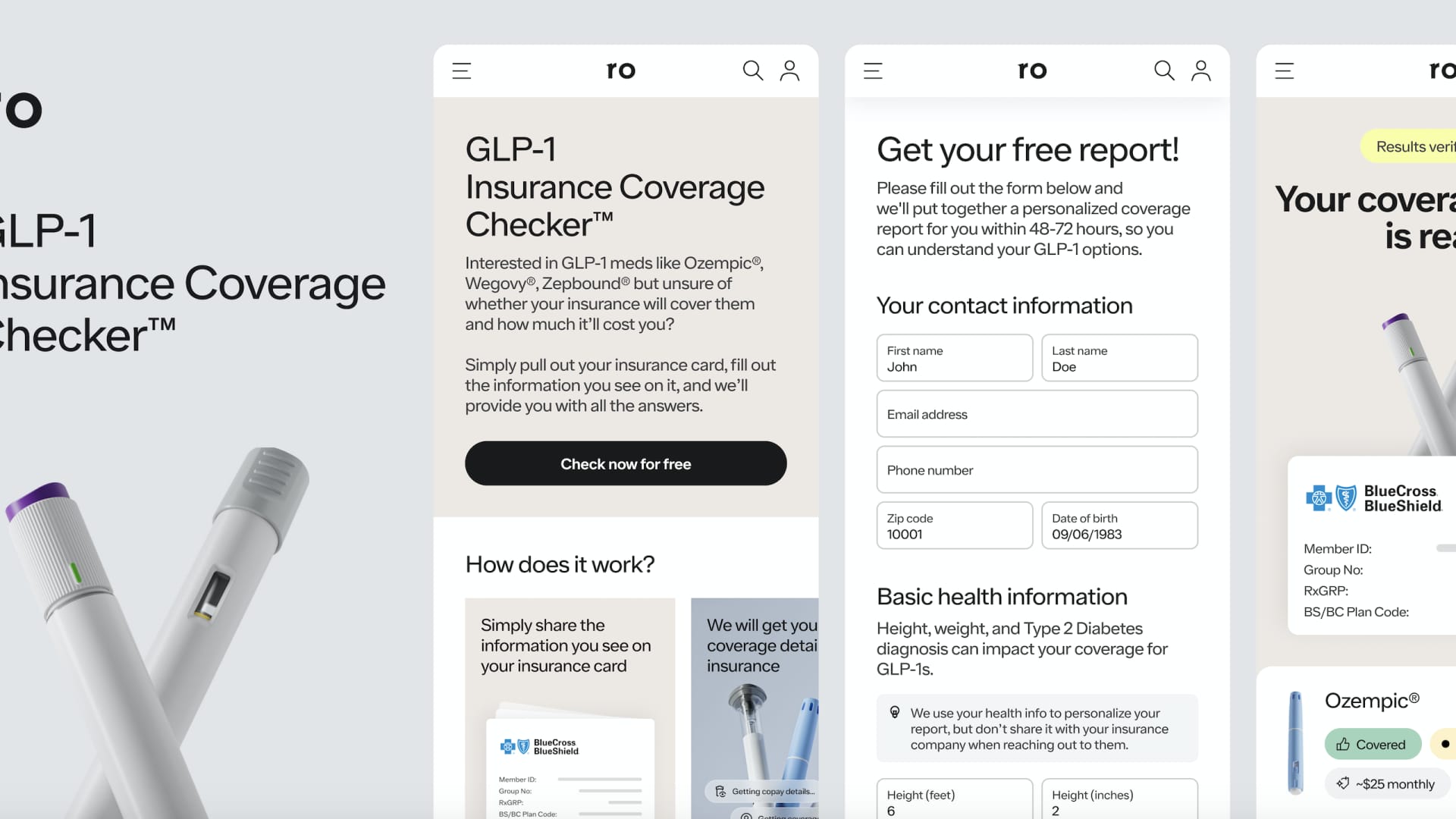

The signaling of Health Health outside the New York Stock Exchange (NYSE) during the company's initial public offer (OPI) in New York, USA, on Thursday, May 21, 2025.

Michael Nagle | Bloomberg | Getty images

Actions of Hinge health He appeared in his debut in the New York Stock Exchange on Thursday after the digital physiotherapy company raised around $ 273 million in its OPI.

The action opened to $ 39.25, increasing 23% of its OPO price of $ 32. It closed 17% to $ 37.56 per share, which leads to its market capitalization to more than $ 3 billion. Hinge sold 8.52 million shares in the offer, while the total offer was 13.7 million shares, with the balance selling for existing shareholders.

Hinge, founded in 2014, uses software to help patients treat acute musculoskeletal lesions, chronic pain and carry out rehabilitation after surgery from anywhere.

The company based in San Francisco presented its initial prospect in March and updated the document earlier this month with an expected price range from $ 28 to $ 32.

Wall Street and the digital health sector have been observing Hinge's debut closely, since it will shed some light on the appetite of investors for the new health technology solutions.

The widest technological market of IPO has been in an extended drought since the late 2021, when inflation and upward interest rates expelled investors from risk assets. Within digital health, it has been almost completely inactive. Hinge leads the position, with the virtual chronic attention company Health to present that it must be made public earlier this month.

“Medical care is difficult, absolutely, but we are very different from any of the digital health companies that have come before,” Hinge CEO Daniel Pérez said Thursday to the “Movers” of CNBC. “Our technology is actually automating the provision of care in itself, and that is why many investors have been so interested in the health of hinges.”

The executive president of Pérez and Hinge, Gabriel Mecklenburg, co -founded the company after experiencing personal struggles with physical rehabilitation. Pérez broke an arm and a leg after he was hit by a car, and Mecklenburg broke his anterior cross ligament during a judo game. Both men went through about 12 months of physiotherapy.

At the price of the opi, Hinge was worth approximately $ 2.6 billion, although that number could be higher in a completely diluted base. That has significantly decreased from a private market assessment of $ 6.2 billion in October 2021, the last time the company raised external funds.

Hinge has raised more than $ 1 billion of investors, including Insight Partners, Tiger Global Management, Coatue Management and Atomic.

Ben Blume, an Atomico partner, said the Hinge scale capacity “really distinguishes them.” The firm led the Hinge Serie A financing round in 2017.

“Hinge Health has become a clear category leader, improving the lives of people living with chronic pain,” Blume said in a statement to CNBC. “His success is a testimony of the power of innovation promoted by mission.”

Hinge is operating at the Nyse under the “Hnge” Ticker symbol.

LOOK: Ipo Market will stop for the summer and collect the second half of the third quarter, says Dan Primack de Axios