Anyone who has followed the fortunes of the television business in recent years cannot be blamed for thinking that the medium is dying.

Consumers have been moving away from traditional or linear television that is viewed in real time toward streaming video, where they can watch whatever they want on demand. In 2023, streaming will surpass broadcast and cable television viewing for the first time, according to Nielsen.

But in the current 2024 presidential election cycle, the mantra is: long live television.

Political advertising is a regular shot of adrenaline for the television business every two years, when seats in the House and Senate are at stake. The dose is even more potent when the White House is at stake. Even as ratings decline, television is expected to post a record in 2024 as a contentious presidential primary and general election (plus 435 congressional seats, 33 U.S. Senate races and 14 gubernatorial races statewide) will boost political advertising spending across all platforms to $17 billion. , according to media investment agency GroupM.

The figure represents an increase of 31% compared to what was spent in the 2020 presidential election year and 24% compared to the previous maximum of $12.8 billion spent in 2022, according to GroupM data.

“Local TV will see the vast majority of that,” said Kate Scott-Dawkins, global president of business intelligence at GroupM. One television executive estimated that local stations could see between $8 billion and $9 billion in political ads.

That's why major station owners like Nexstar, Fox Corporation, Scripps and Paramount Global are predicting a financial windfall, especially in markets located in swing states at stake in the presidential campaign. California will see spots early and often as Democrats compete for their party's nomination to run for the U.S. Senate seat previously held by the late Dianne Feinstein.

Cable news networks, which devote most of their coverage to politics, will also profit from national campaigns and advertising aired by advocacy groups and political action committees.

The polarized political climate is a factor in the increase in spending. Referendums on abortion rights are expected to be included in several states. The last such vote, held in Ohio in November, generated $70 million in advertising spending from groups representing both sides of the issue.

While most members of Congress are in safe districts and don't have to spend much on advertising, a growing number of incumbents on the far left or right are facing challenges as more moderate candidates challenge them.

“Historically, you only saw big money in primaries in an open seat,” said Patrick Paolini, executive vice president of advertising sales at Fox Television Stations. “Now we are seeing it when the position is filled by an incumbent who will actually continue to run. “That’s part of the changing landscape as to where this money comes from.”

While streaming is diverting viewers, local television is still considered easier and more efficient to purchase for a campaign that wants to spread a message quickly. While overall ratings have steadily declined, broadcast television still has high-rating live sporting events, such as the NFL, where every game is broadcast on local television in the teams' markets, even in matchups that are They broadcast nationally on television. streaming or cable.

“Regardless of any type of viewership decline, television remains the best way to reach the masses in a short period of time,” said Robert Breen, co-head of operations and sales for CBS Television Stations.

Television stations may also be benefiting from political consulting firms and campaigns being slow to adapt to streaming.

“There's a certain amount of 'This is what we've done in the past, we know it works and we're going to do it again,'” Scott-Dawkins said.

According to GroupM, streaming services like Netflix, Hulu, Disney+ and Amazon, which now have ad-supported tiers, are expected to garner a larger share of political dollars this campaign cycle. Ondine Fortune, a veteran political advertising buyer based in Redondo Beach, said spending is still not proportional to the number of viewers the broadcast delivers.

“When I get a new client, I have to put them through a whole learning process,” Fortune said. “They are not putting in the dollars that should be in streaming. They don't believe in that. “It’s what cable was like in the early days.”

Fortune believes more political advertising money will go to streaming as a younger generation of political operatives comes online.

But for now, traditional television will continue to benefit from one of its key advantages: local newscasts, which will be saturated with political ads in markets with competitive races.

Campaigns prefer to run their ads on local news broadcasts because they are seen by viewers who are politically engaged and more likely to go out and vote. They tend to be older and more likely to watch traditional television than younger consumers.

The local news environment also attracts campaigns. Surveys conducted by the Knight Foundation have found that Americans trust local news more than national news sources by a margin of 2 to 1, with television stations being their primary source of news.

As viewers have turned to streaming to watch dramas, sitcoms and scripted movies, television stations have added more live local newscasts to their lineups.

A survey conducted by the Radio Television Digital News Association. and Syracuse University's Newhouse School found that television stations were broadcasting 6.6 hours of news each weekday in 2022, up from 5.7 hours in 2022.

Unlike network and syndicated programming, stations earn all of their commercials and advertising revenue during those hours. The Fox station group collectively produces 1,200 hours of local news a week.

While the generally nonpartisan approach of local television news is a selling point for campaigns, some also want to reach tribal politics junkies who also watch cable news. Campaigns for president, U.S. Senate and governor will make national cable news buys to raise their profile and spur campaign contributions.

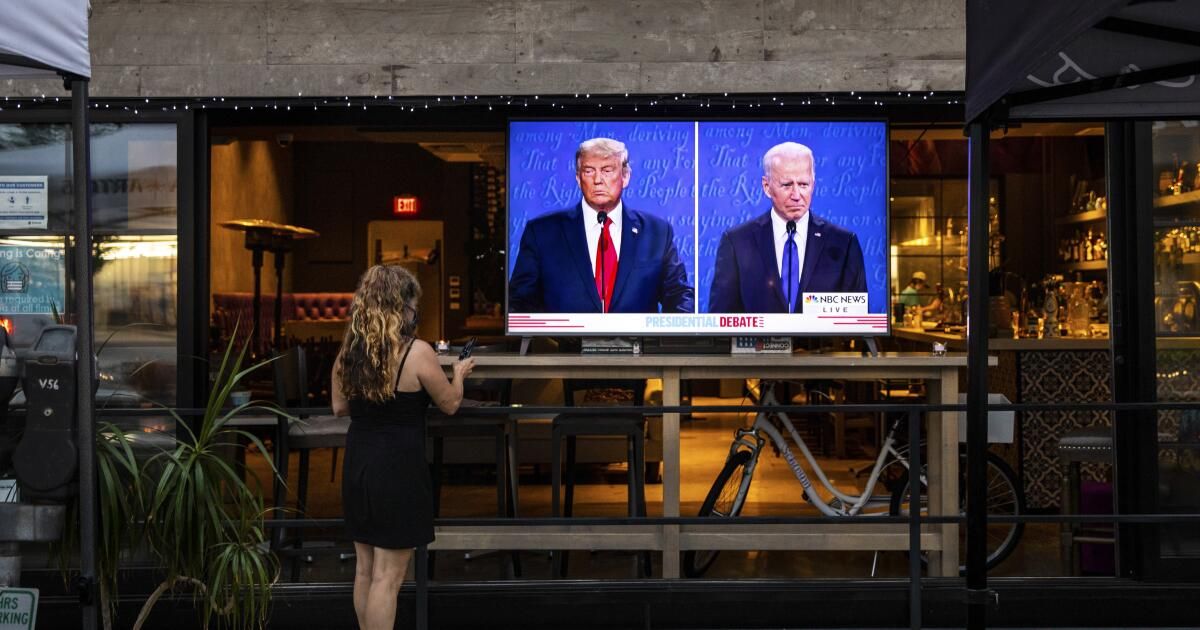

Although much of the conservative-leaning Fox News' programming is not welcoming to liberal viewpoints, the most-watched cable network has a large number of Democrats and independents tuned in, and campaigns want to reach them. In 2020, President Biden's campaign made a multimillion-dollar business purchase at Fox News, including during the network's coverage of the Republican National Convention.

“Candidates have realized that,” said Jeff Collins, executive vice president of advertising sales at Fox News. “We've seen them go out and want to be on high-rating programming to get their message to an engaged audience that cares about politics.”

Collins added that his network is open to all parties and points of view, with few restrictions on where his ads are published.

One of the ads that aired during last week's Fox News town hall with former President Trump, watched by 4.5 million viewers, was purchased by Republican Accountability, a political action committee opposed to Trump.

The ad used images depicting violence in the January 6 insurrection with the message “You can never be president again.”