For more than a week, Paramount Global has been prepared to accept David Ellison's bid for control of the troubled media company. But one big question looms over the protracted deal negotiations:

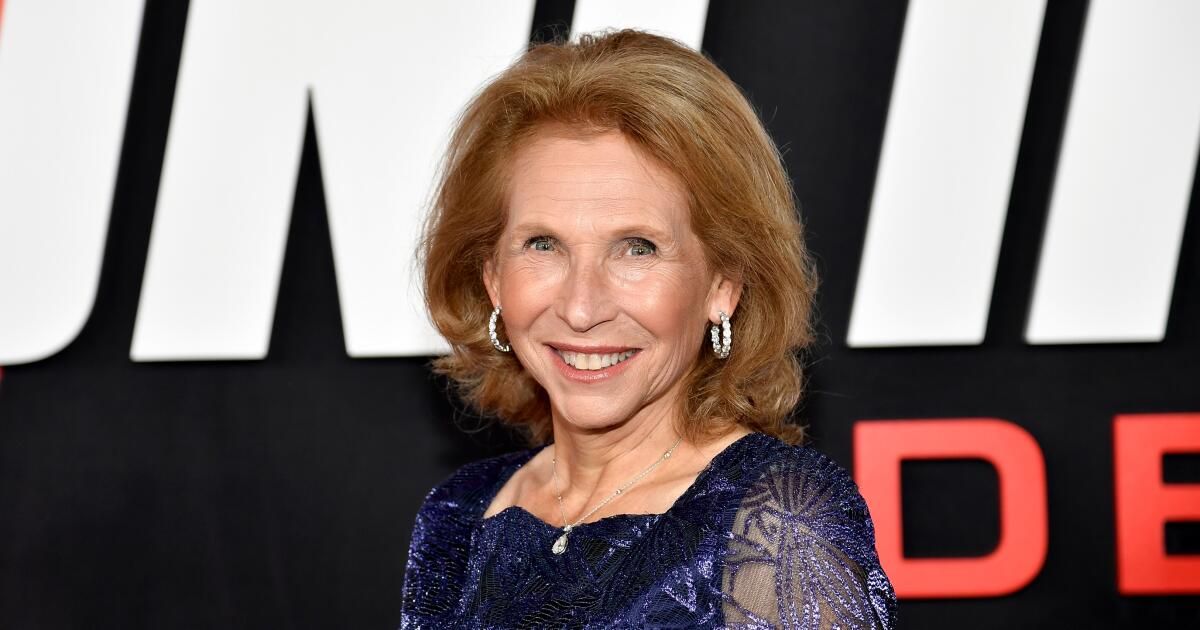

Will Paramount majority shareholder Shari Redstone and her three children finally approve the deal?

People close to the sale process say Ellison's production company, Skydance Media, and its financial backers are close to closing a deal that Ellison has been pursuing since last summer. By Monday, after a weekend of negotiations, lawyers for the two sides (Skydance and the Redstone family) had reached an agreement on several important outstanding issues, but were still grappling with the remaining points of the agreement, according to three people knowledgeable people who were not authorized to comment given the sensitive nature of the conversations.

The long, public auction, prolonged by a six-month review by the independent directors committee of Paramount's board, has been complicated by an additional problem. In recent weeks, two other potential suitors have expressed interest in purchasing the Redstone family's investment vehicle, National Amusements Inc., which owns 77% of the voting shares in Paramount.

The arrival of two potential new bidders, who appear willing to pay the family more than what is contained in Skydance's offer, has increased the pressure already facing the heirs of the late media mogul Sumner Redstone.

Former Seagram and Warner Music top executive Edgar Bronfman Jr., as well as Hollywood producer Steven Paul (“Ghost in the Shell,” “Baby Geniuses”), have separately expressed their desire to buy National Amusements, two said. of knowledgeable people. The Wall Street Journal was the first to report Bronfman and Paul's interest.

But any deal with Bronfman, who is backed by Bain Capital, would be contingent on conducting due diligence, according to one of the people familiar with the matter. The former entertainment executive and liquor scion, who pushed his family to acquire Universal Studios Inc. before selling it to France's Vivendi more than two decades ago, has suggested paying more than $2 billion for the Redstone firm. .

Separately, Paul has been trying to get financial backers to make a bid of about $3 billion for National Amusements.

The structure of Ellison's deal with Skydance is dramatically different from Paul and Bronfman's proposals.

Representatives for Paramount and Redstone declined to comment.

Ellison's proposed $8 billion acquisition is a two-step process. First, his group would buy National Amusements, giving the Redstone family an exit from the movie business after more than 80 years.

The deal with Skydance currently provides $2.3 billion to purchase National Amusements. Of that amount, nearly $600 million would be used to pay off NAI's debt, which includes loans taken out by the late tycoon. His heirs would raise around $1.7 billion, according to knowledgeable sources.

Ellison's vision is to consolidate his small Santa Monica-based film, television and animation company Skydance with Paramount and lead the merged entity as its CEO. The deal with Skydance is structured so that most of the money would be distributed between Paramount and its shareholders.

That phase of the deal requires approval from Paramount's board, which is why Ellison and his group needed to negotiate acceptable terms with the media company's directors who are not affiliated with the Redstones. That process began last December.

The tech scion's bid is backed by RedBird Capital Partners, private equity firm KKR and his father, Larry Ellison, co-founder of software giant Oracle Corp.

His offer includes setting aside $4.5 billion for Paramount's non-voting shareholders, who could offer some of their shares at $15 each. Another $1.5 billion would be injected into Paramount's battered balance sheet, allowing the company to pay off some of its heavy debt load. While negotiating with Paramount board members, the Ellison group doubled its offer, in part to find ways to satisfy non-voting shareholders who were upset that the Redstone family would be paid a premium for their shares. Actions.

Paramount closed Monday at $11.98 a share, virtually unchanged.

The sale of Paramount has been one of the most complicated media deals in history, analysts said.

The company's two-class share structure is the root of the problem, said Charles Elson, a corporate governance expert at the University of Delaware.

“This is a recipe for a high level of conflict and major problems,” Elson said. “Any time you have dual-class stock, that eliminates some of the checks and balances that a normal corporation would have. There really is no control [Redstone’s] Decision making.”

Once attorneys for both sides have reached a consensus, the deal will be presented to National Amusements, whose board of directors includes Shari Redstone, her three adult children and several longtime advisors. The family estate is expected to be divided among Sumner Redstone's five grandchildren, according to his trust documents.

Paramount's full board, which includes Redstone as its non-executive chairman, must also ratify the deal.

What weighs on the family is the timing of the deal, when Paramount stock has been slow to perform.

A year ago, Paramount cut the dividend to its shareholders and the stock plummeted. Paramount's dividend was a major source of income for National Amusements.

A decade ago, shares of Paramount, then known as Viacom, were trading above $70 each, making the Redstone family billionaires. But management missteps and the industry's shift toward streaming have hit Paramount Global (the company created from the combination of Viacom and CBS). The entertainment company is worth $8.3 billion, about a third of its value just five years ago.