The KSE-100 benchmark index crosses the 64,000 barrier and analysts attribute the increase to energy stocks that open at highs

KARACHI: Pakistan Stock Exchange (PSX) started the new year on a positive note as it started trading in the green zone with an increase of over 1,500 points.

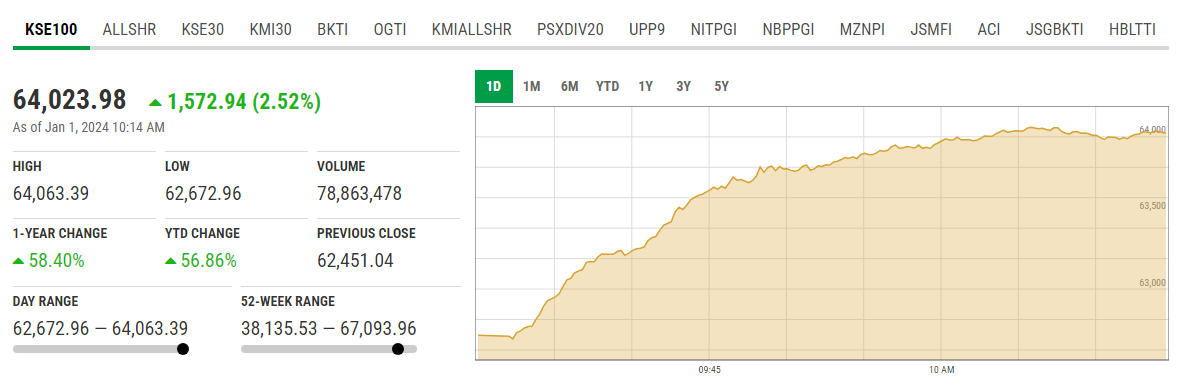

The benchmark KSE-100 index reached 64,023.98 points on Monday, up 1,572.94 points or 2.52% from the previous close of 62,451.04 points.

Intermarket Securities head of equities Raza Jafri attributes the rise in energy stocks to expectations of dividend payouts as earnings season approaches and the government appears serious about tackling circular debt.

“There are also expectations of higher institutional flows into equities and monetary easing is expected to begin in the coming months,” Jafri said. geo.tv.

In the last trading session of 2023, the stock gained 0.64% as investors cheered the rise in foreign exchange reserves and the influx of loans from multilateral lenders. News reported on Saturday, citing analysts.

The market was boosted by the central bank’s announcement that its foreign exchange reserves increased by $853 million to $7.8 billion in the week ending December 22, thanks to financial support from bilateral and multilateral sources.

‘The best year since 2010’

Meanwhile, the PSX capped its best year since 2010 as the KSE-100 index ended 2023 with a 55% gain, third best among global markets in local currency terms.

The index also rose 24% in dollar terms, outperforming the MSCI Emerging Markets Index, which gained 18%.

Looking ahead, analysts were optimistic about the market outlook in 2024, as they expect the International Monetary Fund (IMF) program to continue, the currency to remain stable, interest rates to fall, profits grow and valuations increase. improve.

“We expect the local stock market to remain in the green zone,” said brokerage Arif Habib Ltd.

“In addition, we expect an influx of new liquidity amid the January effect. Furthermore, the bonds are trading at attractive valuations and are expected to further boost the positive sentiment in the index.”