- Prime Minister highlights inflation rate falling to single digits in three years.

- The Prime Minister reaffirms his determination to provide relief to the common man.

- “Our work is not done and there is still much to do,” he said.

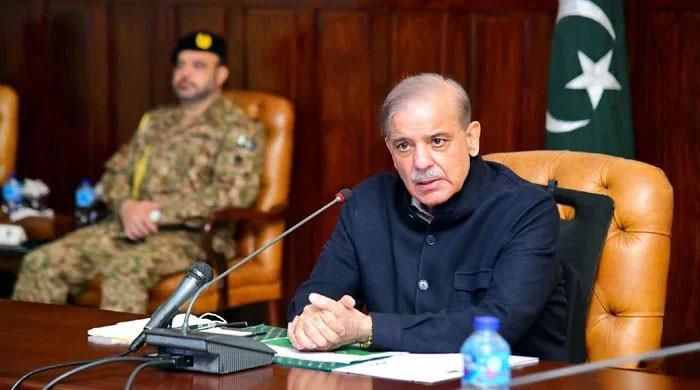

Prime Minister Shehbaz Sharif on Tuesday hailed the efforts and policies of the current government for the remarkable reduction in inflation, with the country's annual rate falling to 9.6 percent.

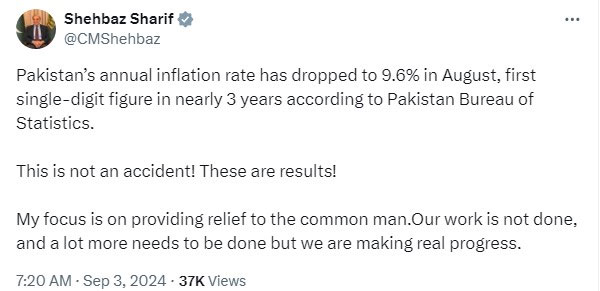

“Pakistan's annual inflation rate has fallen to 9.6% in August, the first single-digit figure in nearly three years according to the Pakistan Bureau of Statistics. This is no coincidence! These are results,” Prime Minister Shehbaz said in a statement posted on his official X account.

The Prime Minister's comments come after PBS data revealed a significant drop in the inflation rate, which has breached the 20% mark since May 2022, reaching a staggering 38% last May and these soaring inflation rates coincided with reforms implemented as part of a much-needed bailout programme by the International Monetary Fund (IMF).

“Headline CPI inflation rose to 9.6% year-on-year in August 2024, compared with an increase of 11.1% in the previous month and 27.4% in August 2023,” the PBS said a day earlier.

Reaffirming the government's resolve to provide relief to the masses, the prime minister added, “My aim is to provide relief to the common man. Our work is not over and there is still a lot to do, but we are making real progress.”

It should be noted that on a monthly basis, the Consumer Price Index (CPI) increased by 0.4% in August 2024 compared to an increase of 2.1% in the previous month and an increase of 1.7% in August 2023.

According to the data, urban CPI inflation rose to 11.7% year-on-year, compared with 13.2% in the previous month and 25.0% in August 2023.

On a monthly basis, it increased to 0.3% compared to an increase of 2.0% in the previous month and an increase of 1.6% in August 2023.

Meanwhile, CPI inflation in rural areas rose to 6.7% year-on-year in August 2024, compared with an increase of 8.1% in the previous month and 30.9% in August 2023.

On a monthly basis (MoM), it increased to 0.6% in August 2024 compared to an increase of 2.2% in the previous month and an increase of 1.9% in August 2023.

Food prices that increased on a monthly basis included onions (22.84%), chicken (13.62%), eggs (12.39%), fresh vegetables (12.25%), besan (4.88%), pulses (4.55%), whole pulses (3.82%), potatoes (2.90%), moong pulses (2.83%), fresh milk (1.27%), dairy products (1.20%) and vegetable ghee (1.10%).

It is noteworthy that last month, Moody's Ratings upgraded Pakistan's local and foreign currency issuer and senior unsecured debt ratings to Caa2 from Caa3 due to improving macroeconomic conditions.

The upgrade to Caa2 reflects Pakistan's improving macroeconomic conditions and moderately improved government liquidity and external positions, from very weak levels.

As a result, Pakistan's default risk has been reduced to a level consistent with a Caa2 rating, according to Moody's. “There is now greater certainty over Pakistan's external financing sources, following the sovereign's staff-level agreement with the IMF on 12 July 2024 for a 37-month $7 billion Extended Fund Facility (EFF).”

Pakistan's foreign exchange reserves have nearly doubled since June 2023, although they remain below what is needed to meet its external financing needs, it said.

According to Moody's, the country remains dependent on timely financing from its official partners to fully meet its external debt obligations.

However, the agency warned that “the Caa2 rating continues to reflect Pakistan's very weak debt repayment capacity, which creates a high risk of debt sustainability.”