Former Seagram and Warner Music executive Edgar Bronfman Jr. continued his last-minute pursuit of Paramount Global, upping his offer to $6 billion for the Redstone family investment firm and the storied studio, according to two people familiar with the matter who were not authorized to comment.

The latest twist in the chaotic auction came Wednesday as independent members of Paramount's board were considering whether to keep the door open for Bronfman's bid for the struggling company that owns CBS, Comedy Central, Nickelodeon, Showtime and its namesake Hollywood film studio.

The flurry of activity comes six weeks after Paramount agreed to an $8.4 billion, two-phase acquisition of the Redstone family's investment vehicle, National Amusements Inc., and Paramount by media executive David Ellison.

Bronfman is trying to fix the problem created by a clause in Ellison’s deal with Skydance Media, which was approved in early July by Paramount board members and controlling shareholder Shari Redstone. That clause created a 45-day “shop around” period that allowed rival bidders to submit “superior” proposals, according to a regulatory filing.

The Bronfman Group's previous offer, of $4.3 billion, came on Monday, day 43.

On Wednesday night, Paramount’s Special Committee of Independent Directors announced it had extended the deadline for the stock purchase until Sept. 5. The directors must now review Bronfman’s offer and examine the strength of their investor group’s financing to decide whether to change course and pursue a transaction with Bronfman rather than moving forward with Skydance.

The committee also said the sale window would be closed to other potential bidders.

People familiar with the process said the 69-year-old billionaire heir to the Seagram liquor fortune faces an uphill battle to unseat Ellison, the son of billionaire Larry Ellison, who contributed part of that family's fortune to Skydance's bid to acquire National Amusements and Paramount.

Bronfman worked for months behind the scenes to prepare a bid for National Amusements and Paramount, but fell short earlier this summer, leading Shari Redstone to accept Skydance's improved offer for the entities in July.

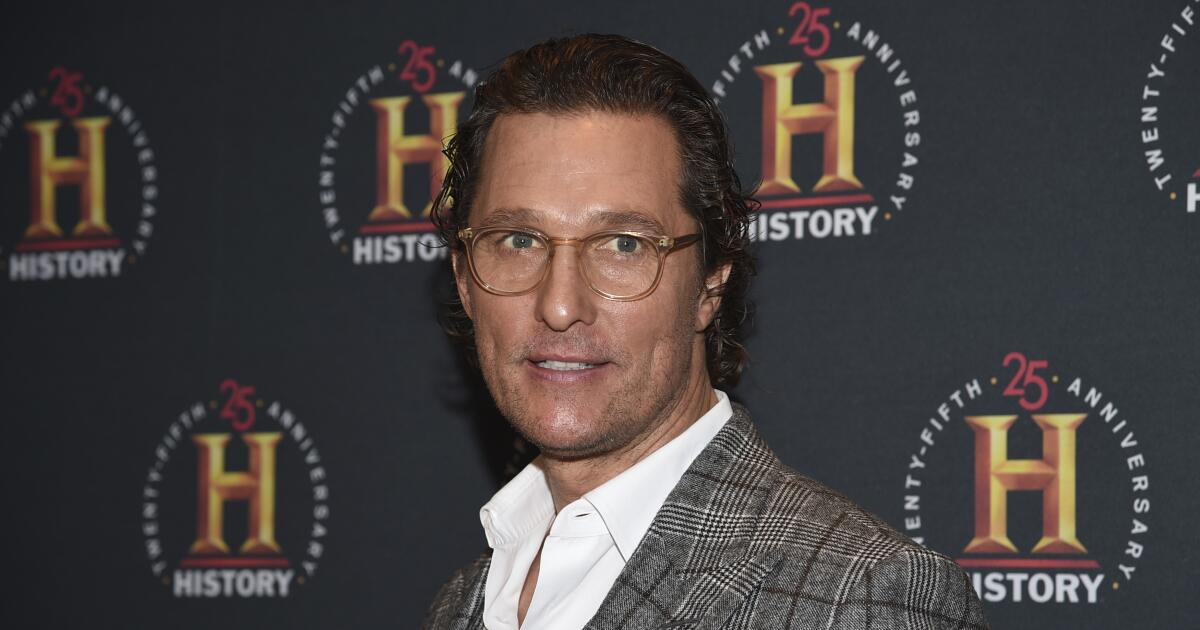

David Ellison is the founder and CEO of Skydance Media. Skydance's offer for Paramount Global is nearly $2.5 billion higher than Edgar Bronfman Jr.'s increased offer.

(Evan Agostini/Invision/Associated Press)

Skydance's offer still appears stronger than Bronfman's.

Skydance's offer is nearly $2.5 billion higher than Bronfman's increased bid. Ellison also has a signed deal and equivalent rights to any rival bid, as well as backing from RedBird Capital Partners and his billionaire father.

Skydance's proposal also includes a key provision that helped it win the support of Paramount's board: $4.5 billion set aside to buy back shares from Paramount investors, including nonvoting Class B shareholders who want to exit at $15 a share.

Bronfman, in his letter to Paramount Special Committee Chairman Charles E. Phillips, Jr., said his group would like to create a fund to buy out some of the Class B stockholders.

The Wall Street Journal reported that the new offer gives some non-Redstone, non-voting Paramount shareholders the option to sell at $16 a share.

Class B shareholder compensation has been a critical issue. Paramount's board members have worked to demonstrate that they have fulfilled their fiduciary duty to look out for the interests of all shareholders, not just the voting Class A shareholders, including the Redstone family, which owns 77% of the controlling shares.

Some shareholders have expressed dismay at Ellison’s multi-phased deal, most notably his plan to merge his Santa Monica studio, Skydance, with Paramount. The deal places a $4.75 billion valuation on Skydance, which co-owns some of Paramount’s biggest franchises, including “Top Gun: Maverick,” “Transformers,” “Mission: Impossible,” “Reacher” and “Star Trek.”

Both Skydance's and Bronfman's proposals would involve buying the Redstones' National Amusements company for $2.4 billion. After paying off the company's debt, the family would be left with about $1.75 billion.

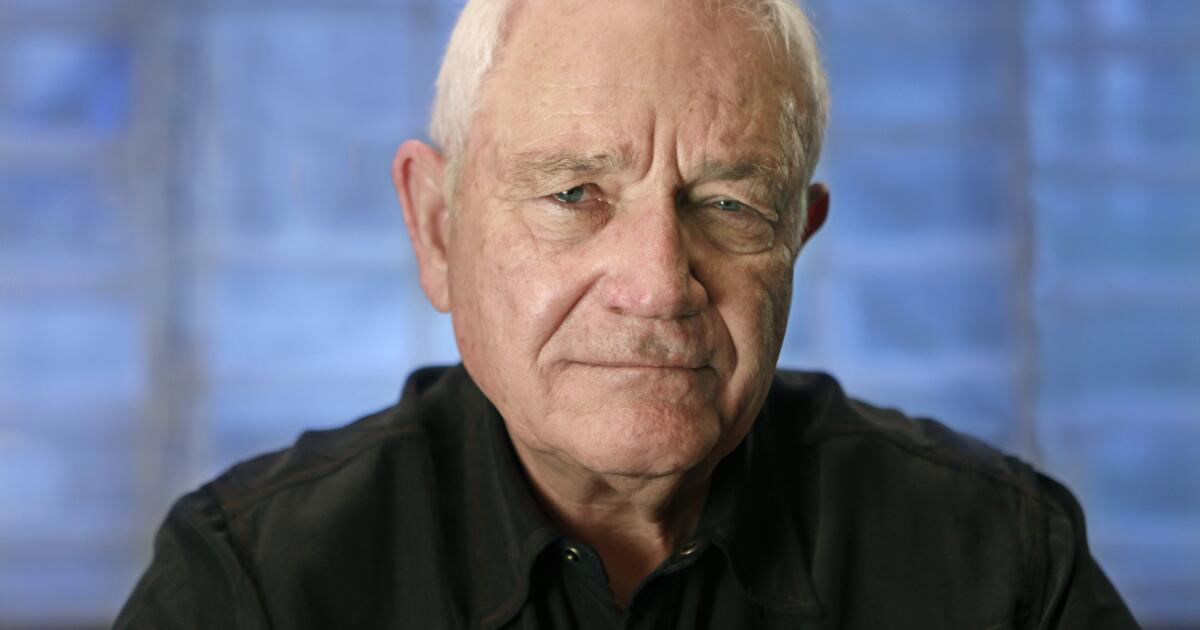

Bronfman has been a major figure in Hollywood for decades.

He previously ran Universal Studios and then Warner Music, and currently serves as chief executive of FuboTV, which last week won a major court victory over Walt Disney Co., Warner Bros. Discovery and Fox Corp. Citing antitrust concerns, a federal judge in New York has at least temporarily halted the launch of the companies’ joint venture to create a sports-focused streaming service called Venu.

This spring, Bronfman struggled to submit a bid with funding from Bain Capital, according to people familiar with the process but not authorized to comment. Bain ultimately scrapped the offer, leaving Bronfman without a firm offer at a crucial moment during the auction.

Although Redstone was temporarily put off by Skydance's offer, his other suitors failed to prove they had the necessary financing.

Bronfman began recruiting a group of individual investors that includes former Fox and AOL executive Jon Miller; Atlas Comics investor Steven Paul; former “Mighty Ducks” actor Brock Pierce; and John Martin, former chief financial officer of Time Warner.

The group rushed to put together a proposal with enough weight to be considered by the Special Committee before this week's deadline.

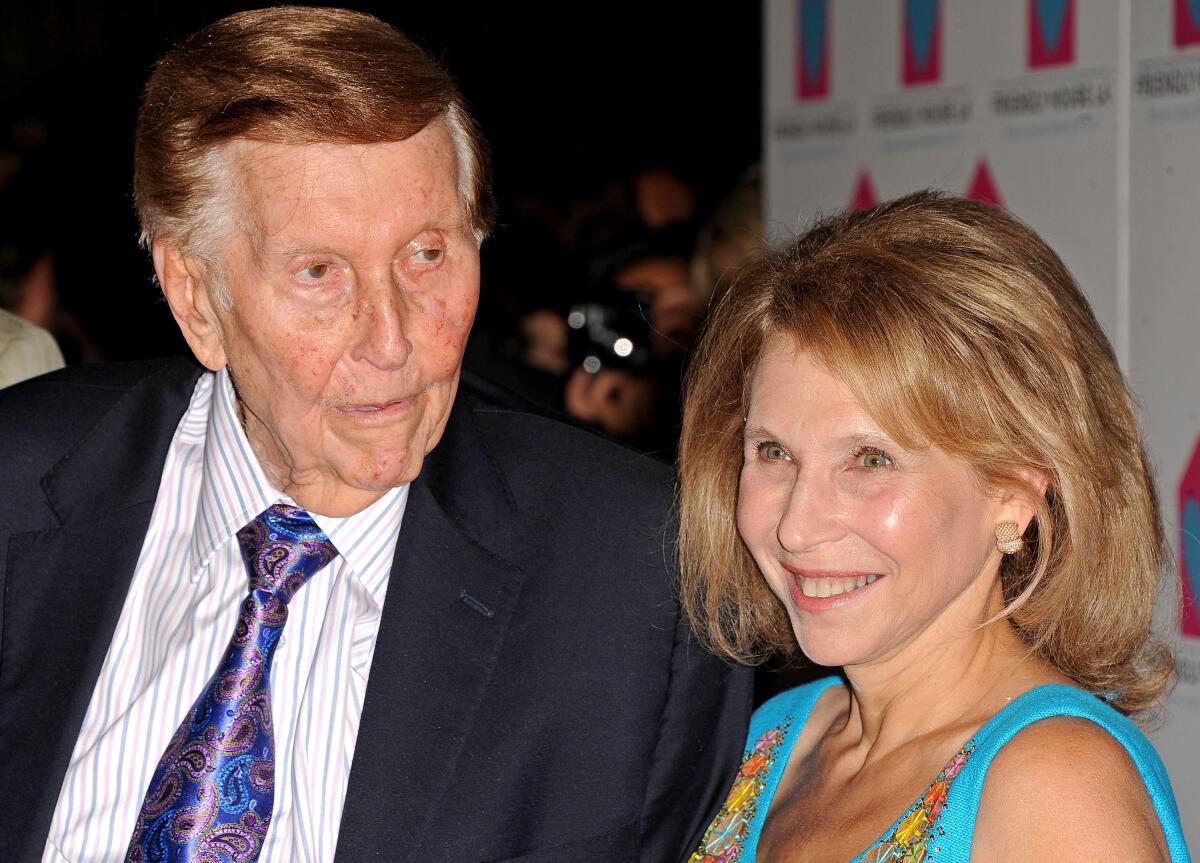

The late Sumner Redstone, left, is shown with his daughter, Shari Redstone, in 2012.

(Katy Winn/Invision/Associated Press)

“We believe Shari Redstone philosophically prefers the concept of merging with Skydance given [the Ellison family’s wealth and because] “Skydance has no plans to split up the company (for now),” Raymond James media analysts Ric Prentiss and Brent Penter wrote in a report this week.

But the 70-year-old tycoon has a cordial relationship with Bronfman, according to people familiar with the case. Both are members of prominent dynasties and both move in some of the same New York media circles. And one of his longtime advisers, Miller, is a key member of Bronfman’s investment group. Miller was a partner at Redstone’s boutique investment firm, Advancit Capital.

Even if Bronfman's offer falls short of targets, the exercise could be leverage in fending off shareholder lawsuits. Paramount can argue that the sale process was open to other offers.

Paramount shares closed up 1.4 percent at $11.09.

Times sTaff writer Samantha Masunaga contributed to this report.