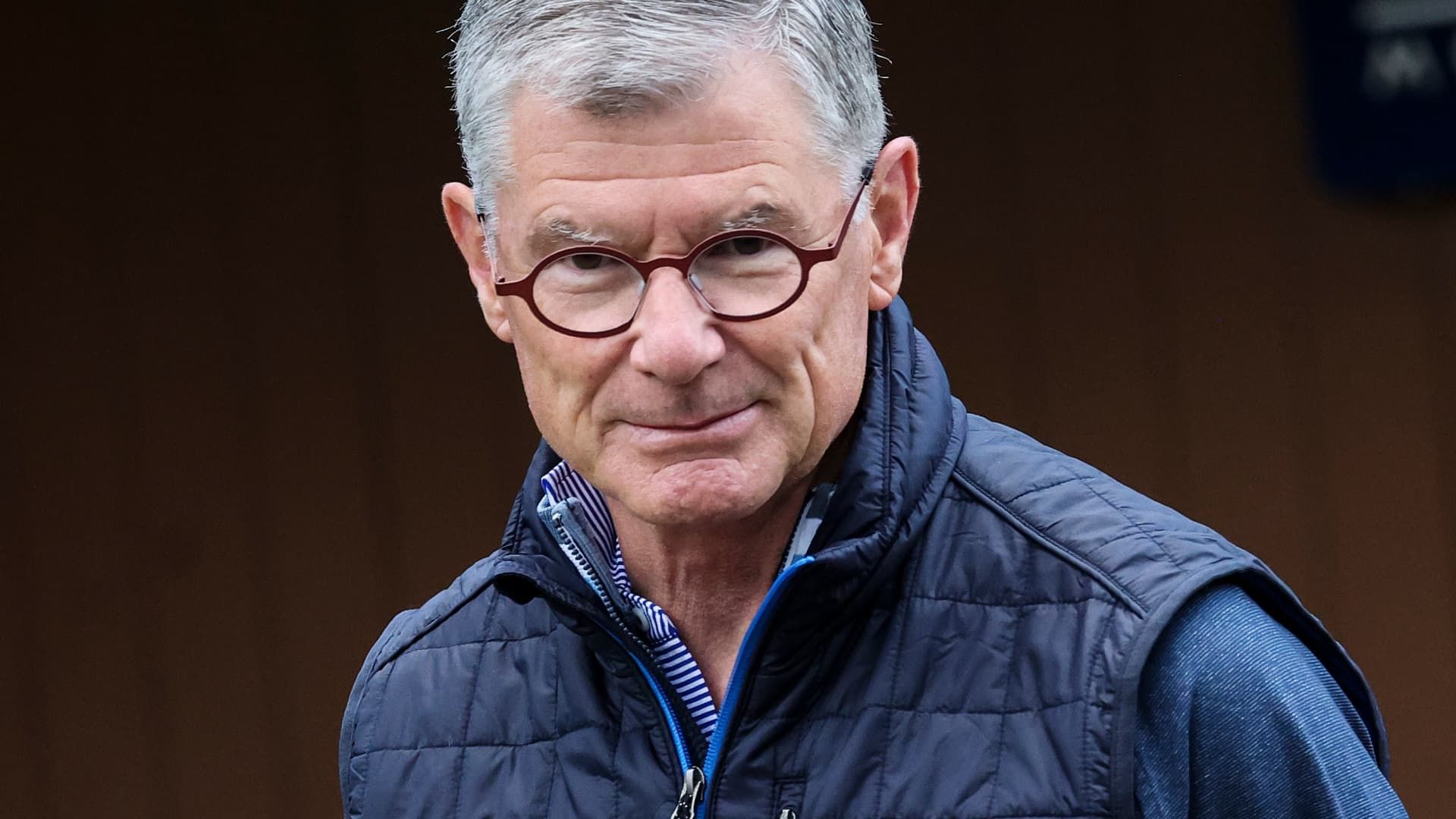

Barry McCarthy, president and CEO of Peloton Interactive, walks to a morning session at the Allen & Company Sun Valley Conference on July 6, 2022 in Sun Valley, Idaho.

Kevin Dietsch | fake images

Platoon announced Thursday that CEO Barry McCarthy will resign and that the company will lay off 15% of its staff because it “simply had no other way to align its expenses with its revenue.”

McCarthy, a former Spotify and Netflix executive, will become a strategic advisor to Peloton through the end of the year, while Karen Boone, the company's president, and director Chris Bruzzo will serve as interim co-CEOs. Boone most recently served as CFO of Restoration tools while Bruzzo was a long-time executive at electronic arts. Peloton is looking for a permanent CEO.

The company also announced a broad restructuring plan that will reduce its global workforce by 15%, or around 400 employees. It plans to continue closing retail showrooms and make changes to its international sales plan.

The measures are designed to realign Peloton's cost structure with the current size of its business, it said in a news release. It is expected to reduce annual expenses by more than $200 million by the end of fiscal 2025. About half of those savings will come from payroll reductions, while the rest will come from lower marketing spending, a reduced retail footprint , and reduced spending on IT and software, said chief financial officer Liz Coddington.

The departments most affected by the restructuring will be Peloton's international, marketing and research and development teams, Coddington said.

“This restructuring will position Peloton for sustained positive free cash flow, while allowing the company to continue investing in software, hardware and content innovation, improvements to its member support experience, and optimizations of marketing efforts. to scale the business,” the company said. saying.

Peloton shares rose more than 12% in premarket trading, but opened lower after the company's conference call with Wall Street analysts concluded. Shares closed about 3% lower.

Peloton's board is ready for its next CEO

McCarthy took the helm of Peloton in February 2022 from founder John Foley and has spent the past two years restructuring the business and working to return it to growth.

As soon as he took over, he implemented mass layoffs to tighten Peloton's cost structure, closed some of the company's flashy showrooms and enacted new strategies designed to increase membership. He overhauled Peloton's executive team, oversaw its rebranding and created new revenue drivers like the company's rental program.

The latest round of cuts, which affected 500 employees, was announced in October 2022. McCarthy later said the company's restructuring was “complete” and that it was instead pivoting toward “growth.”

“We're done,” McCarthy had said in November 2022 about the layoffs. “There are no more heads to take out of the business.”

Unlike Peloton's founder, McCarthy redirected Peloton's attention to its app as a means to recruit members who may not be able to afford the company's expensive bikes or treadmills, but who might be interested in taking its classes. digital.

In a letter to staff, McCarthy said the company now needed to implement layoffs again because it would not be able to generate sustainable free cash flow with its current cost structure. Peloton hasn't made a profit since December 2020 and can only burn cash for a limited time when it has more than $1 billion in debt on its balance sheet.

“Achieve positive results [free cash flow] makes Peloton a more attractive borrower, which is important as the company turns its attention to the necessary task of successfully refinancing its debt,” McCarthy said in the memo.

In a letter to shareholders, the company said it is “aware” of the maturity schedule of its debt, which includes convertible notes and a term loan. He said he is working closely with his lenders on JPMorgan and Goldman Sachs on a “refinancing strategy”.

“Overall, our refinancing objectives are to deleverage and extend maturities at a reasonable combined cost of capital,” the company said. “We are encouraged by the support and interest from our existing lenders and investors and look forward to sharing more on this topic.”

In a press release, Boone thanked McCarthy for his contributions.

“Barry joined Peloton during an incredibly challenging time for the business. During his tenure, he laid the foundation for scalable growth by constantly redesigning the business's cost structure to create stability and reach the important milestone of achieving free cash flow.” positive”. Boone said.

“With a strong leadership team in place and the Company now on solid footing, the Board has decided that now is an appropriate time to search for Peloton's next CEO.”

During a conference call with analysts, Boone said Peloton's board of directors is looking for a leader who can “design and lead the company's next phase of growth.”

Disappointing earnings, downgraded outlook

Also on Thursday, Peloton announced its fiscal third-quarter results and missed Wall Street's expectations in terms of revenue and results. Here's how the connected fitness company fared compared to what Wall Street expected, according to a survey of analysts by LSEG:

- Loss per share: 45 cents vs. an expected loss of 37 cents

- Revenue: $718 million vs. $723 million expected

The company's reported net loss for the three months ended March 31 was $167.3 million, or 45 cents per share, compared with a loss of $275.9 million, or 79 cents per share, one year earlier.

Sales fell to $718 million, down about 4% from $748.9 million a year earlier.

Peloton has tried a little of everything to help the company grow sales again. It removed the free membership option from its fitness app, expanded its corporate wellness offerings, and partnered with megabrands like lululemon to increase membership, but none of the initiatives have been enough to increase sales.

For the ninth consecutive quarter, Peloton's revenue fell during its fiscal third quarter, compared to the same period a year ago. It hasn't seen sales grow compared to the prior-year quarter since December 2021, when the company's exercise bikes were still in high demand and many had yet to return to gyms amid the Covid-19 pandemic.

The company continues to bleed money and has not made a net profit since December 2020.

For its current fiscal year, Peloton lowered its outlook for paid connected fitness subscriptions, app subscriptions and revenue. It lowered its connected fitness subscription outlook by 30,000 members, or 1%, to 2.97 million heading into the current quarter, which is typically the toughest because people tend to exercise less in the spring and summer months.

“Our connected fitness paid subscription guidance reflects an updated outlook for hardware sales based on current demand trends and expectations for seasonally lower demand,” the company said.

Peloton now expects app subscriptions to fall by 150,000, or 19%, to 605,000.

“We maintain our disciplined focus on app media spend as we evaluate the tiers and pricing of our apps and refine the acquisition funnel for paid app subscriptions,” the company said.

As a result of expected declines in its subscription sales, Peloton now projects full-year revenue to be $2.69 billion, a decline of about $25 million, or 1%. That's below expectations of $2.71 billion, according to LSEG.

However, the company raised its full-year outlook for gross margin and adjusted EBITDA. It now expects total gross margin to grow 50 basis points, to 44.5%, and adjusted EBITDA to grow $37 million, to negative $13 million.

“This increase is largely due to superior third-quarter performance, combined with lower media spending and cost reductions due to the restructuring plan announced today,” the company said.

The quest to achieve positive free cash flow

Last February, McCarthy set a goal for Peloton to return to revenue growth within a year. When he failed to reach that milestone, McCarthy rejected it and said he now expects the company to return to growth in June, at the end of the current fiscal year.

McCarthy also expected Peloton to reach positive free cash flow in June, a goal the company said it reached early in its third quarter. It's the first time Peloton has hit that mark in 13 quarters. In a letter to shareholders, Peloton said it generated $8.6 million in free cash flow, but it's unclear how sustainable that figure is.

Last month, CNBC reported that Peloton had not paid its suppliers on time, which could temporarily increase its balance sheet. Data from business intelligence firm Creditsafe showed that Peloton's late payments to suppliers increased in December and again in February after improving in January.

The company did not provide specific guidance on what investors can expect with free cash flow in the coming quarters, but said it expects to “deliver modest positive free cash flow” in its current quarter and fiscal 2025.

“While we fully intend to return the business to growth, with the cost reductions announced today, we are reducing our cost base and see a path to positive free cash flow without requiring a significant improvement in growth for get there,” Coddington said on the conference call. “I also want to clarify that we have carefully reviewed these cost measures to ensure we still have the ability to invest in innovation so the business can grow profitably.”

Part of the reason Peloton failed to reach positive free cash flow is because it simply isn't selling enough hardware, which is expensive to manufacture and has become less popular since the Covid-19 pandemic ended and people returned. to the gyms.

“If we look at the numbers in more detail, the biggest problem lies in the part of the business where Peloton first made its name: exercise equipment. Revenue from connected fitness products plummeted 13.6% year-over-year past, in a sign that consumers are still cooling off. equipment that, while aesthetically and technically pleasing, is very expensive,” GlobalData CEO Neil Saunders said in a note. “Many people who want Peloton equipment already have it and aren't likely to upgrade anytime soon; the rest of the market is either not interested or needs a lot of persuasion to buy Peloton.”