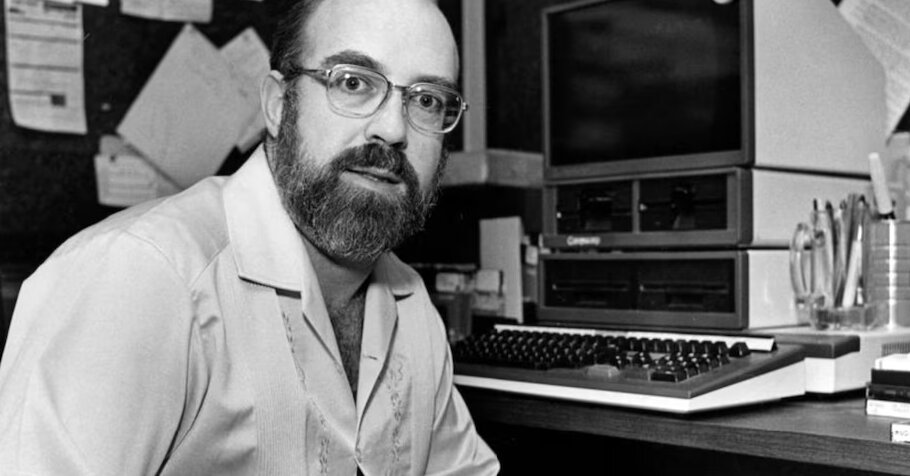

Lucid Motors CEO Peter Rawlinson poses at Nasdaq MarketSite as Lucid Motors (Nasdaq: LCID) begins trading on the Nasdaq Stock Exchange after completing its business combination with Churchill Capital Corp IV in New York City, New York, July 26, 2021.

Andrew Kelly | Reuters

DETROIT – Investors misinterpreted a public offering Wednesday by Lucid Group That raised about $1.75 billion and led to the stock's worst daily performance in nearly three years, CEO Peter Rawlinson told CNBC.

Rawlinson said the raise, which included a public offering of nearly 262.5 million common shares, was a strategic and timely business decision to ensure the electric vehicle company has enough capital for its ongoing operations and growth plans. It should also alleviate any potential concerns that the company will need to issue a “going concern” statement regarding its operations, he said.

“We had noted that we had a cash runway until the fourth quarter of next year. As a Nasdaq company, we have to avoid a going concern. And a going concern is issued within 12 months of its financial runway,” Rawlinson said. Monday from the company's site. Newly opened offices in the suburbs of Detroit. “So it shouldn't have been a surprise to anyone.”

But Wall Street analysts largely took a negative view of the move because of its timing. Several said the increase was unnecessary or came sooner than expected for the company, which had $5.16 billion in total liquidity at the end of the third quarter. That included more than $4 billion in cash, cash equivalents and investment balances.

The announced transactions also come two months after Lucid said Saudi Arabia's Public Investment Fund had agreed to provide the company with $1.5 billion in cash, as the electric vehicle maker looks to add new models to its product lineup. .

“A capitalization increase was slightly larger and earlier than we expected,” Morgan Stanley analyst Adam Jonas wrote following the increase announced Wednesday after markets closed.

actions of lucid

RBC Capital Markets analyst Tom Narayan shared similar thoughts: “We suspect investors will be wondering why LCID is raising more capital just after securing PIF capital in August, and with share price levels currently depressed. “We expect Lucid shares to trade sharply lower as the outcome unfolds,” he wrote in a note to investors late Wednesday.

Rawlinson reiterated Monday that the company would raise capital “opportunistically.” He said the company's current funding now secures its capital through 2026, before launching a new midsize platform later that year.

“This is exactly what was expected. It's exactly according to the playbook. It shouldn't have been a surprise to anyone,” he said. “And why did I choose this moment? Because I didn't want to drag it out to the end, because it wasn't necessary.”

Lucid shares fell about 18% on Thursday following the announcement, marking the worst daily drop for the company since December 2021.

Rawlinson said Lucid is currently in a highly capital-intensive investment period as it expands its only U.S. factory in Arizona; builds a second plant in Saudi Arabia; is preparing to launch its second product, an SUV called Gravity; develops its next-generation propulsion system; and develops its retail and service network.

“Those five categories are the long-term investment for the future that we're making now,” Rawlinson said. “Do we have to reduce costs with every car we make? Absolutely.”

Wednesday's announcement was made in conjunction with plans for Lucid's majority shareholder and PIF affiliate, Ayar Third Investment Co., to purchase more than 374.7 million Lucid common shares to maintain its ownership of about 59% of the company.

This transaction is called pro rata, and it allows an investor like PIF to participate in future financing rounds and retain their ownership interest. It's something the PIF has routinely done with Lucid.

Individual investors were probably concerned about share dilution following the move, but Rawlinson said continued support from the PIF should be seen as a positive.

“I think it's been misinterpreted and misinformed,” Rawlinson said. “The rule is to prorate. If we didn't do that, it would surely be a sign that the PIF was losing faith in us.”

Lucid said last week that the public offering was expected to raise about $1.67 billion, with a 30-day option for underwriter BofA Securities to also buy up to nearly 39.37 million additional Lucid common shares.

Lucid has reported record deliveries in 2024 of its current model, an all-electric sedan called the Air. The company expects to produce 9,000 vehicles this year. Production of its Gravity SUV is expected to begin later this year.

However, Lucid's sales and financial performance have not scaled as quickly as expected due to higher costs, slower-than-expected demand for electric vehicles, and marketing and awareness issues for the company.