Terran Orbital banner above the New York Stock Exchange on March 28, 2022.

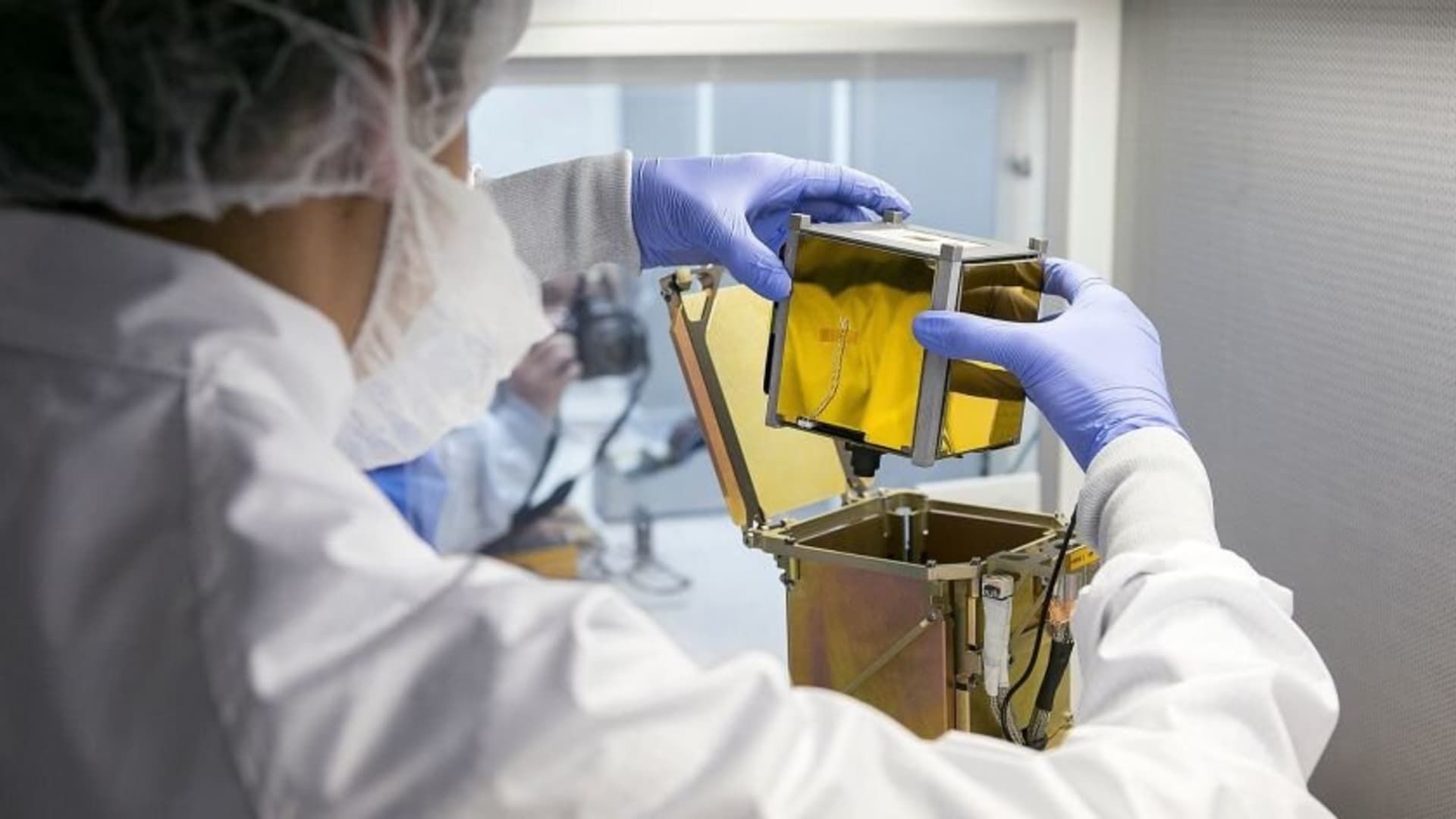

Earth orbit

Lockheed Martin is buying Earth orbit“the company announced Thursday, with the defense giant reaching an agreement to privatize the struggling spacecraft maker.

The deal will see Lockheed acquire Terran at an enterprise valuation of nearly $450 million, down from Lockheed's previous offer of nearly $600 million in March.

Lockheed would acquire Terran Orbital's outstanding common stock for 25 cents per share in cash. In addition, Lockheed will pay down Terran's debt and establish a $30 million capital facility to keep the company operating while the deal closes.

Terran shares closed at 40 cents a share on Wednesday.

The deal, which is expected to close in the fourth quarter, would help Terran avoid the debt and liquidity chasm the company is about to face. Terran’s cash reserves were less than $15 million at the end of July, it reported in a filing Monday, and it also has about $300 million in debt.

The small spacecraft maker went public via a special purpose acquisition company in early 2022 at a valuation of $1.8 billion. Like many other space stocks that debuted in recent years, the still-unprofitable company has been hit hard by the changing risk environment in the market.

Lockheed Martin is already a significant shareholder in Terran Orbital, having purchased during the company’s SPAC process and again in late 2022. Lockheed Martin is also a major customer for Terran, accounting for 70% of Terran’s $30.4 million in revenue during the second quarter.

Eighteen months ago, Terran signed a blockbuster spacecraft production contract with satellite communications operator Rivada Space Networks, worth $2.4 billion for 300 satellites. But the deal has yet to generate significant funds for Terran, which reported recognizing just $6.2 million from the Rivada deal in the first half of this year.

On Monday, Terran announced it would remove the Rivada deal from its overall backlog, reducing its backlog by 88%, from $2.7 billion to $312.7 million. Of its non-Rivada orders, 91% of Terran's contracts are “programs associated with Lockheed Martin.”