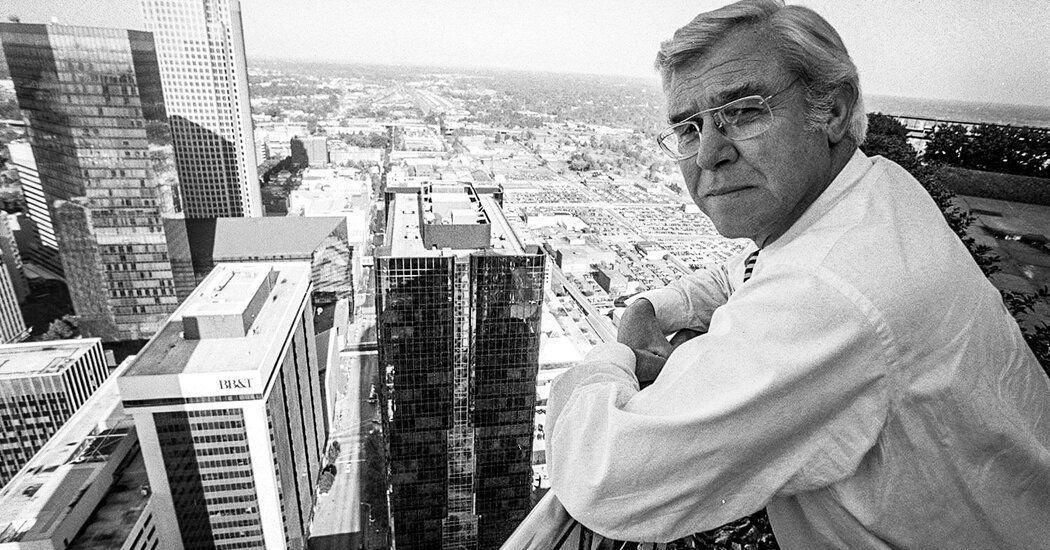

Edward E. Crutchfield, a banker who grew a small North Carolina bank into one of the largest in the country on a wave of deals that earned him the nickname “Fast Eddie” and helped establish Charlotte as a national financial center, died on January 2. at his home in Vero Beach, Florida. He was 82 years old.

His death was confirmed by his son, Elliott Crutchfield, who said his father suffered from dementia.

When Mr. Crutchfield graduated from business school in 1965, he accepted a job as a credit analyst at First Union Bank in Charlotte, North Carolina. It was the lowest-paying job he was offered, but he thought he could advance faster at a smaller bank. He sensed an opportunity, he told his family and colleagues, at the bank and in the region.

Both hunches paid off. At age 32, just seven years after joining First Union, he became its president and was believed to be the youngest person in the country to hold that title at a major bank. His ambitions were expanded by a 1985 Supreme Court ruling that legalized interstate banking. The decision empowered Crutchfield, then president and CEO of his bank, to gobble up rival banks and failed thrifts, transforming First Union into a superregional bank with thousands of branches across the Southeast.

“I just had a feeling that what turned out to be the Sun Belt would be a good bet,” he told the New York Times in 1983, shortly before beginning his shopping spree. “I guess we're rubbing the rabbit's foot in the right way.”

By the time Crutchfield retired in 2000, First Union had acquired more than 90 banking and lending companies and became the nation's sixth-largest bank by assets. In 2001, First Union merged with Wachovia, taking the other bank's name. Wells Fargo bought Wachovia in 2008, during the crisis that reshaped the financial industry.

Crutchfield's imprint lives on in the enormous role Charlotte still plays in the banking industry. Wells Fargo has 27,000 workers there, more than it employs at its San Francisco headquarters.

“Ed just had a vision that we could be one of the biggest and best banks in America, and that's what made him,” said Austin Adams, who was First Union's chief information officer for 17 years.

Edward Elliott Crutchfield Jr. was born on July 14, 1941, in Dearborn, Michigan, and grew up in Albemarle, North Carolina, a rural town about 40 miles from Charlotte. His father worked for the FBI before becoming a lawyer and county judge. His mother, Katherine (Sikes) Crutchfield, was a high school teacher.

He attended Davidson College on a football scholarship and graduated in 1963, then earned an MBA from the Wharton School of the University of Pennsylvania. His marriage to Nancy Robson ended in divorce. In 1996 he married Barbara Massa, who was director of corporate communications for First Union. In addition to his son, she is survived by a daughter, Sally Davis, both children from his first marriage; a stepdaughter, Elizabeth Howze; his wife; and five grandchildren.

At First Union, he quickly established himself as a go-getter. Shortly after joining the bank, he created its municipal bond department. In 1968, at age 26, he was asked to solve serious problems in the bank's credit card operations. He kept the administrative office open 24 hours a day and brought a cot to sleep on. “I felt like I had to be there to welcome the midnight shift and the 8 o'clock shift,” he told The Times.

As a manager, he had a reputation for not delegating, a style he had to adapt as the bank grew. But when he acquired a new bank, one of the first things he did was take over the bank's investment portfolio. He was also quick to rebrand new acquisitions, developing what Adams called “the fastest integration model in the country.”

“It was never more than 11 months from the time we announced the transaction to when we converted all the systems, changed the signs, the products, the branches, everything,” Adams said.

Crutchfield was “a quintessential southerner” who loved to hunt, fly fish and live far from Wall Street, according to his son. “He enjoyed our underdog status and enjoyed both seeing Charlotte outperform her rivals and First Union outperforming other banks,” the younger Mr. Crutchfield said.

When he set his eyes on a target, he did not like to be defeated. To persuade Malcolm McDonald to sell Signet Banking Corporation to First Union in 1997 for $3.25 billion, Crutchfield joked, “I kept stacking billion-dollar bills on the table until Mac said yes.”

There were stumbles. In 1998, First Union bought CoreStates Financial for $17 billion (a record six times the bank's book value and, at the time, the largest bank merger in U.S. history) and then lost 20 percent of the profits. two million CoreStates customers in an effort to steer them away from human tellers and toward phone and Internet service. One of Crutchfield's last purchases, home equity lender Money Store, became a cash sink and was soon closed by his successor.

Ken Gepfert, a First Union employee who worked for several years as Mr. Crutchfield's speechwriter, said his boss once recounted a conversation he had with his father, who was also a devoted fisherman, about his son's acquisitive streak. bank.

“His father said, 'Son, I hope you don't catch them faster than you can string them,'” Gepfert said. “Ed knew First Union needed to expand quickly to survive in interstate banking. But privately, he always said that one of his biggest fears was that First Union would grow too big and lose its kind of community roots.”