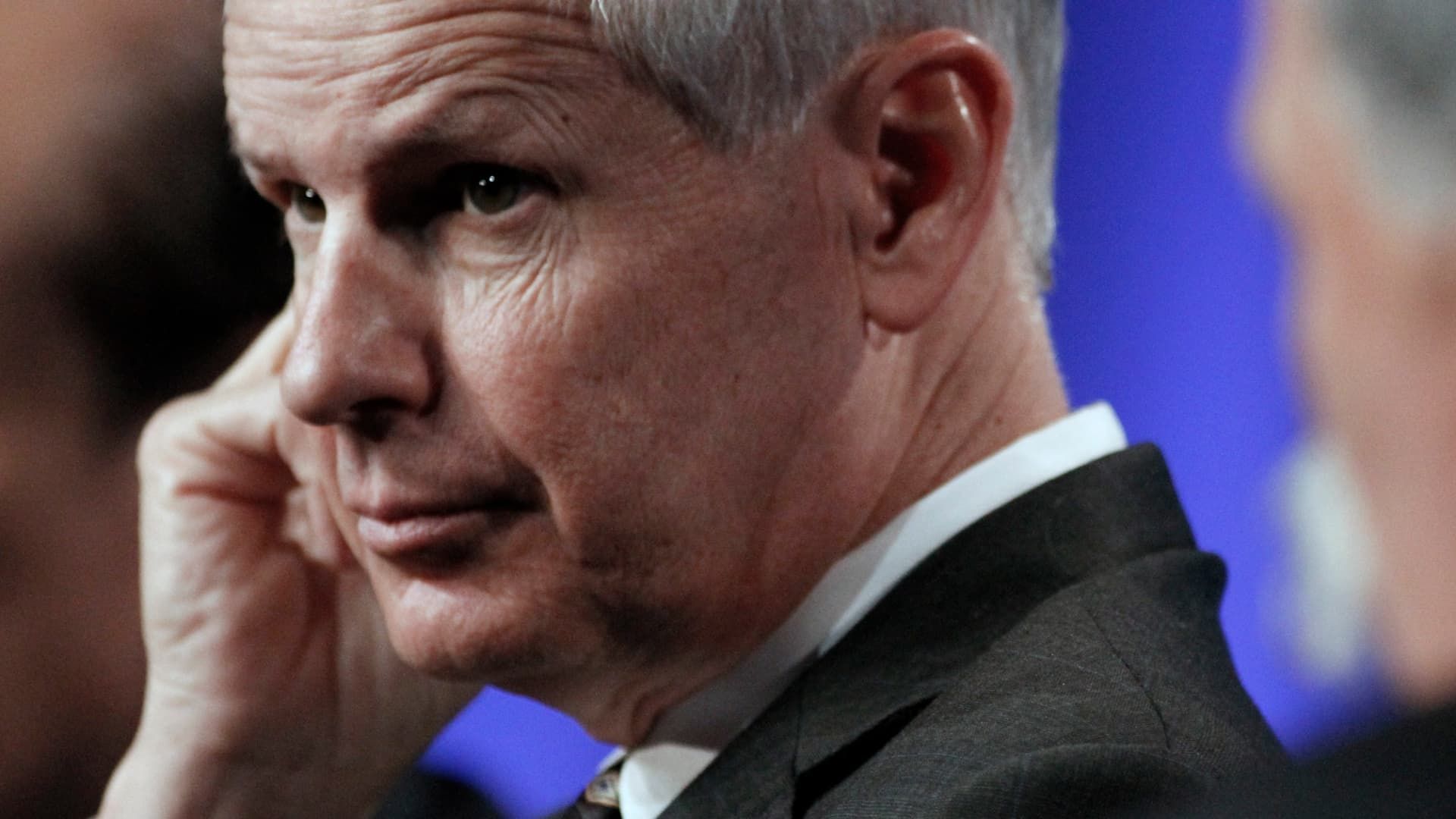

Charlie Ergen, president and co-founder of Dish Network Corp.

Jonathan Alcorn | Bloomberg | fake images

Charlie Ergen is about to sell the pay TV business he founded more than 40 years ago.

ecostar is in advanced talks to sell satellite TV provider Dish Network to rival DirecTV, the pay TV operator owned by private equity firm TPG and AT&T, according to people familiar with the matter. While the sides hope to complete a deal by Monday, no agreement is guaranteed and the talks could still fail, said the people, who asked not to be identified because the discussions are private.

The combination of Dish and DirecTV has been rumored for years and almost happened in 2002 until it collapsed under regulatory pressure. This time, the deal is being driven by EchoStar's desire to pay off $1.98 billion of debt that comes due in November, two of the people familiar with the process said. EchoStar had just $521 million in cash and cash equivalents and marketable investment securities as of June 30 and forecasts negative cash flows for the rest of 2024, according to public filings.

The prospect of future EchoStar bankruptcy and creditor approval of the deal complicate completion of the deal. Dish attempted to refinance some of its debt earlier this week with bondholders, but negotiations failed, according to a Sept. 23 filing.

The company said in public filings that it remains in talks with other debtholders.

A potential DirecTV-Dish transaction is being structured all cash, with DirecTV paying EchoStar for the satellite TV business, its Sling digital business and associated liabilities, people familiar with the matter said.. In total, the transaction may be worth more than $9 billion, according to one of the people.

A DirecTV spokesperson declined to comment. A Dish spokesperson could not immediately be reached for comment.

“The bottom line is that we now see bankruptcy in the next four to six months as the most likely outcome. [for EchoStar]”Craig Moffett of MoffettNathanson said in a note to clients in August. “They will need to raise new capital.”

EchoStar has a total enterprise value of about $31 billion and a market capitalization of about $7.6 billion. There is no wireless spectrum involved in the proposed deal, which Dish Network has spent the last decade accumulating as it seeks to transition into a wireless company, the people said.

Satellite television, once one of the largest distributors of package television, has been declining for years, often at a faster rate than cable competitors — as consumers shift to subscription streaming services like netflix, Disney+ and Amazon Main video. Dish ended its latest quarter with 6.1 million satellite subscribers and 2 million customers for Sling TV, Dish's linear network-over-the-Internet package.

DirecTV has also felt the pain, losing millions of subscribers since AT&T bought the company in 2015 for $67 billion with debt. AT&T spun it off in 2021 and sold a portion of the company to TPG. At the time, DirecTV had approximately 15.4 million subscribers. It currently has about 11 million, CNBC previously reported.

Recently, the company has focused on developing its streaming business, focusing its latest advertising campaign on dispelling the belief that DirecTV is only available through a satellite dish. MoffettNathanson estimates that DirecTV added more than 20,000 streaming customers earlier this year. Most of their customers still use satellite dishes.

More recently, DirecTV was in a distribution fight with Disney, causing networks like ESPN to go dark for nearly two weeks for the satellite TV company's customers. The two companies reached a deal that gives DirecTV the ability to offer slimmer, genre-specific packages.

—CNBC's Lillian Rizzo contributed to this report.