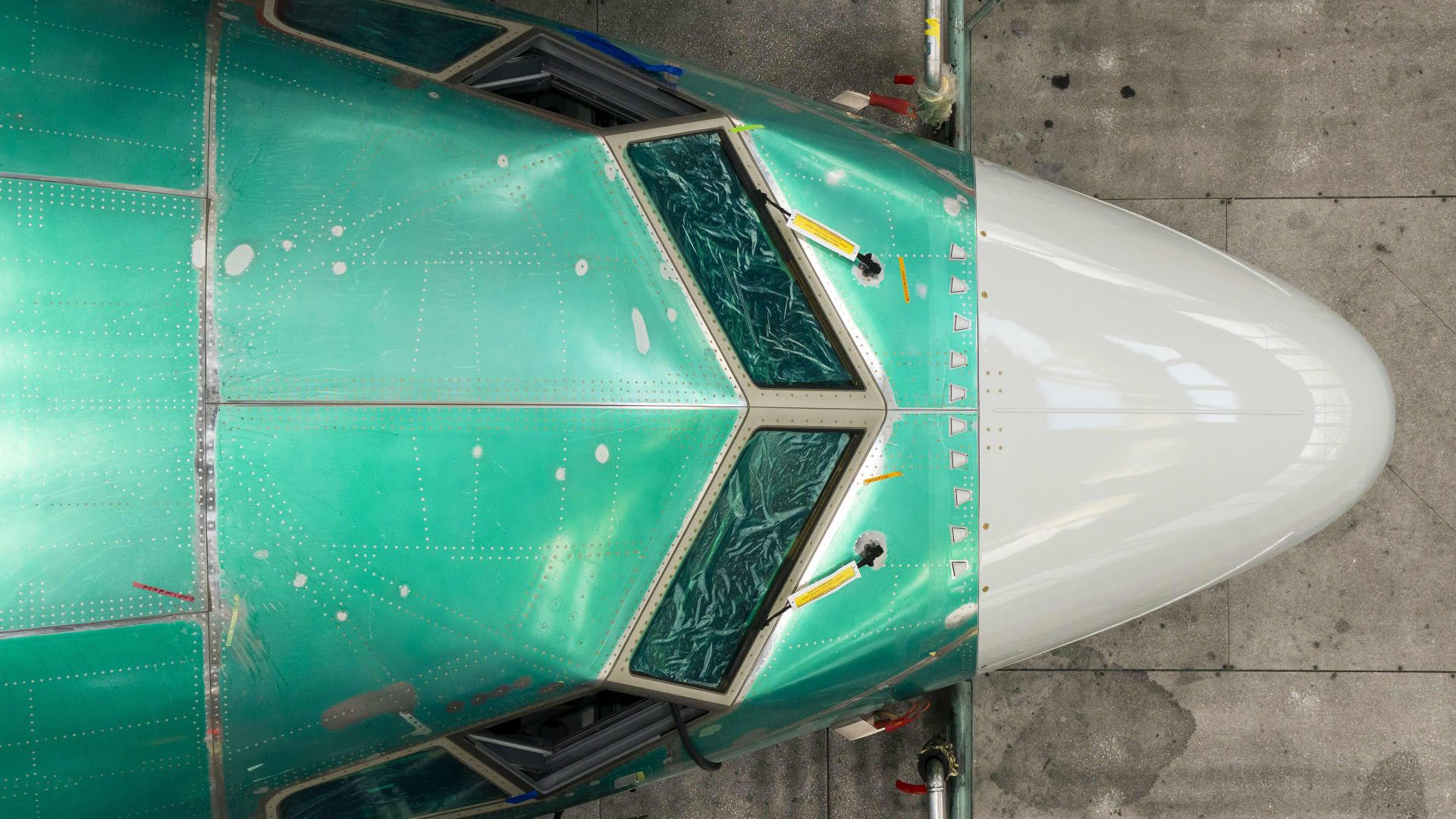

A Boeing Co. 737 Max aircraft at the company's manufacturing facility in Renton, Washington, U.S., Thursday, Nov. 20, 2025.

David Ryder | Bloomberg | fake images

boeing is set to report this week that it delivered the most planes since 2018 last year after stabilizing its production, the clearest sign of a turnaround yet after years of safety crises and rising quality defects.

Now, the aerospace giant plans to increase production.

“There's a long road back from a… let's say, a pretty dysfunctional culture, but they're making great strides,” said Richard Aboulafia, managing director of AeroDynamic Advisory, an aerospace industry consulting firm.

Boeing has been forced to reduce production in recent years following two fatal crashes of its popular 737 Max aircraft in 2018 and 2019 and the mid-air explosion of a door plug on one of its planes in the first week of 2024. The Covid pandemic hit aircraft assembly at both Boeing and its main rival Airbus, with supply chain delays and the loss of experienced workers even after the worst of the health crisis subsided.

A Boeing 737 approaches San Diego International Airport for landing on May 10, 2025.

Kevin Carter | fake images

Boeing leaders, including CEO Kelly Ortberg, a longtime aerospace executive who came out of retirement to take the top job months after the mid-air door plug crash, are preparing to ramp up production this year of its 737 Max aircraft and the longer-range 787 Dreamliners.

That could help the manufacturer, the top U.S. exporter by value, return to profitability, as analysts expect this year, territory that was out of reach for seven years while its leaders focused on damage control and were stuck reassuring frustrated airline executives awaiting delayed planes.

His tone has changed as Boeing has become more predictable and increased production, with the blessing of the Federal Aviation Administration. In a sign of the FAA's increased confidence in Boeing, the agency said in September that Boeing could issue its own airworthiness certificates before customers take delivery of some of its 737s and 787s after years of restrictions.

Boeing's commercial aircraft business is its largest unit, accounting for about 46% of sales in the first nine months of last year, with the rest coming from its defense and services business. Boeing last reported full-year earnings in 2018.

Investors are optimistic about the possibility of further improvement. Boeing shares have gained 36% over the past 12 months, outpacing the S&P 500It is almost 20% progress.

“Boeing is definitely better and more stable,” said Bob Jordan, chief executive of the all-Boeing airline. Southwest Airlinesin an interview on December 10.

The company is scheduled to outline its 2026 production plans later this month when it reports quarterly results on January 27.

Get going

For Boeing, the recent change has largely occurred on the assembly floor.

With Ortberg, the manufacturer has drastically reduced so-called itinerant jobs, in which assembly tasks are carried out out of order, to avoid costly errors. The company has also made other changes in manufacturing, including additional training.

The National Transportation Safety Board said in June that inadequate training and management oversight were among the company's problems, according to its investigation into what caused the door stopper explosion in January 2024.

On December 8, Boeing also completed its acquisition of airframe maker Spirit AeroSystems, which Boeing had spun off from the company two decades ago. You now have more direct control of the crucial supplier.

Squirting

Boeing delivered 537 planes in the first 11 months of last year. It reports December deliveries on Tuesday, but Jefferies estimates that the company delivered 61 commercial airplanes last month, 44 of them Boeing's best-seller, the 737 Max.

Boeing delivered 348 planes in 2024 and 528 in 2023. Last year's total would still be far from the 806 planes it delivered in 2018.

Last October, the FAA increased its production limit for Boeing's 737 Max from 38 per month to 42. (The FAA required its approval after the door plug accident.) Chief Financial Officer Jay Malave said at a UBS conference on Dec. 2 that he expects the company to reach that rate by early 2026. Ortberg told investors in October that further rate increases are on the table, in five-plane increments.

Boeing Co. CEO Kelly Ortberg during a media event at the Boeing Delivery Center in Seattle, Washington, U.S., Wednesday, Jan. 7, 2026.

M. Scott Brauer | Bloomberg | fake images

Deliveries to airlines in 2026 will likely be new production, compared to disposal of older inventories, Malave had said. Boeing is also likely to produce about eight Dreamliners a month early this year, he added.

Deliveries are key for plane makers because airlines and other customers pay most of the price of a plane when they receive it. Boeing's main competitor, Airbus, is scheduled to report 2025 orders and deliveries on Monday.

Still, several planes already expected to carry passengers are not yet certified, including the Boeing 777X, as well as the Max 7 and Max 10 variants, depriving Boeing of cash and driving up costs.

Southwest is waiting for the delayed Max 7, the smallest plane in the Max family. The model is important for air routes that have lower demand, so that airlines can avoid an oversupply of seats in the market, which will drive down fares.

Southwest CEO Jordan said last month that he does not expect the airline to fly the Max 7 before the first half of 2027 as Boeing's certification work continues. At one point, Boeing expected it to enter service in 2019.

“They're still a long way from delivering the aircraft we need, but I'm glad to see the progress on the Max 7,” Jordan told CNBC.

Solid demand

Orders for Boeing and Airbus aircraft appear strong, and demand will continue to outstrip supply over the next decade, Bernstein aerospace analyst Douglas Harned said in a note last week.

Airbus surpassed Boeing in deliveries last year, although Boeing appears to have outsold its European competitor in new orders.

Through November, Boeing recorded 1,000 gross orders compared to Airbus' 797. Airline customers have begun to look beyond this decade, securing delivery slots into the mid-2030s as they plan for growth and international expansion.

On Wednesday, Alaska Airlines said it is ordering 105 Boeing 737 Max 10 planes, the longest plane in the Max group. Alaska fleet chief Shane Jones told CNBC that the order is a sign of “our confidence in the Max 10 certification,” as well as “our confidence in Boeing and its ability to produce quality aircraft on time.”

Alaska also exercised options on five 787 Dreamliners for more international routes just over a year after acquiring Hawaiian Airlines, a combination that gave Alaska more Dreamliners and Airbus A330s to reach destinations it couldn't reach before, such as Japan, South Korea and Italy.

The market for wide-body aircraft is gaining momentum, said Ron Epstein, an aerospace analyst at Bank of America, and orders are starting to be delivered more quickly to customers.

International travel, especially high-end travel, has been particularly strong in the years since the pandemic, as travelers vacation around the world. More global airlines are considering acquiring long-haul jets such as Boeing's Dreamliner and Airbus' A330 and A350 in the coming years, heating up the wide-body jet market, analysts said.

Globally, planes flew at nearly 84% capacity in November, the highest level on record, according to the latest data available from the International Air Transport Association, an airline industry group.

As travel demand remains strong, orders to replace older aircraft and source new ones will continue to drive growth.

“The magic, so to speak, of air transportation is until someone comes up with a transporter, you know, [like] 'Star Trek,' where you vaporize and appear somewhere else, let's fly,” Epstein said.