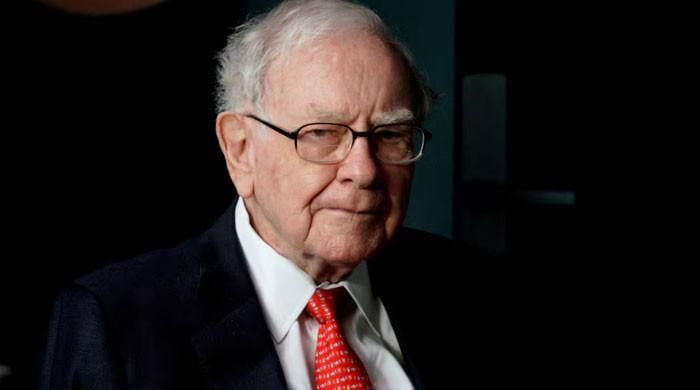

Washington: The famous billionaire investor Warren Buffett has announced that he will retire from Berkshire Hathaway leader by the end of the year. He has recommended Greg Abel as his successor to assume the position of executive director.

Buffett's success, along with his ability to explain his thoughts in Clear Soundbites, has made it very influential in commercial and financial communities, which earned him the nickname “The Oracle of Omaha”.

Several years ago, Buffett had already indicated that Abel, 62, would be his choice for successor in an interview with CNBC.

“The time has come when Greg should become the company's executive director at the end of the year,” said Buffett, 94, to an annual shareholders meeting in Omaha, the city of the west media where Berkshire Hathaway is located.

Buffett said he believed that the Board of Directors would be “unanimously in favor of” its recommendation.

“I would still stay and could be useful in some cases, but the last word would be what Greg said in operations, in the deployment of capital, whatever it is,” he added.

Buffett transformed Berkshire Hathaway from a medium -sized textile company when he bought it in the 1960s in a giant conglomerate, now valued at more than $ 1 billion and with liquid assets of $ 300 billion.

The company reported profits from the first quarter of $ 9.6 billion, 14 percent less. That works at $ 4.47 per share, also going abruptly.

Buffett's net assets starting on Saturday was $ 168.2 billion, according to the rich real -time list of Forbes magazine.

“I have no intention, zero, to sell a part of Berkshire Hathaway. Eventually I will give it to it,” Buffett told the shareholders, who responded with a standing ovation.

“The decision to maintain each part is an economic decision because I believe that Berkshire's perspectives will be better under Greg's management than mine.”

Abel, a central figure for a long time from Berkshire, joined the business group in the Energy Division in 1992 and has been on the Board of Directors since 2018.

“So that is the news hook for the day,” Buffett joked.

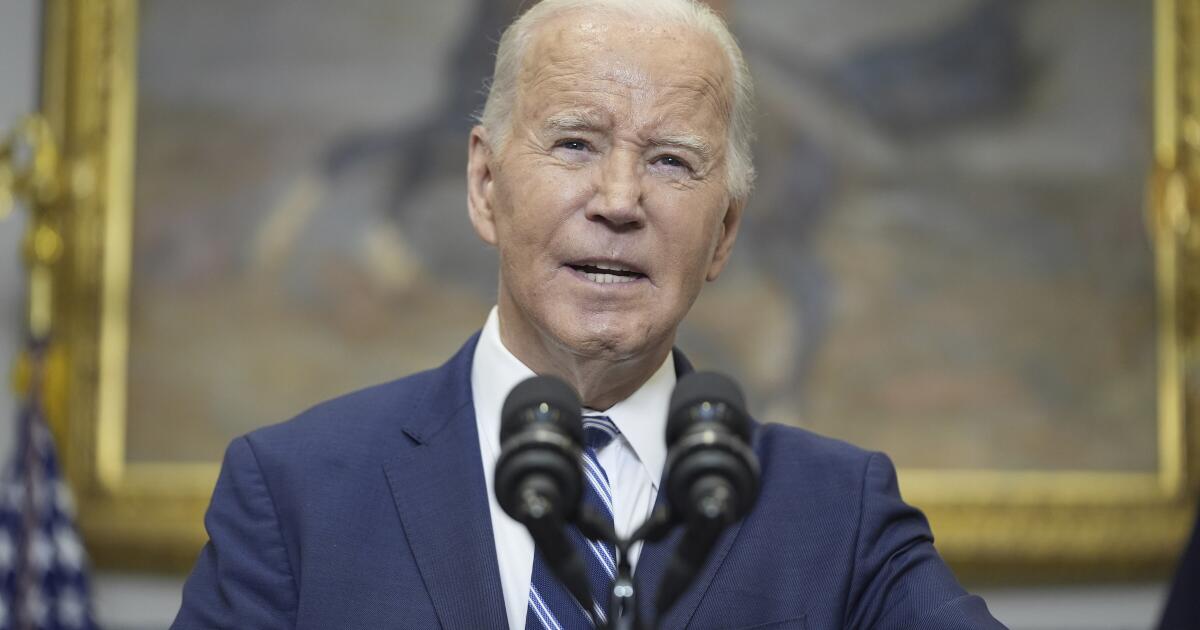

Trade 'should not be a weapon'

Buffett previously used the stage to declare that “trade should not be a weapon”, in comments clearly aimed at the aggressive use of the president of the United States, Donald Trump, of tariffs against countries around the world.

“There is no doubt that trade can be an act of war,” he said, not really mentioning Trump by his name.

These comments occurred when analysts in the United States and abroad have expressed a growing concern that tariffs could seriously slow global growth.

Two months ago, Buffett told a CBS interviewer that tariffs “are a property tax”, and not an increase in relatively painless income, as Trump has suggested, and added: “I mean, the fairy of the tooth does not pay them!”

On Saturday, Buffett urged Washington to continue exchanging with the rest of the world, saying: “We should do what we do best and that they should do what they do best. That is what we originally did.”

Achieving prosperity is not a zero sum game, with the successes of one country, which means the losses of another, he said. Both can prosper.

“I think the more prosperous the rest of the world is, it will not be at our expense. The more prosperous we will be and the safer we will feel,” said Buffet.

He added that it can be dangerous for a country to offend the rest of the world while claiming superiority.

“It is a big mistake, in my opinion, when you have seven billion and a half people who do not like very well, and you have 300 million that are singing somehow about how well they have done it,” Buffett told shareholders.

Compared to that dynamic, he said, the recent turns of financial markets are not “really anything.”