The last time Donald Trump was president, he implemented a massive tax cut, touting the many benefits of the 2017 law. But a series of nonpartisan reviews concluded that it primarily benefited the wealthy, vastly expanded the federal deficit and failed to deliver promised economic benefits to the middle class.

Perhaps recognizing that his previous tax cut lacked populist appeal, the former president has spent the summer listing new tax-cut proposals, promising to exempt tips, Social Security benefits and overtime pay from federal taxes.

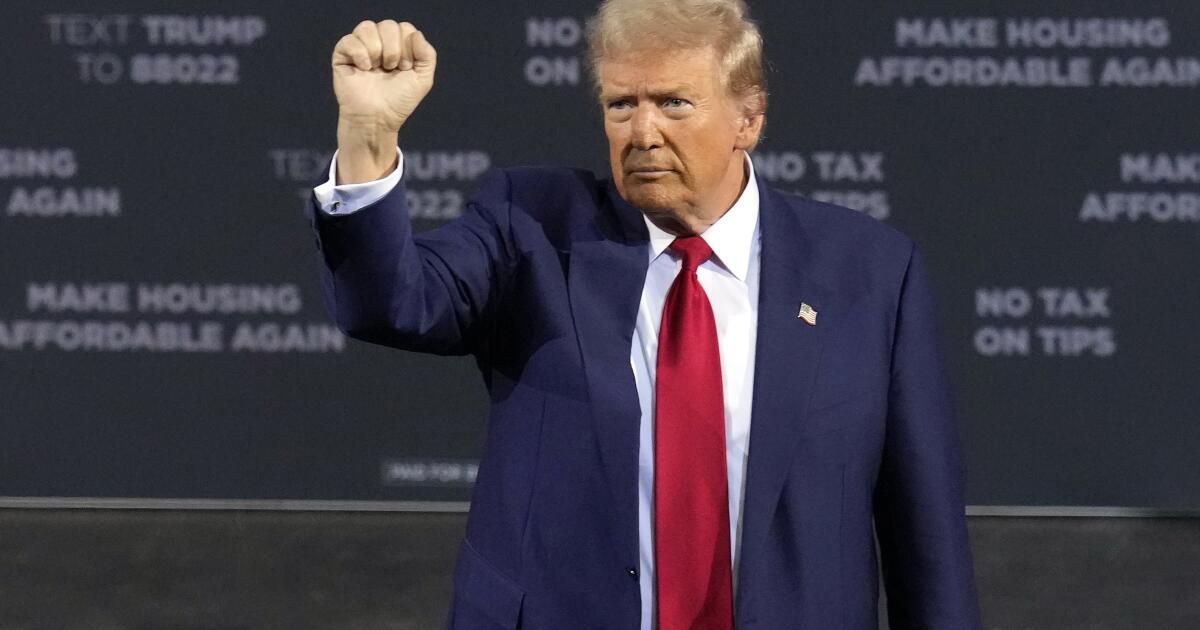

Trump used a Thursday rally in Tucson to present his latest proposal: to stop taxing overtime pay.

“People who work overtime are among the hardest-working citizens in our country,” the Republican presidential candidate said. “And for too long, no one in Washington has been looking out for them.”

He said his proposal meant that “police officers, nurses, factory workers, construction workers, truck drivers and machine operators” would finally “get some breathing room.”

Fiscal and policy analysts across the ideological spectrum were quick to criticize Trump’s proposal, saying it would make the already huge federal budget deficit even larger. It was not immediately clear how much eliminating the three taxes would cost the U.S. Treasury, though one group said banning the Social Security tax alone would deprive the government of $1.6 trillion over a decade.

Several critics said the proposals amounted to pandering to working-class voters whose support could tip the balance in several states. Offering breaks to those who earn tips and overtime seemed like a “sham,” they added, coming from a man whose Labor Department failed to protect workers’ tips and enacted policies that made millions of employees ineligible for overtime pay.

“Trump has a long history of opposing overtime,” Heidi Shierholz, a senior economist at EPI Action, a labor rights group, said in a statement. “As president, he stripped overtime protections for millions of workers by refusing to defend the Obama-era overtime regulations in court and instead issuing his own, much weaker regulations.”

By changing the income eligibility level at which the Labor Department requires workers to receive overtime pay, Trump helped push about 3.2 million workers out of the category designated to receive the extra pay, typically time-and-a-half, Shierholz's analysis showed.

Another 5.2 million workers were at risk of losing overtime pay from companies that might misclassify them as managers or executives, a maneuver frequently used by companies, Shierholz said. And the rules proposed by Project 2025 — written for a new Trump administration by Trump allies and former aides but which the former president insists he will not follow — “would strip overtime protections from at least 8 million workers.” [additional] workers,” Shierholz said.

The promise to exempt tips from taxes also rings hollow for some groups of employees. That’s because of another move by Trump’s Labor Department, which passed regulations allowing companies to “pool” tips, so they could be distributed among employees, but without guaranteeing that the money wouldn’t end up in the hands of management.

The service workers union said Trump-appointed bureaucrats cost workers about $5.8 billion in tips each year. That “departs from longstanding practice and precedent and threatens the economic security of millions of workers and their families,” the union told the Labor Department.

After an avalanche of 375,000 comments, many of them from angry waiters and bartenders, Congress passed a bill amending the Fair Labor Standards Act. It makes clear that employers cannot keep tips earned by their workers.

The Trump campaign did not respond to a request for comment Friday. It has not released detailed summaries of the tax cut proposals, including how the government would make up for lost revenue or cut programs to make the changes “deficit neutral.”

J. Bradford DeLong, an economist at the University of California, Berkeley, said the twin economic crises of the Great Recession and the COVID-19 pandemic justified deficit spending. “But that time has come to an end,” DeLong said by email.

“So the first question to ask with any promise of tax cuts is, will it be funded by spending cuts, and if so, by whom? Or will it be funded by tax increases on others, and if so, on whom?” DeLong said. “And if you don’t cut spending and you don’t explicitly raise other taxes, then ultimately inflation will collect taxes in a very nasty and destructive way.”

DeLong said it appeared Trump and his advisers had not thought through those issues, calling it “deeply unserious” behavior.

Douglas Holtz-Eakin, president of the center-right American Action Forum, said Trump appeared to be preparing his policy proposals on the fly, testing their popular reception at his rallies without a serious assessment of their effect on the economy and the federal budget.

“He’s looking for populist appeal,” said Holtz-Eakin, who once headed the Congressional Budget Office and advised President George W. Bush. “It’s horrible gimmicks and ideas. Some pointy head like [me] “You can worry about the impact and the numbers. That’s not your problem.”

Shortly after Trump called for an end to tip taxes, Vice President Kamala Harris also said she would eliminate tips. The Democratic presidential candidate said she would simultaneously push for an increase in the federal minimum wage, which is currently $7.25 and has not changed since 2009.

Harris's team said it was aware of concerns that high-income earners might try to mischaracterize their income as tips to reduce their tax liability.

A campaign official who declined to be named to discuss internal policy discussions said: “As chair, she would work with Congress to craft a proposal that includes an income cap and strict requirements to prevent hedge fund managers and lawyers from structuring their compensation in ways that would attempt to profit from politics.”

Holtz-Eakin said Harris, like Trump, had also made proposals — such as a $25,000 down payment assistance for first-time homebuyers and a $50,000 tax deduction for small businesses — that could potentially expand the deficit. He accused her and Trump of not taking the U.S. debt crisis seriously.

In the first seven months of this fiscal year, net interest spending reached $514 billion, more than the amount spent on national defense. It was also more than what the United States spent on Medicare.

“Yesterday, for the first time in American history, interest costs exceeded $1 trillion in a year,” Holtz-Eakin said, noting that the fiscal year ends on Sept. 30. “And the year isn’t over yet, so hang in there.”

The nonpartisan Tax Foundation estimated that Trump's proposal to end taxes on Social Security benefits would increase the budget deficit by $1.6 trillion over 10 years and accelerate the insolvency of the Social Security and Medicare trust funds.

Trump’s continuation of the 2017 tax cuts (including corporate and capital gains taxes) would be another budget boondoggle. At last week’s debate, Harris protested that the result would be “a tax cut for billionaires and big corporations, which will result in a $5 trillion deficit for the United States.”

The Tax Foundation essentially agreed, saying that the Trump tax cuts (before the most recent proposed reductions) would reduce federal tax revenues by $6.1 trillion over 10 years, and somewhat more modestly, when accounting for potential economic growth.

Harris has proposed raising taxes on capital gains and other sources. Still, the Tax Foundation estimated that her tax and spending proposals would increase deficits by $1.5 trillion over the next decade. That deficit could rise to $2.6 trillion, considering the economic impacts of her policies, the nonprofit said.

Holtz-Eakin called the debt spiral “appalling,” adding: “It is a paramount threat to the American economy and to national security. Everyone who has looked at it closely has come to the same conclusion. But it is hard work to deal with and [the candidates] “I don’t want to do the work.”