Seoul, South Korea – At the Malaysia International Halal Expo last September, an unlikely sight caught the attention of many attendees.

Located among stalls from Muslim-majority countries such as Indonesia and Kuwait, a kiosk representing pork-loving, hard-drinking South Korea invited visitors to sample halal products ranging from seaweed to sanitary pads.

“The halal food market is a blue ocean with great growth potential,” Lee Yong Jik, head of the food export division at South Korea's Ministry of Agriculture, Food and Rural Affairs, told Al Jazeera.

After conquering the worlds of film, television and pop music, South Korea is setting its sights on the global halal industry, which meets the dietary standards and lifestyle requirements of some 1.8 billion Muslims worldwide. .

Halal is not easily associated with traditionally homogeneous South Korea, where the Muslim community is estimated to number fewer than 200,000 people, or less than 0.4 percent of the population.

But growing demand for Korean cuisine and snacks in Southeast Asia, where Korean pop culture has a devoted and growing fan base, has turned Korean exporters into a potentially lucrative opportunity.

Muslim spending on halal foods alone reached $1.27 trillion in 2021 and is projected to reach $1.67 trillion in 2025, according to research firm DinarStandard.

The South Korean government has wanted to encourage companies to capitalize on the trend, providing assistance ranging from food ingredient analysis to subsidies for certification fees and promotional events to connect buyers and suppliers.

In 2015, then-President Park Geun-hye signed an agreement with the United Arab Emirates to promote business in new markets, including halal food.

In Daegu, South Korea's fourth-largest city, local authorities have spearheaded a “Halal Food Activation Project” aimed at increasing the number of halal-certified businesses in the city tenfold and tripling exports to 200 million. dollars by 2028.

Daegu Mayor Hong Joon-pyo recently described the halal market as an opportunity that “cannot be ignored.”

Lotte Foods, CJ CheilJedang, Daesang and Nongshim are among the Korean food giants that have launched halal-certified products, from kimchi to rice cakes.

Last year, South Korea began exporting halal native Korean meat, known as hanwoo, for the first time after receiving the go-ahead from Islamic affairs officials in Malaysia.

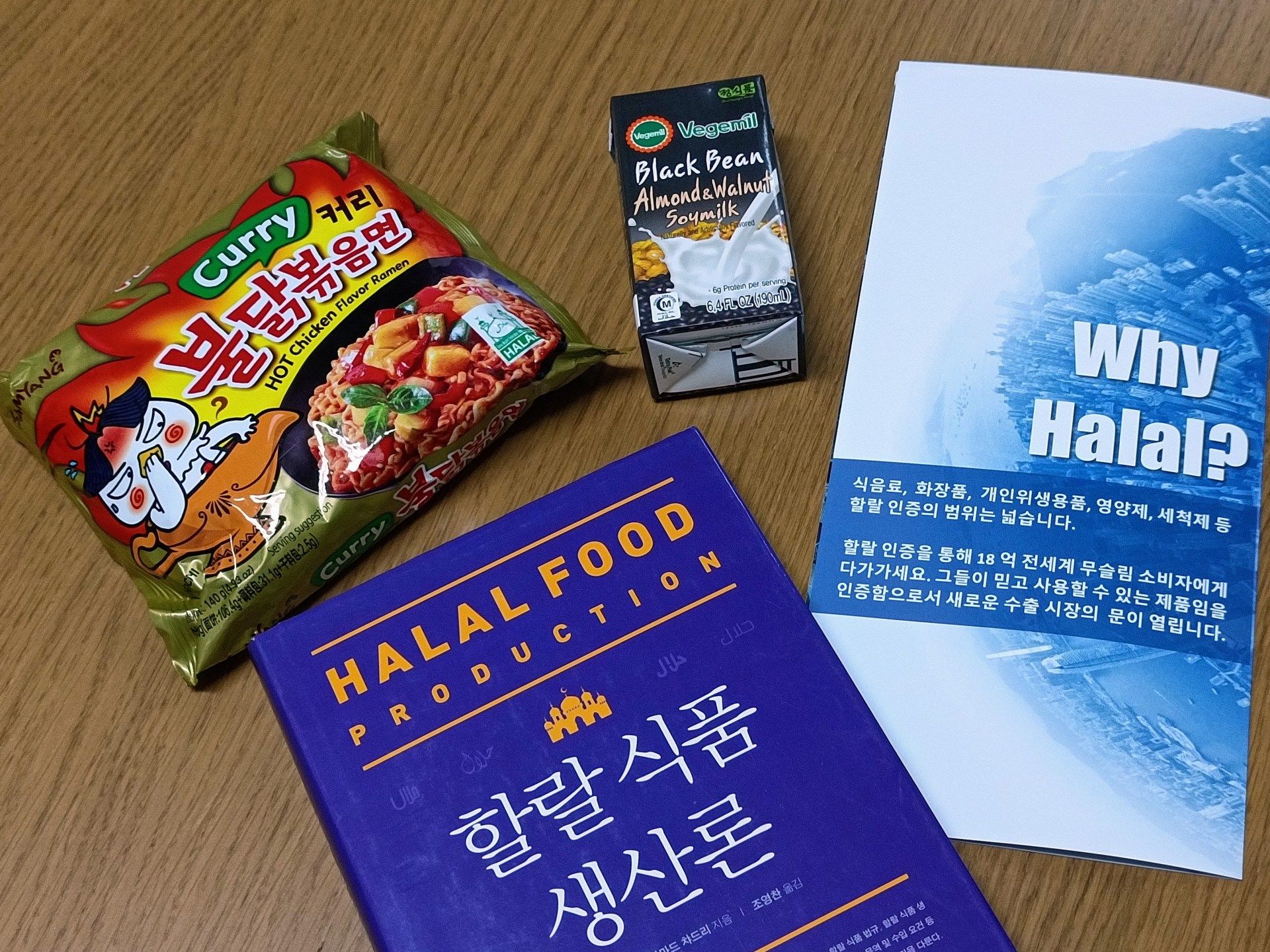

Samyang Foods, one of South Korea's leading food manufacturers, exports halal products to 78 countries, including its highly popular “Buldak Ramen” instant noodles.

Samyang's halal product sales reached $200 million in 2022, accounting for about 45 percent of total exports. Sales in 2023 were expected to reach about $270 million.

Samyang has “consistently recognized the importance of the Muslim market” and has been actively working to promote “K food” globally, a company spokesperson told Al Jazeera.

In addition to the food industry, actors in the so-called “K-beauty” sector have also benefited from this trend.

Seoul-based cosmetics maker Cosmax has been producing halal products at its Indonesian facility since 2016.

Despite the growing market, becoming halal certified can seem daunting for many businesses, especially smaller ones.

“The first step is to determine if your product is halal and, if it is, then evaluate whether you really need halal certification,” Saifullah Jo, president of the Korea Halal Association (KOHAS), told Al Jazeera.

Jo, a South Korean citizen who converted to Islam, founded an Islamic consulting company for Korean companies and translated a book on halal into Korean.

“Just because a company requests a certification does not mean we will grant it. Some people come to us seeking certification for things that may technically be certifiable but it's not always practical,” said Jo, whose organization is one of South Korea's four halal certification bodies.

“We need to consider the audience and the genuine need to obtain certification.”

While alcohol, blood, pork, and animals not properly slaughtered in the name of God, and meat from animals that died before sacrifice, are considered haram or forbidden, even seemingly innocuous items such as rice and Mineral water may be candidates for halal certification.

“Complexities arise in production processes. For example, when rice is separated from the husk in the milling process, the machinery involved may use lubrication and some oils may contain ingredients of animal origin,” Jo said.

“This causes cross-contamination and presents a challenge in ensuring the final product meets halal requirements.”

To further complicate matters, Indonesia, home to the world's largest Muslim population, announced last year that starting in October food companies would have to obtain halal certification within the country.

In November, the governments of South Korea and Indonesia reached an agreement to exempt agricultural and food products in the Southeast Asian country from certification, as long as they have received the halal label from two of South Korea's certifiers.

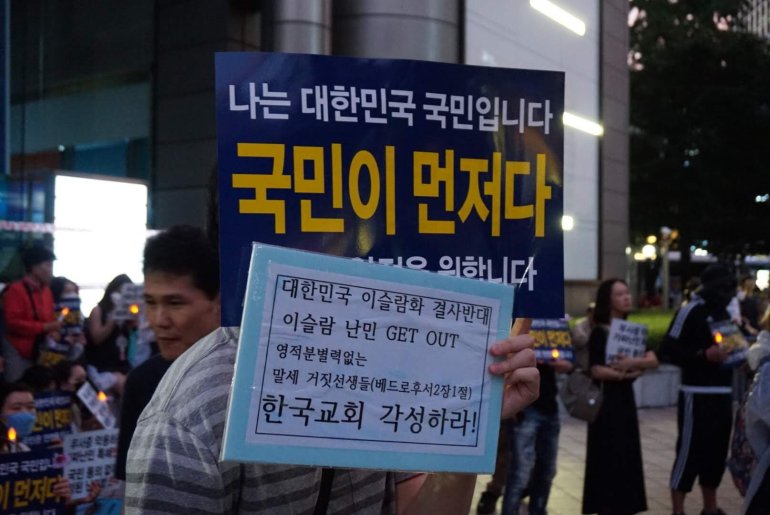

While South Korea has made no secret of its ambitions to forge trade connections with the Muslim world, social attitudes toward Muslims and Islamic culture are often not so friendly.

“Muslims in South Korea are viewed with, at best, apathy and, at worst, fear,” Farrah Sheikh, an assistant professor at Keimyung University who specializes in Islam in Korea, told Al Jazeera. from the south.

Sheikh said some Koreans see halal products as a conduit for Islam to “invade” Korean society.

In Daegu, where officials are aggressively pursuing the Muslim market, plans to build a small mosque have met fierce opposition from residents and conservative Christian groups.

In August last year, UN Human Rights Council rapporteurs expressed “serious concern” to the South Korean government over its alleged failure to address the campaign against the mosque, which included the display of pig heads outside of the construction site and banners describing Islam. as “an evil religion that kills people.”

After the government began promoting the halal industry in 2015, several Christian groups began warning about the potential “Islamification” of South Korea, an alleged influx of Muslims and concerns about the safety risks associated with halal food, leading which led the government to issue an explanatory document to dispel misinformation and rumors.

In 2016, a proposal to build an industrial zone for the production of halal-certified products in the western city of Iksan failed due to opposition from Christian groups.

That same year, a brand of potato chips manufactured in Malaysia sparked controversy over the halal certification of its packaging, which was later withdrawn without explanation.

In 2018, South Korea witnessed a wave of protests against the arrival of several hundred Muslim asylum seekers from Yemen. That same year, plans to build a prayer hall at the Winter Olympics were canceled following vehement protests by anti-Muslim activists.

For Muslims living in South Korea, halal products can be difficult to find.

While there are restaurants that offer halal food, they are mainly concentrated in Seoul and other large cities with significant Muslim communities.

With few halal products available on supermarket shelves, some Muslim residents have resorted to reimporting halal-certified “made in Korea” instant noodles for their consumption.

When asked about the lack of halal products in South Korea, Samyang Foods said there was currently not enough domestic demand to support a market.

“However, as the number of Muslim visitors and residents in Korea increases, interest in halal products grows. “Samyang Food is also reviewing the marketability of selling halal products in the Korean market to make it more convenient for domestic Muslim consumers to purchase halal products,” a spokesperson said.

Sheikh, a professor at Keimyung University, said Korean companies cannot be blamed for wanting to cash in on a lucrative market.

“However, when we see Korean attitudes towards Muslim refugees, or as we have seen in Daegu, we have a clear discrepancy and a big social problem,” he said, adding that South Korea must improve its attitude towards Muslims if it wants to improve. target markets abroad.

Saifullah Jo of KOHAS said he sees a bright future for Korea's halal industry despite the challenges.

“Looking at it from the Korean industry's point of view, we are aware of the potential and must act quickly. “One of Korea’s key strengths is its ability to adapt quickly,” she said, adding that a growing halal market could promote tolerance and understanding.

“Despite some negative opinions, we are thinking positively about entering this new market and Koreans are also learning. It helps us open up culturally.”