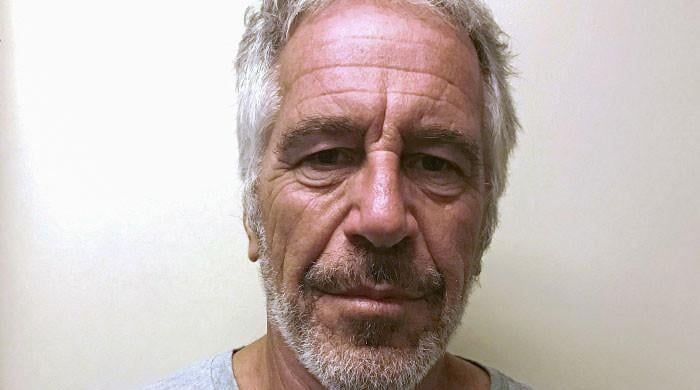

Epstein was accused of exploiting numerous teenage girls before his 2019 suicide in federal custody.

The recent release of legal documents has once again shone a spotlight on the notorious Jeffrey Epstein, sparking renewed interest in the late financier’s wealth and the intricacies of its accumulation. CBS News reported.

Accused of exploiting numerous teenage girls before his 2019 suicide in federal custody, Epstein, although lacking a college degree, navigated the echelons of society, mingling with prominent figures around the world.

At the time of his passing in 2019, Epstein’s net worth was approximately $560 million, accompanied by opulent assets, including a $50 million Upper East Side townhouse, a $12 million Palm Beach mansion of dollars, a ranch in New Mexico of 17 million dollars and a property of 8.6 million dollars. Parisian apartment. In particular, his Caribbean islands, valued at $86 million, were acquired by billionaire Stephen Deckoff in 2023.

Epstein’s career path began as a mathematics teacher at The Dalton School in the 1970s, which led to a path that involved tutoring the son of Bear Stearns CEO Alan Greenberg. He later worked for Bear Stearns until its collapse in 2008, and went on to become a money manager for business magnates such as Les Wexner and Leon Black.

Wexner, the founder of L Brands, trusted Epstein as his money manager for more than a decade, acknowledging that he was unaware of the illegal activities later charged in the indictment. Black, president of Apollo Global Management, paid Epstein $158 million for financial services, a matter cleared up by a law firm hired by Apollo’s board of directors.

Epstein’s financial dealings extended to JPMorgan Chase, which lent him money and allowed large cash withdrawals between 1998 and 2013, resulting in a class-action settlement last year. Deutsche Bank also settled a $75 million lawsuit in 2023, acknowledging its “mistake in bringing Epstein on board in 2013.”

Epstein’s acquisition of the Caribbean islands involved the purchase of Little St. James for $7.95 million in 1998 and Great St. James for more than $20 million in 2016.

The revealed documents provide a glimpse into Jeffrey Epstein’s multifaceted financial legacy, unraveling a complex web of partnerships, transactions and controversies.