Ho Chi Minh, Vietnam – On a sunny California afternoon in late September, Vietnam's Prime Minister Pham Minh Chinh toured Silicon Valley and approached officials from semiconductor companies Synopsys and Nvidia.

Just over a month earlier, in Hanoi, Pham tasked four government ministries with increasing by tens of thousands the number of Vietnamese engineers capable of working in semiconductor production.

The government's efforts to make Vietnam an attractive option for chip investment have continued into the new year.

Science and Technology Minister Huynh Thanh Dat told local media last month that authorities had established tax incentives for high value-added products, such as semiconductors.

Dat said the country wanted to welcome a “wave” of investment by collaborating with other ministries and technology corporations to boost research and attract talent to the semiconductor sector.

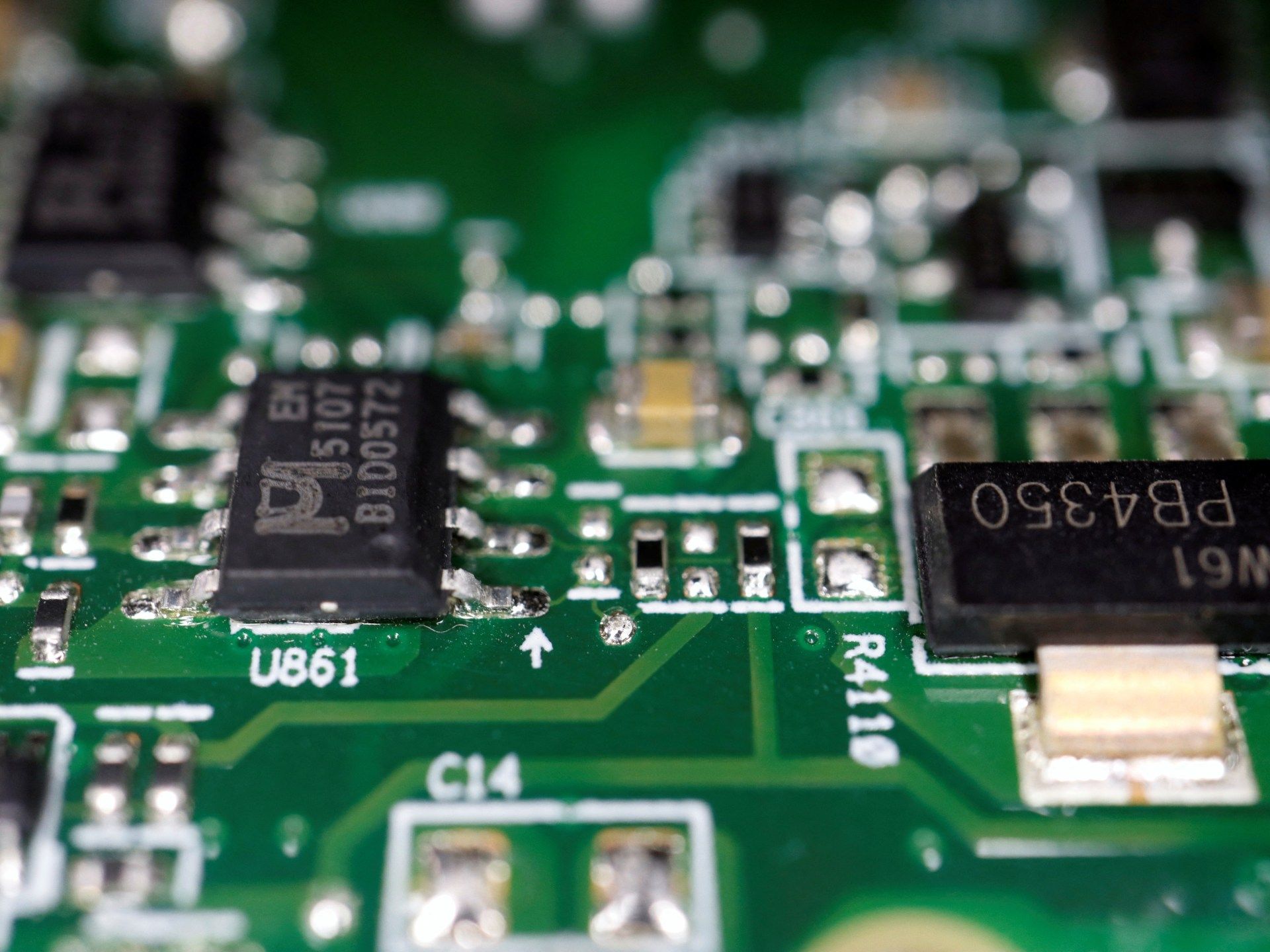

Vietnam has set its sights on becoming a leading player in the global supply chain for semiconductors – the ultra-thin integrated circuits essential to modern technology.

As Hanoi and a group of nations align around the need to de-risk China amid escalating geopolitical tensions, the Southeast Asian nation appears to have momentum on its side as it seeks to rival China's dominance. Taiwan and South Korea.

However, Vietnam also faces obstacles, including a limited pool of skilled labor and energy insecurity in the country's technological manufacturing hub in the north.

The global push to diversify semiconductor supply chains is in line with Hanoi's development goals, said Le Hong Hiep, a senior researcher at the Singapore-based ISEAS-Yusof Ishak Institute, who previously worked as an official in the Ministry of Vietnam Foreign Affairs.

“The semiconductor industry is considered a very important industry that can help Vietnam transform its economy and turn Vietnam into a developed and high-income economy by 2045,” Hiep told Al Jazeera.

“In terms of timing and strategic configuration, it is favorable for Vietnam to develop the industry now.”

At first glance, Vietnam's chip ambitions appear to be flourishing amid an influx of foreign capital.

During a visit to Hanoi in early December, Nvidia co-founder and CEO Jensen Huang called Vietnam the chip giant's “second home,” pledging to expand partnerships with local companies and establish a base in the country, according to local media reports.

Nvidia, whose market capitalization last week surpassed $2 trillion, says it has invested $12 million in the country so far.

An Nvidia spokesperson declined to comment on Nvidia's future operations in Vietnam when contacted by Al Jazeera.

Vietnam has about 5,000 engineers trained in semiconductors, but will need up to 20,000 in the next five years, according to the US-ASEAN Business Council.

“When companies look at Vietnam, it looks great on paper, but when they actually have to check and see if there is enough electricity, what the infrastructure is and, most importantly, what the human resources are like… I don't think Vietnam is going to be the producer it thinks it is,” Zachary Abuza, a professor at the National War College in Washington, D.C., who focuses on Southeast Asia, told Al Jazeera.

Vietnamese authorities are aware of workforce shortfalls and are leading an effort to train more engineers, said Nguyen Thanh Yen, senior engineer at the Hanoi branch of Korean chip design company CoAsia SEMI.

“The government is now aggressively planning specific programs to increase the number of semiconductor engineers,” Yen told Al Jazeera.

Semiconductors were a centerpiece of the historic improvement in relations between Vietnam and the United States announced in September, when the two countries agreed to a comprehensive strategic partnership, the highest level in Hanoi's diplomatic hierarchy.

“We are deepening our cooperation on critical and emerging technologies, particularly around building a more resilient semiconductor supply chain,” US President Joe Biden said during a joint press conference on September 9 with Nguyen Phu Trong, Secretary general of the Communist Party of Vietnam. .

American chip companies appear to be aligning themselves with Washington's agenda.

Arizona-based Amkor launched operations at a $1.6 billion chip factory in northern Vietnam in October, while Delaware-based Marvell announced in May it would establish a semiconductor design center in the country. .

South Korean companies are also joining the race. Samsung, Vietnam's largest investor, announced in August 2022 that it would invest $3.3 billion to manufacture semiconductor components in the country.

Hana Micron Vina, which specializes in chip packaging and memory products, is building a second factory in Vietnam and plans to invest $1 billion in the country by 2025, according to a Nikkei Asia report.

Chip companies “are all competing for this very small and restricted labor market,” Abuza said. “[Vietnam] “You'll have to increase your engineering rate about five times a year to do this.”

Others, like Yen, are optimistic about Vietnam's ability to meet the challenge.

He said the country excels in mathematics and science and 20 technical universities are starting semiconductor training programs with the goal of adding 50,000 engineers to the workforce by 2030.

“Vietnam has the advantage of young and hungry human resources,” Yen said. “The fields that help them make money most easily are usually the technical sectors. Semiconductors are heating up now.”

Help also comes from outside.

During his visit to Vietnam, Biden announced $2 million in seed funding for training in Vietnam's semiconductor industry.

Europe could be next to get involved, said Bruno Sivanandan, co-chair of the Digital Sector Committee at the European Chamber of Commerce in Vietnam.

“There may be partnerships with academies in Europe to support the education of Vietnamese workers,” Sivanandan told Al Jazeera. “Vietnam has such huge potential that has not yet been tapped, which is why big players are looking at Vietnam.”

Still, Vietnam may not have the luxury of spending time with regional rivals competing for investment.

ISEAS' Hiep said Malaysia and Singapore were formidable competitors and Indonesia and Thailand were also chasing the sector.

“Everyone is looking for opportunities to establish their presence in the global chip supply chain,” Hiep said. “It's a very, very competitive industry.”

Energy insecurity is also a challenge.

During Vietnam's hottest summer to date last year, northern towns experienced intermittent blackouts. In early June, the weather was so sweltering during a power outage in Hanoi that some families sought shelter in a mountain cave near the city center.

For several weeks, factories in northern Vietnam's industrial parks remained dark for hours at a time during the evenings.

“They had to stop operations because there was no power in the middle of the day for about four or five hours,” an individual who works in the energy sector based in Ho Chi Minh City told Al Jazeera, asking that his name not be used. would reveal. His company had not authorized him to discuss the issue.

“Samsung and other Korean factories were in a big crisis because they had to close their factories completely due to lack of electricity.”

After the outages, authorities launched an investigation into EVN, the country's state electricity provider. Ultimately, officials disciplined 161 EVN staff members over the power shortage.

Northern Vietnam relies heavily on hydroelectric dams, which can dry up during the hottest months of the year when demand is highest. The infrastructure is obsolete and the country “lacks the network capacity and energy resources to address the problem,” said the energy sector employee.

“We should have invested in power transmission and energy resources in northern Vietnam many years ago, but EVN was left behind,” he said.

“In northern Vietnam, [factories] “We will face a huge problem in relation to energy security.”

Energy is also a concern for European investment.

Under the terms of the European Union's trade deal with Vietnam, European companies doing business with the country must comply with increasingly strict regulations on carbon emissions, which could pose problems as long as Vietnam relies heavily on coal.

“To do business with Europe, you need to meet those carbon emissions requirements,” Sivanandan said. “If we apply this to the semiconductor industry, it will be a barrier.”

Abuza said there is a considerable gap between Vietnam's potential and the reality on the ground.

“These chip factories and server farms and all the high-tech things that Vietnam wants to do really rely on very constant electricity and they just don't have it,” he said. “Vietnam has incredible potential for investors, but there are many things they are struggling to resolve.”