Californians who took out federally-backed student loans from private banks can have all or part of their remaining debt forgiven by the Biden administration, but they must act fast: The deadline to qualify is Tuesday.

Relief is available to students enrolled in income-based repayment plans or the Public Service Loan Forgiveness program. It is also available to some parents who applied for loans through the Federal Family Education Loan program.

However, this is not a new initiative; rather, it is the last chance to participate in one of the administration's first and most successful efforts to reduce the mountain of student debt.

The Department of Education launched the single income-based repayment adjustment initiative in 2022 to address complaints about loan servicing companies that lose track of payments, do not give borrowers adequate credit for their work in positions of public service and lead struggling borrowers into costly forbearance or deferment. programs instead of payment plans based on your income.

After completing its review of payment records last year, the department automatically granted full or partial forgiveness to qualified borrowers; no application was required. The Education Department estimated that 3.6 million borrowers would receive credit for at least three additional years of payments, putting them much closer to eliminating their remaining debt.

Under income-driven repayment plans, borrowers pay a monthly amount that is a percentage of their income, regardless of the size of their debt. Those who stay current on their payments have all remaining debt canceled after 10 years if they are in the public service loan forgiveness program; Otherwise, those with income-based plans would have their debt canceled after 20 to 25 years of payments.

However, the new calculation applied only to loans issued directly by the federal government. That left out borrowers with federally backed loans issued by banks through the Perkins Loan, Federal Family Education Loan and Health Education Assistance Loan programs.

Those borrowers have one last chance to qualify. for a unique fit. If you combine your federally backed loans into a Federal Direct Consolidation Loan before Wednesday, your previous payments on those loans will automatically be eligible for review.

Borrowers can apply online to consolidate their loans on the Studentaid.gov website. To meet the deadline, the application only has to be submitted by the end of the day Tuesday; Approval may come later, said Celina Damian, student loan services ombudsman for the California Department of Financial Protection and Innovation.

As part of the one-time adjustment, the Department of Education is providing credit to borrowers for the entire period in which payments were suspended due to the pandemic. That's a little over three years of credits.

Additionally, the department grants credits for payments made under any other type of payment plan the borrower was on before opting for an income-based plan. And it credits borrowers for months they were in deferment or long periods of forbearance.

Borrowers whose adjusted payment counts take them above the 20-year (for most undergraduate loans) or 25-year (for graduate student loans) thresholds will automatically have their remaining debt forgiven.

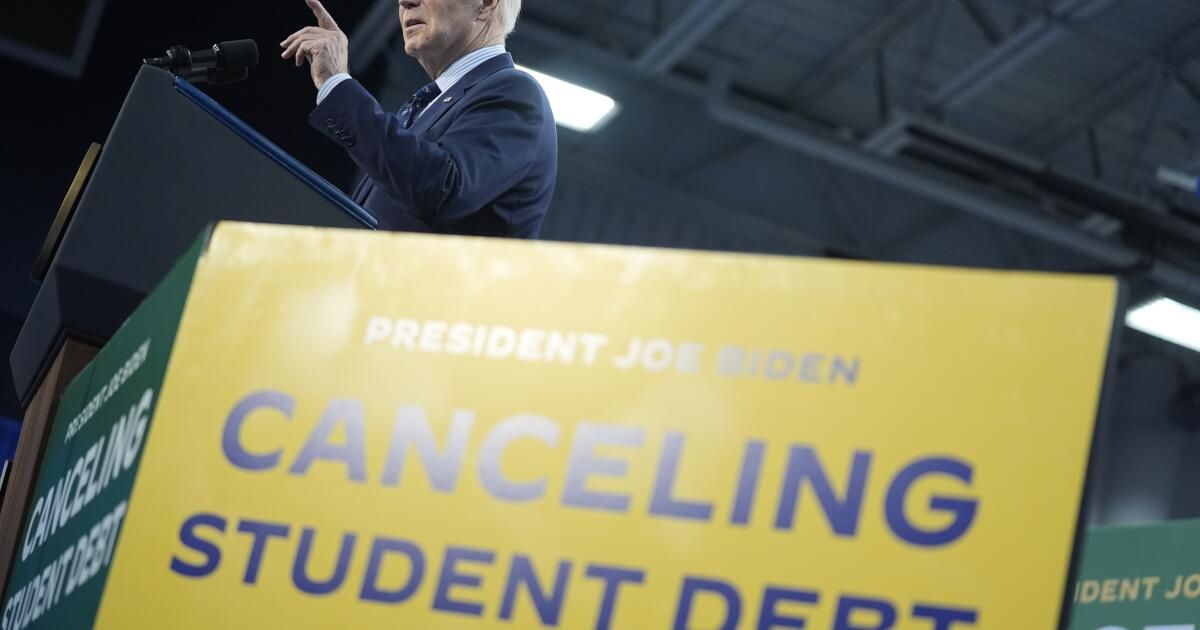

Although the Supreme Court rejected President Biden's attempt to provide debt relief to approximately 40 million borrowers in 2023, the administration has two other major efforts available or in the works. It has proposed a set of rules that would reduce debt for about 30 million borrowers and has launched a new income-based repayment plan that has lower monthly payments and accrues less interest.