AMD's flagship AI GPUs, the Instincts, are sold at a significant discount to Microsoft, offering a competitive alternative to Nvidia's more expensive H100. According Tom HardwareNvidia's H100 AI GPUs cost up to four times more than AMD's competing MI300X, with prices exceeding $40,000.

Despite the price advantage, AMD's market strategy is not expected to significantly impact Nvidia's strength in the AI GPU market. This is due to Nvidia's established CUDA software stack, which has been optimized for a wide range of AI applications and workloads, resulting in overwhelming demand for its GPUs.

AMD recently raised its AI-related revenue forecast to $3.5 billion this year, up from $2 billion. However, Citi analyst Christopher Danely believes AMD could be deliberately understating sales figures. He predicts that AMD will generate $5 billion this year and $8 billion next year with the MI300.

Big discount

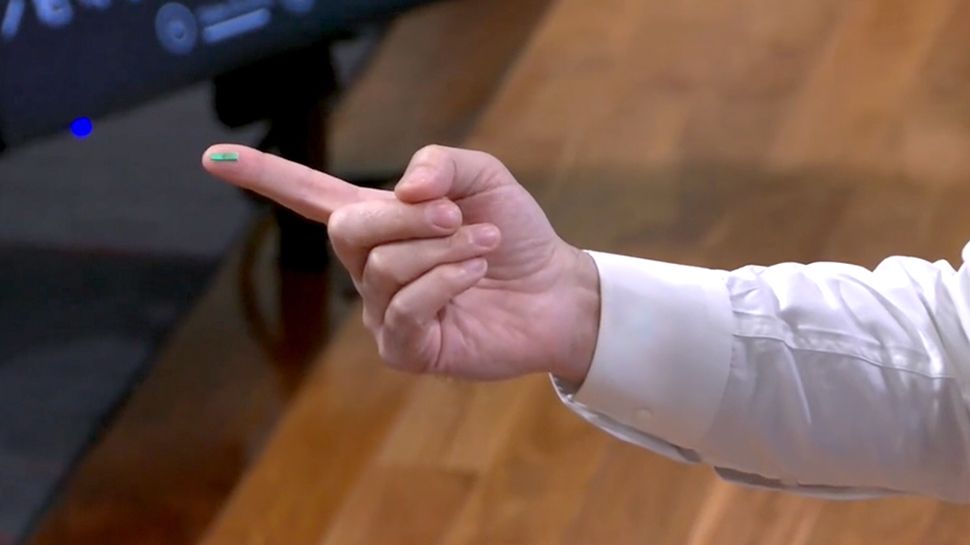

Microsoft and Meta are reportedly the biggest customers of the MI300, which was introduced in December. Microsoft's average selling price is about $10,000, while other customers pay $15,000 or more.

Despite AMD's aggressive pricing strategy, risks remain. The PC space replenishment might be over and Intel is catching up to Taiwan Semiconductor (TSM) in manufacturing.

Additionally, AMD's sales figures could be affected by the fact that Nvidia does not officially reveal the price of its 80GB H100 products, which depends on several factors such as batch volume and overall volumes purchased by a particular customer. .

While AMD's Instincts are vastly cheaper than Nvidia's H100s, the impact on Nvidia's dominant position in the market remains to be seen. With AMD's data center GPU sales expected to exceed $3.5 billion and supply still available, this offers a stark comparison to Nvidia's rumored 52-week wait times. However, given Nvidia's established software infrastructure and its high demand, AMD's price advantage may not be enough to significantly disrupt the market.