In 2022, Google Wallet practically replaced Google Pay as the tech giant's main tap-and-go app, except in several countries, including the United States. But a recent announcement finally puts an end to the payments app.

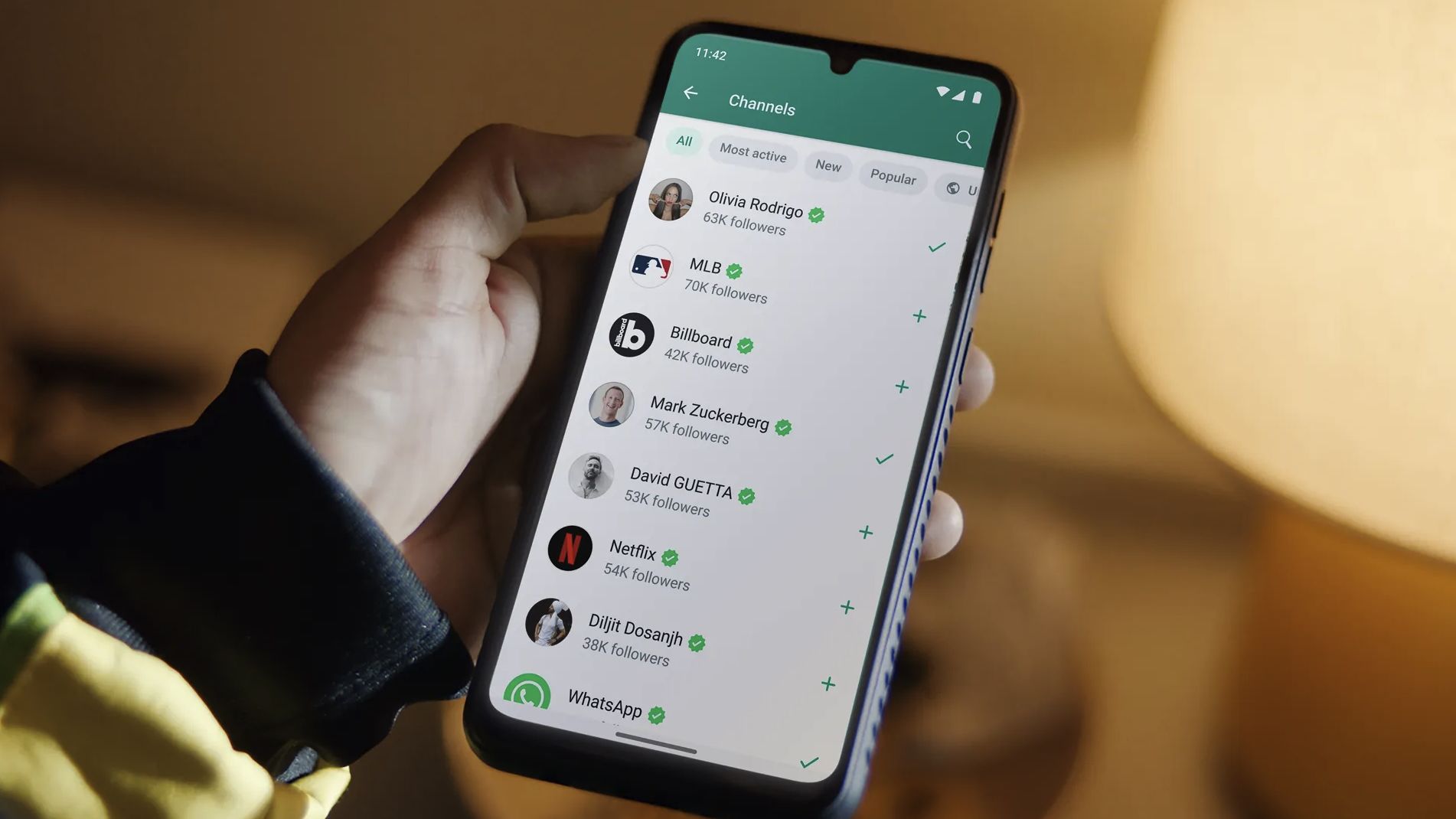

Google Pay will be discontinued on June 4, 2024 in the US and most other regions besides Singapore and India, according to the google official blog. For those still using Pay, Google says Wallet offers the same features, as well as new ones, such as digital items like transportation cards, driver's licenses, state IDs, and more. Google claims that Google Wallet “is used five times more than the Google Pay app in the US,” meaning most users appear to have already made the transition.

However, if you're using the Google Pay app right now, you can still view and transfer your balance up to the cutoff point, including transferring it to your bank account. After the cutoff point, you will only be able to transfer balances to bank accounts through the Google Pay website. Additionally, you won't be able to send, receive, or request money from other people through the app after June 4.

Transition could be a problem

News of the official end of Google Pay shouldn't come as a surprise to most people, as Google Wallet had already taken over years ago. Honestly, I was surprised that Pay still existed at this point, especially since Wallet is the top app thanks to its wealth of features and support.

However, there is one major hurdle that Google will have to overcome and that is the issue of branding. While most people use Google Wallet, that doesn't mean that's what they call it. It's still widely known as Google Pay, thanks to how similar it sounds to Apple Pay, and many retailers are using the Pay label.

Google Wallet is easily one of the best mobile payment apps out there and it would be a shame if it lost brand recognition because many users are not even aware of the name change. Especially if, instead of a proper information campaign to notify people about the change, Google simply distributes new stickers to replace the old ones at retailers.

While that is a valid part of the strategy of converting people, it cannot be the only part, or else there will be great confusion and even mistrust. If the average user doesn't understand that Wallet is a simple conversion to Pay, chances are they won't want to rely on that app for future purchases. And it's even worse, since data theft is so widespread today, which could contribute to even more mistrust.

It doesn't help that Google had a failed physical card that it stopped supporting, possibly further damaging the brand. Hopefully the tech giant has a plan for this transition or it will be a big problem in the long run.