By

Reuters

Published

November 27, 2024

Heavy online marketing spending by Temu and Shein is making it more expensive for other retailers and brands to reach shoppers on Black Friday, marketing and industry experts say, with both platforms bidding big on online marketing keywords. search used by competitors.

Typing a few words into a search engine is a key starting point for shoppers searching for gifts online or shopping for themselves in the Black Friday sales, the unofficial start of the holiday shopping season the day after Black Friday. Thanksgiving in the United States.

Retailers compete to have the products they advertise appear at the top of online search results by bidding on keywords. The higher the demand for a keyword, the more the search engine charges for each click on an ad that appears in those results – a metric called “cost per click.”

In the United States, for example, Temu has bid on keywords including “Walmart Black Friday deals,” “Kohls Black Friday” and “Bed Bath Beyond,” according to Google search ad data compiled by the online marketing platform. Semrush for Reuters.

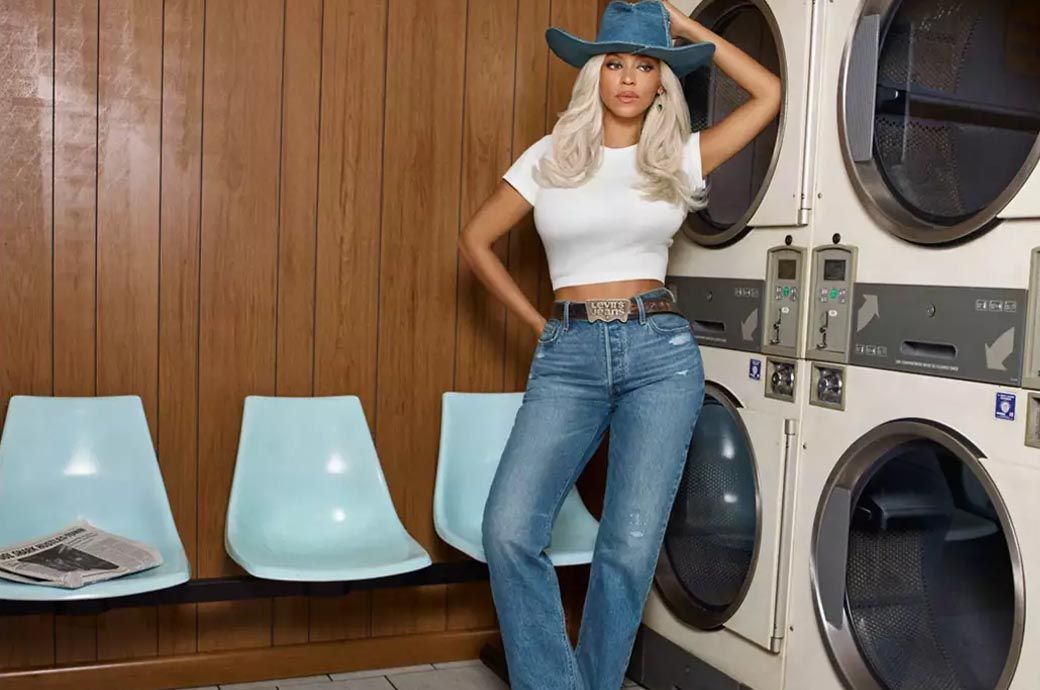

Shein has bid on keywords including “Walmart clothing,” “Zara jeans,” “Mango dresses” and “Nordstrom Rack shoes” in the United States, the data shows. The cost per click for “Walmart clothing” increased 16 times from August 2022 to August 2024.

Generic keywords like “cheap clothes online” and “shopping” have also become much more expensive, the data showed.

“It's brutal, it's really difficult,” said Erik Lautier, an e-commerce expert at consulting firm AlixPartners.

“By definition, when the cost per click increases, the return on your marketing investment decreases. In some cases, that can mean you are not profitable and that can have a big impact for retailers who rely on paid search ads for boost your business.”

Paid search ads can generate 15% to 30% or more of a retailer's online sales and account for up to half of the marketing budget, Lautier said.

'Aggressive'

Brands bidding on other brands' keywords are not unusual, but Shein and Temu stand out because they bid on a much wider range of competing keywords than average, said Olga Andrienko, vice president of brand marketing at Semrush.

“We are seeing a fundamental shift in the dynamics of search marketing and fast fashion brands are now outperforming traditional retailers' offerings, and it appears their strategies are much more aggressive,” he said.

In response to questions from Reuters, a Temu spokesperson said the platform is committed to fair competition and responsible advertising practices, and maintains a “list of negative keywords” to prevent ads from targeting brands.

“On rare occasions, brand names may be inadvertently included in our campaigns due to automated keyword insertion processes on advertising platforms such as Google,” the spokesperson said, adding that Temu acts quickly to address these cases.

Shein did not immediately respond to a request for comment.

Rising costs are leading some companies to shift marketing spend away from paid search toward other channels such as Facebook, TikTok, influencers and traditional advertising, said Erin Brookes, head of Alvarez & Marsal's consumer and retail practice in London.

“I've seen a lot of brands start to think that, in fact, that activity may get us a customer we don't want, a customer who operates only on price, not a high-margin customer who returns, and I want to invest in attract a more specific customer to the brand,” Brookes said.

British online fast fashion retailer Asos announced a new loyalty program this month, part of its marketing efforts to reach customers “in more engaging and emotional ways” using cinema ads and also influencers, the head of customer service Dan Elton, adding that performance marketing is “just one piece of the puzzle.”

© Thomson Reuters 2024 All rights reserved.