By

Bloomberg

Published

July 24, 2024

We’re all drinking less Champagne as the world becomes a scarier place. That was the message from LVMH Moet Hennessy Louis Vuitton SE. It underscores what is becoming the biggest failure of ostentation in a decade. And not even the world’s largest luxury group is immune.

The Louis Vuitton and Dior owner on Tuesday reported a 1% rise in sales excluding currency movements and mergers and acquisitions in the fiscal second quarter, below analysts' expectations for a 2.89% increase and the lowest level of growth since 2009, excluding the pandemic-related downturn.

Sales of fashion and leather goods, the group's driving force, also rose 1% in the three months to June 30, about half of what analysts had expected. Shares fell as much as 6.5%.

The operating margin for the first half of the year fell to 25.6% from 27.4%. After three years of strong sales growth, cost bases will inevitably have expanded, while the company has continued to invest well. There has also been a “violent” shift among Chinese customers towards Japan, according to CFO Jean-Jacques Guiony. The weak yen is driving down handbag prices, while store rents are likely to rise along with sales, putting pressure on profitability.

The industry slowdown is being felt because the two main drivers of demand, the United States and China, have slowed. The second quarter is comparable to the period a year ago, when China emerged from lockdowns and consumers returned to spending with a vengeance. Buyers are now more cautious amid a deepening housing market slowdown, which perhaps explains why they are so keen to save their spending for those trips to Japan. Meanwhile, middle-class consumers in the United States remain under pressure from inflation and higher borrowing costs.

The pain brought on by industry trends has not been spread evenly, however. Winners need a top-shelf customer base and top-tier brands. LVMH certainly has both, but it is also exposed to wines and spirits, where there has been a “serious demand problem in Champagne,” and to middle-class customers, for example in the U.S., where the company is trying to elevate Tiffany jewelry at a time when its core buyers are cutting back on engagement rings.

As a result, its overall growth rate is lagging behind that of Italy’s Brunello Cucinelli SpA, which sees sales rising 10% this year. Hermes International SCA, maker of the $10,000 Birkin bags, is also expected to hold its own. LVMH said demand for pricier items such as designer clothes is holding up better than for its cheaper handbags.

By comparison, those who sell to those who are simply comfortable seem more vulnerable. Britain’s Burberry Group Plc warned last week that it could make a loss in the first half of the year, suspended its dividend and said goodbye to its chief executive, Jonathan Akeroyd. Kering SA is trying to bring its flagship Gucci brand into the luxury market but is struggling to gain traction. Gucci’s organic sales fell 18% in the first quarter, and analysts don’t expect the situation to have improved much since then.

Finally, brand desirability matters. Burberry and Gucci's problems have been exacerbated by the fact that they are suffering a double whammy of middle-class consumers and brand turnarounds that have yet to bear fruit. Meanwhile, jewelry shined at Cartier and Cie Financiere Richemont SA's Van Cleef & Arpels, which are both revered right now.

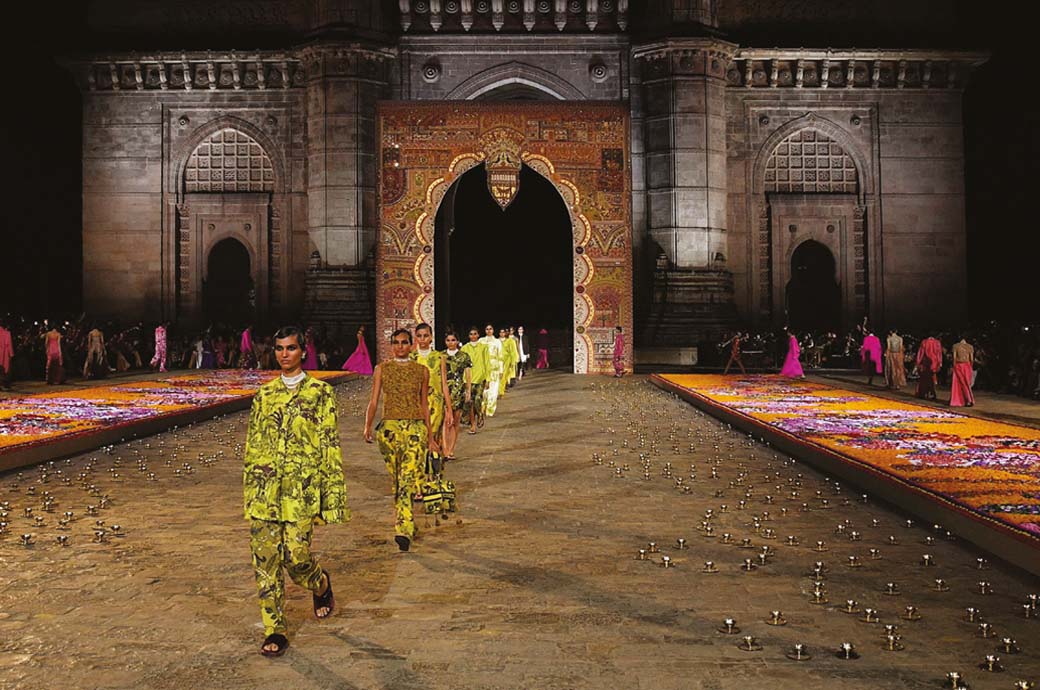

LVMH's Loewe fashion house is one of the most popular, while Louis Vuitton is holding its own, especially in China. There is further concern about Dior after allegations of poor working conditions in its supply chain in Italy. Guiony said the brand would step up its scrutiny of suppliers and also invest in bringing more Dior production in-house to avoid similar problems in the future.

One company still expected to perform strongly is Prada SpA, whose namesake brand has retained its cool factor after its turnaround a few years ago, while sister brand MiuMiu is on the rise.

Even with these few bright spots, luxury stocks have given up all their gains since January, when LVMH Chief Executive Bernard Arnault said the industry was normalizing rather than falling off a cliff.

Comparisons become easier in the second half, as Chinese revenge spending slowed in the third and fourth quarters of 2023, and the United States continued to slow.

Guiony said U.S. consumer demand improved in the second quarter for fashion, leather goods and cognac. However, Chinese customer appetite weakened slightly.

While any meaningful recovery has been delayed until at least 2025, in the long term, the higher-end segment should continue to benefit from rising revenues around the world. And LVMH, being the strongest, should achieve a disproportionate amount of sales when things finally improve.

But until Chinese and American consumers regain their love of luxury, there will be little reason to pop the champagne anytime soon.