By

Reuters

Published

December 20, 2024

Faced with a broad decline in demand for their usual products, including handbags priced at $3,000 and up and cashmere jackets priced at $4,000 and up, major marketers of designer and luxury goods are expanding their product lines to emphasize scarves, belts, , purses and home items with low prices. at $500 and less.

The companies' renewed focus on more affordable products is aimed at attracting aspirational, middle-class customers who are more price-sensitive, although the strategy may hit the companies' typically high profit margins.

After more than two years of sharp price increases (LVMH's Chanel, Prada and Dior all raised handbag prices by more than 50% in France in 2023 compared to 2020, according to Bernstein Wall Street analysts), the luxury brands are at risk. to alienate the middle class.

U.S. spending on merchandise from top luxury brands fell 6% year-over-year in November, according to Citi credit card data, setting a stark tone for the holiday shopping season for LVMH, Kering and other global designer goods purveyors. .

Kering Gucci brand's home decor and lifestyle gifts this season include a $440 pet leash and a box of sticky notes covered in the brand's logo, priced at $200.

Louis Vuitton, which is owned by LVMH, offers a $360 card holder and a $395 canvas and metal Monogram Double Spin bracelet for $395 in the gifts section of its e-commerce site.

Burberry plans to change its store design to emphasize “scarf bars” to boost sales of its cashmere scarves priced from $450 to $1,050.

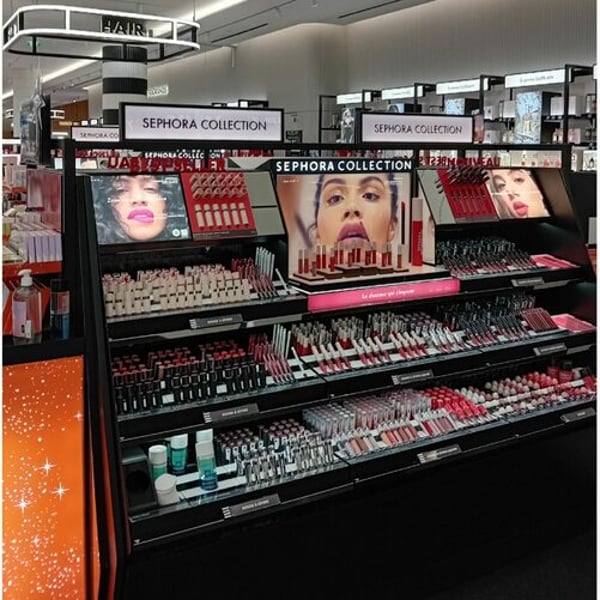

And Kering and Richemont de Cartier are looking to bring their perfume and cosmetics lines back in-house, while LVMH has been developing cafes and entertainment, said Jonathan Siboni, chief executive of Luxurynsight.

Following the Nov. 5 U.S. presidential election, “luxury demand appears fragile, particularly among aspirational clientele,” Citi analysts said, highlighting weak household employment in November following tepid U.S. hiring. .

The absence of this consumer is reflected in a decline in luxury buyers globally from 60 million to 355 million, RBC analysts said. They cite inflation pressures and growing interest in spending on experiences rather than products as key reasons for the decline.

Global sales of luxury personal items, such as clothing, accessories and beauty products, are expected to remain stable at constant exchange rates during the holiday season, according to consultancy Bain.

Bain previously forecast that global sales of luxury personal items would fall 2% this year, one of the weakest on record, with a shrinking customer base, especially so-called aspirational buyers, who are more price-sensitive.

The appetite for high-end products in China, one of the luxury goods industry's biggest markets and main source of growth in recent years, has been slowed by a housing crisis and low youth unemployment, and analysts JPMorgan's analysts predict an “altered” outlook for the sector after a difficult 2024, as ongoing macroeconomic challenges in China continue to weigh.

In this context, luxury consumers are particularly selective. They don't want to buy things perceived as “lower quality or older styles,” said Caroline Reyl, head of premium brands at Pictet Asset Management.

Instead, brands can gain attention through marketing campaigns as well as expanded product categories, along with the shift toward more affordable product categories.

“It's still very high quality, but cheaper in terms of price,” Reyl added.

Siboni, which combines information drawn from brands' websites and from the companies themselves, has seen an average increase of 8% in small leather items, such as wallets, in proportion to full-size bags, compared to ago. one year.

In November, the average price of small leather goods from LVMH's Dior brand fell 21% year-on-year, according to data from Luxurynsight. Meanwhile, its Louis Vuitton brand has increased the proportion of products in its selection of small leather goods with prices under 500 euros by 9% compared to the same period last year.

The emphasis on lower-priced products, while necessary to preserve relevance at a time when middle-class and even wealthy shoppers resist high-priced products, is likely to erode the profit margins of players like LVMH and Kering. Balenciaga matrix. They are already facing pressure due to slowing sales.

“What we are trying to do is expand the price range,” Andrea Guerra, CEO of industry-leading Prada, told analysts in late October.

Meanwhile, Burberry's new CEO Joshua Schulman, presenting his turnaround plan for the British luxury brand, emphasized expanding the core-priced product assortment, noting that prices had been raised “too high across the board.” “.

Industry leader LVMH, however, warned against the risk of straying too far from the brand, which could damage a brand's exclusive aura. Chief financial officer Jean-Jacques Guiony said the group would avoid introducing a new range of “very affordable products”.

“I think it would be a mistake,” he told analysts in October, highlighting the importance of not completely changing offers with a “very short-term view.”

© Thomson Reuters 2024 All rights reserved.