By

Reuters

Published

October 11, 2024

In this wine-growing region of western France, where brandy producers are worried about the fallout from a trade dispute between the European Union and China, Christophe Bouetard is more concerned than most. Bouetard runs the MG Motor dealership in Cognac and makes a living selling Chinese-made electric vehicles (EVs) that will soon face hefty 45% EU tariffs. But many of its customers work in the local brandy trade, which China is now targeting with retaliatory anti-dumping measures.

Bouetard, 56, described the double blow he faces as complicated. Electric vehicles made in China account for about half of its sales: “We are trapped in a vicious circle between the Cognac region and the image of our Chinese vehicles, which are now in conflict because of these European tariffs.”

A darkness hangs over Cognac, a small town that has given its name to France's most famous brandy.

The sector was in a crisis that lasted a decade until rising inflation affected foreign sales. Cognac exports fell by more than a fifth in 2023, and this year's crop was already threatened by disease and bad weather before Beijing announced its provisional tit-for-tat measures against the region's main drink.

France was seen as a target of Beijing's brandy investigation because of its support for tariffs on electric vehicles made in China. Shipments of French brandy to China reached 1.7 billion euros ($1.85 billion) last year, generating revenues of 1 billion euros for cognac producers.

France's Commerce Ministry has said Beijing's brandy measures violate free trade. The European Commission plans to challenge the measure at the World Trade Organization.

“This is not about engaging in a trade war with China, with which we have significant trade, but about restoring the conditions for fair competition,” Trade Minister Sophie Primas told Reuters.

THE LUXURY SECTOR IN FRANCE FEELS THE HEAT

But despite Paris's fighting words, many cognac producers fear that Brussels and the French government will sacrifice the industry to protect the much larger European car industry from cheap electric vehicles made in China.

A senior Cognac official, speaking on condition of anonymity, told Reuters the industry doubted final tariffs could be avoided. In meetings with senior government officials from the president's and prime minister's offices, they failed to hint at any potential solutions, he said.

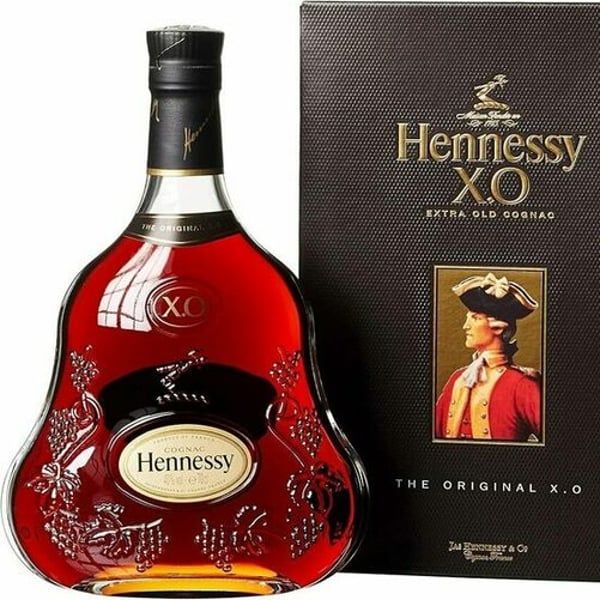

Beijing's measures on brandy have had repercussions on the French luxury sector, which is already struggling with weaker Chinese demand. Shares in LVMH, Remy Cointreau and Pernod Ricard, which market high-end Hennessy, Remy Martin and Martell cognac respectively, fell sharply on Tuesday after Beijing announced the measures. Former French Prime Minister Jean-Pierre Raffarin was France's special representative to China until 2022 and still represents President Emmanuel Macron in China at some events. He doubts China, which also has an ongoing anti-dumping and anti-subsidy investigation into EU pork products, will target French luxury products next.

“Luxury is a sector in which the determining factor is often the Chinese clientele themselves,” he said.

However, Marc Fesneau, France's former agriculture minister, said it was clear that China was targeting France.

“This is a European measure that only has consequences for a single sector: cognac,” he told Reuters. “Cognac is France, so we can see China's diplomatic game.”

NEW HARSH MEASURES

Starting Friday, importers of brandy originating in the European Union will have to make security deposits of 34.8% to 39.0% of the value of imports, according to temporary measures announced by China's Ministry of Commerce this week .

If those measures become permanent, the additional tariffs would cause a drop in exports to China, Cognac's second-largest market after the United States, French trade body Bureau National Interprofessionnel du Cognac said.

Emmanuel Painturaud, owner of the Painturaud Frères Cognac house, founded 90 years ago with his three brothers, said Beijing's response was particularly worrying as Chinese consumers tend to buy older and more expensive cognacs.

“Wine producers feel like hostages, with some vindictive measures by the Chinese government,” he told Reuters in his wine cellar, filled with wooden barrels full of cognac.

Almost all Cognac production is exported. Historically, wine was distilled to take up less space on ships. From Cognac, those boats took it down the Charentes River to far-flung destinations, including China, where it has been sold for more than 250 years, producers said.

Anthony Brun, president of the UGVC general union of cognac winegrowers, told Reuters the outlook for the industry was bleak even before China announced its measures.

“If we add to this the loss of our second market, the consequences will be catastrophic,” he said. Bouetard, the MG distributor, was trying to remain optimistic, even though its sales had already fallen by more than a quarter since France began withdrawing incentives to buy electric vehicles, and particularly those from China.

He said MG could rely more on its hybrid vehicles to avoid tariffs and hoped Chinese automakers would build factories in Europe to circumvent punitive measures. But he admitted that next year could be difficult.

If 45% tariffs become a permanent reality, he said, “we will have to find solutions.”

© Thomson Reuters 2024 All rights reserved.