By

Bloomberg

Published

January 31, 2024

What really matters anyway?

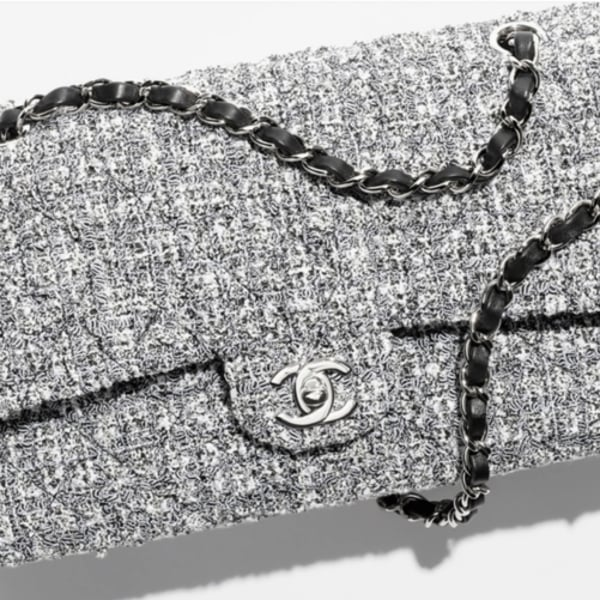

That's what Nia Holland, 24, thought after spending $2,500 on a vintage Chanel bag, depleting her savings. Earning little money doing on-campus research work during graduate school, she knew her money could be better spent, saved, or invested.

But at the same time, he said he didn't feel irresponsible. With traditional milestones like homeownership and a life with children so far out of reach, denying yourself “little luxuries” wasn't going to make a difference. And if anything, the lambskin bag with a 24-karat chain made her feel better.

“The economy sucks, there's global warming, there's constant political and social unrest globally,” said Holland, who receives financial support from his family while pursuing a doctorate in education and psychology at the University of Michigan. “It's easier to spend money on things that will give you immediate satisfaction.”

Typically, when people are on shaky economic ground, they cut back on spending. But increasingly, younger generations are doing the opposite, thinking their financial future is doomed no matter what. A higher burden of student debt, a higher cost of living and changes in the job market have made it more difficult to achieve financial goals, such as buying a home or saving for retirement.

As such, about 27% of Americans admit to engaging in “fatal spending” to address concerns about the economy and foreign affairs, according to Credit Karma, a personal finance company. And the rates are even higher among Millennials and Generation Z, at 43% and 35% respectively.

“It's a way of coping, but not the healthiest,” said Courtney Alev, consumer financial advocate for Credit Karma.

fatalistic tendencies

While fatal spending may capture the economic zeitgeist, the habit is not new. Stephen Wu, an economics professor at Hamilton College in Clinton, New York, published research in 2004 and wrote that those who feel that luck and other external factors play a role in their financial success are less likely to save.

He argues that feelings of fatalism and counterintuitive spending habits have become more common in recent years, particularly after the pandemic and the Great Recession. That's when people began to realize that “a lot of their successes and failures were out of their control,” Wu said.

How younger generations can make big-ticket purchases may also depend on greater parental support. With almost half of young people living at home, some are using the extra disposable income to treat themselves. It can be easy to think that's reasonable too when social media is filled with images of young people enjoying luxurious meals, glamorous vacations and designer items.

However, if one is not careful, fatal spending can be a self-fulfilling prophecy, where the risk of living paycheck to paycheck is much higher.

That's the case for Adrian Siega, 26, who recently spent the last of his emergency savings to buy a knockoff Burberry bag that appeared on the popular HBO show. Succession.

Siega moved to New York from the Philippines in 2019, with the goal of attending college, finding a job, and buying a house. But as time went on, he felt his dreams of homeownership slipping out of reach. While he hopes to finally go to college this year, he still lives with his mother and receives financial support.

“Thirty years ago, an apartment in Elmhurst cost $90,000, and now it costs $400,000 for a one-bedroom; that's crazy,” said Siega, a personal care assistant. So for now, she's focused on what's “needed right now”: skin-care products, a peacoat, and a knockoff of Hermès' 14-inch Birkin Gold Togo bag for $1,088.

A different path

Expensive purchases may seem wrong. But if a person has given up on the dream of a suburban life with children, that's not necessarily the case, said María Melchor, a 27-year-old content creator focused on financial education for Generation Z.

In a TikTok with more than 1.8 million views, the Yale graduate says that when older people ask how young people can afford things they never buy, she says it's because they can't afford anything else.

“Owning a home or starting a family is so out of reach that we are using that down payment or children's money on anything we can afford that will give us a semblance of the kind of adulthood we were promised,” he says in the video.

In an interview, he said he wouldn't classify Gen Z's indulgence in luxury goods as a fatal expense. Rather, it's a look at what life could be like for more people, if they didn't spend all their money on real estate and kids. Marriage and birth rates are declining and remote work, at least for some, opened up the possibility of not being tied to a single zip code.

“I think the 'dream' is changing,” he said.