Japan's luxury boom is expected to continue through 2025, driven by strong domestic and international spending.

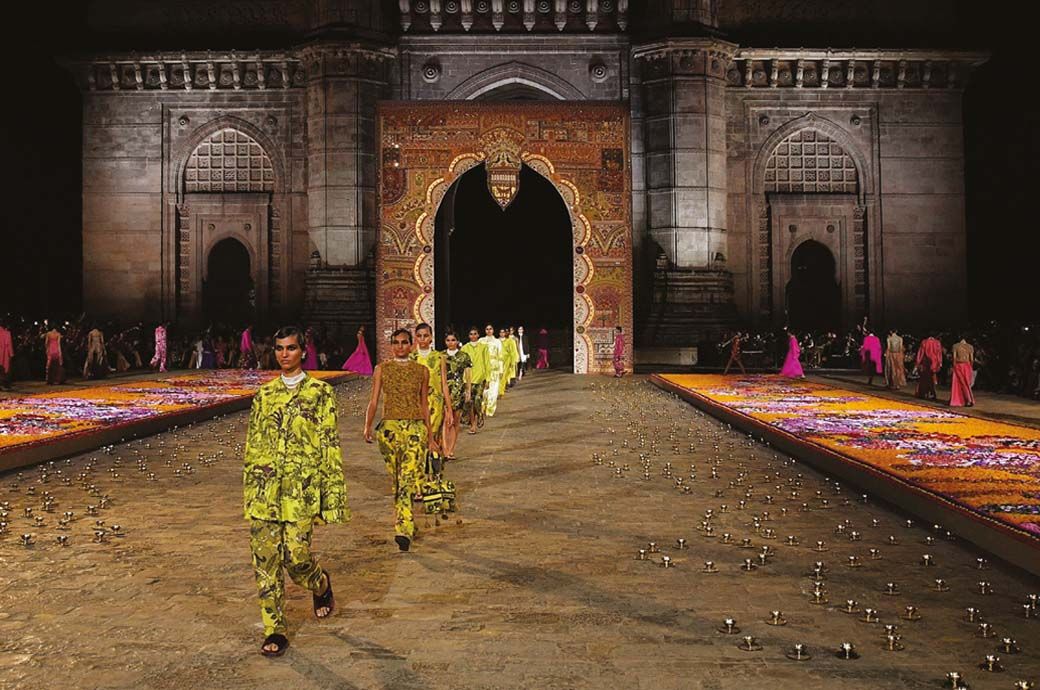

The world's leading fashion brands are looking to Asian markets beyond China, with 67 percent of fashion executives surveyed citing promising growth prospects in India in 2025, according to The State of Fashion 2025 report. Japan's luxury boom will likely continue through 2025. But next year will be turbulent for global fashion, and a deep sense of uncertainty remains among fashion industry executives.

However, economic and geopolitical challenges, combined with shifts in customer values, will define a turbulent year for the $2.5 trillion global fashion industry, the report notes.

A deep sense of uncertainty persists among fashion industry executives. Only a fifth of them expect conditions to improve in 2025 compared to this year, 41 percent believe conditions will remain the same and 39 percent predict they will worsen.

Seventy percent of fashion executives cite a lack of consumer confidence and appetite to spend as the biggest concern for the coming year, and more than 80 percent of shoppers plan to spend the same or less on fashion next year. year, boosting opportunities for discount retailers.

Sustainability has fallen off the agenda, with only 18 percent of fashion executives citing it as one of the top three risks to growth in 2025, down from 29 percent in 2024. Despite increasing regulation, 63 percent of brands are behind on 2030 decarbonization goals. Customers are not willing to pay more for more sustainable products.

Online fashion markets are struggling, with share prices falling 77 percent on average between 2021 and 2024. The coming year will force brands to adapt or become obsolete, McKinsey and BoF said in a statement citing the report.

Share prices of online fashion marketplaces declined by 77 percent between 2021 and 2024. Especially in Europe, online marketplaces are increasingly challenged by high-growth players such as Shein and Temu.

Challenger sportswear brands will offer a bright spot in the market and are expected to generate 57 percent of profits in the sportswear segment, almost tripling its share from 2020.

With industry growth expected to plateau in the single digits, fashion brands will have to fight for market share by re-evaluating their relationship with customers, prioritizing overlooked demographics and proving they're worth the worth paying for their products, the report states.

The report notes that the rise of artificial intelligence (AI) could also empower shoppers and change discovery processes, helping customers combat “choice paralysis” while shopping online. Half of fashion executives surveyed believe that customer product discovery will be the key use case for AI in 2025.

The report found that 41 percent of consumers turn to secondhand stores when looking for deals on clothing. While “cheating” culture has previously been taboo, purchasing cheaper replicas has gained popularity thanks to Generation Z.

Fiber2Fashion News Desk (DS)