In the first half of its FY24 report, Commonwealth Bank of Australia announced that, through “responsible scaling of AI,” it has already produced more than 50 generative AI use cases. The bank says it will simplify operational processes and support new customer experiences.

Beyond that dry language, it's worth paying attention to what CBA is doing with AI because it continues to set trends in technology, and its experiments with AI are likely to be transformative, particularly with respect to how banks can offer personalization and understand and respond better to your customers' behavior.

What established CBA as a technology leader

In April 2008, Commonwealth Bank of Australia announced that it was embarking on a four-year A$580 million (US$379.32 million) program to modernize its traditional core banking and then begin to be able to introduce some new features. . This project was one of the previous examples of a major digital transformation project among financial services organizations.

PREMIUM: Download this free guide on the main Fintech predictions for 2024.

This was driven by the desire to offer IT services to customers, as CIO Michael Harte said at the time.

“Commonwealth Bank has always strived to change the way it delivers IT services. This effort has been redoubled to gain advantage over the past seven years,” Harte said. “We have modernized our infrastructure by implementing a new IP data network, building a new IP telephone network, modernizing our mainframes, consolidating our data centers from 23 to two and introducing security and privacy solutions. And, of course, we committed to modernizing our core banking platform.”

An early example of the innovation that emerged from this was CBA's ability to be the first bank to launch an EFTPOS solution which allowed it to have a direct relationship with business customers and their payments.

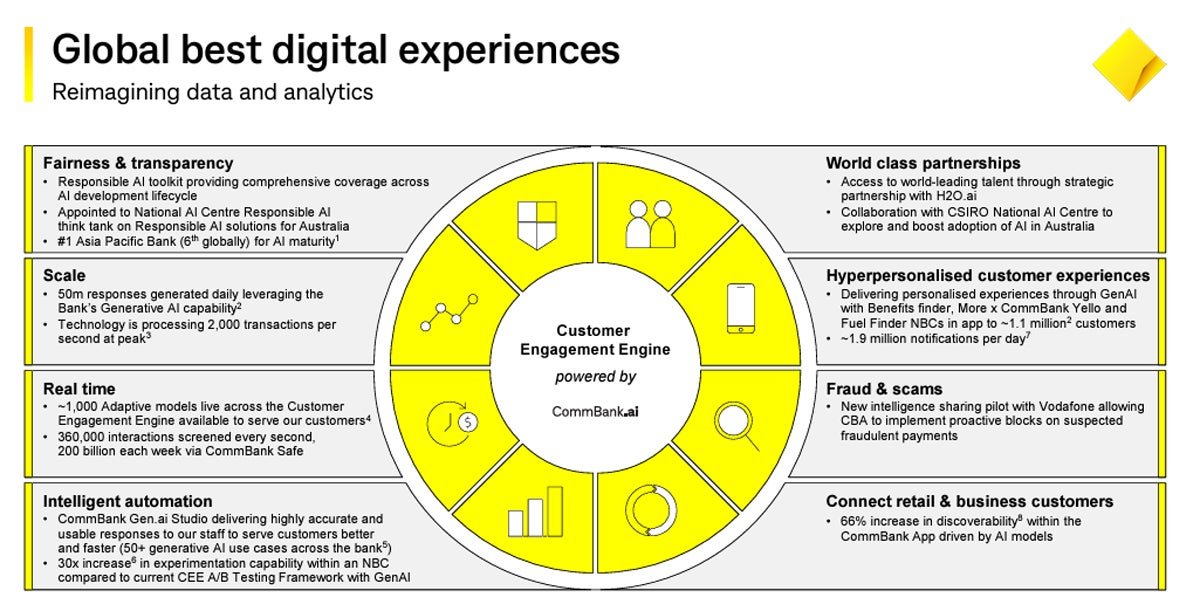

Looking ahead, the company has an ongoing commitment to investing in digital, with the explicit goal being “first-to-market offerings” (Figure A).

What is the CBA doing with AI?

The Commonwealth Bank of Australia market report highlighted three goals for the AI enterprise:

- Use AI to deliver personalized customer experiences. CBA noted that there has been a 66% increase in customer engagement through the CommBank app.

- Responsible scaling, which to date has resulted in more than 50 generative AI use cases to simplify operational processes and support the bank's front line in customer service.

- Upskilled more than 500 employees in AI tools, which in turn allows the bank to democratize the responsible use of AI across the organization.

Pursuing these goals led CBA to launch the CommBank Gen.ai study in mid-2023. One of the first applications of this, which it announced at South by Southwest 2023, was to examine how well generative AI chatbots can not only provide the information that the client is looking for but also emulate their behaviors.

As CBA chief decision scientist Dan Jermyn said at the time, “we are using this advanced technology to explore the creation of customer personas or ‘synthetic agents,’ where GenAI chatbots act as an early experimentation tool.”

AI offers a new frontier of personalization

This has the potential to offer extreme customization. As CBA CEO Matt Comyn said on a call to discuss the results with analysts, early examples of this have been positive. Commonwealth Bank of Australia, for example, had used its AI-backed customer engagement engine to make personalized pricing offers to home loan customers, originating from a fixed rate loan, in real time.

SEE: Australian organizations are working to balance personalization and privacy.

Overall, CBA expects AI to improve its CEE in several different categories, including scale, fairness and transparency, the ability to combat fraud and scams, and better connecting with retail and business customers (Figure B).

How CBA is uniting AI and customer engagement

It's easy to forget that this current wave of innovation around AI is relatively new, and generative AI has only become a mainstream concept in the last 18 months. Commonwealth Bank of Australia was an early adopter of this, and while there will be a lot of innovation coming from AI that we haven't conceptualized yet, what CBA does with its tools will be monitored by financial services around the world.

Most significantly, CBA's innovation efforts are typically laser-focused on delivering results to customers, and AI is following the trends in that regard. The bank is also focused on developing knowledge and capabilities across the market.

As noted in KPMG's analysis of Commonwealth Bank of Australia's successes:

“First, they spend a lot of time and effort listening to their customers. Some of that “listening” is done by machine learning algorithms running in the CEE. But CBA is also interested in hearing from person to person. The bank's efforts to create dynamic partnerships have also helped them move forward. Not only by adding innovative models and services, but also helping the business to develop, innovate and co-create.”

In short, it is important to closely follow what CBA is doing with AI because its current experiments are likely to become standardized approaches to generative AI in financial services in the future.