Square Payroll and Gusto are two popular payroll platforms for small businesses. While they may seem very similar at first glance, the difference becomes more apparent once you start to dig deeper.

In this review, we compare Square Payroll vs. Gusto on pricing, features, pros, and cons to help you choose the best payroll software for your business.

Paycor

Employees by company size

Micro (0-49), Small (50-249), Medium (250-999), Large (1000-4999), Business (5000+)

Micro (0-49 employees), small (50-249 employees), medium (250-999 employees)

Micro, Small, Medium

Characteristics

API, check printing, document management/sharing and more

Square Payroll vs. Taste: comparative table

| Square Payroll | Enthusiasm | |

|---|---|---|

| Our rating | 4.2 out of 5 | 4.6 out of 5 |

| starting price | $35 per month. + $6 per person per month. | $40 per month. + $6 per person per month. |

| Unlimited payroll runs | Yeah | Yeah |

| Automatic payroll option | Yeah | Yeah |

| Automatic tax calculations and filing. | Yeah | Yeah |

| Benefit Add-ons | Health, 401(k), workers' compensation | Health, 401(k), life, disability, HSA, FSA, workers' compensation |

| Induction | Yeah | Yeah |

| Hiring and recruiting | No | Yeah |

| Scheduling and timesheets | Limited | Yeah |

| PTO management | No | Yeah |

| Visit Square Payroll | Visit Taste |

Square Payroll vs. Gusto: Pricing

Square Payroll Pricing

Square Payroll offers two pricing plans, full-service payroll and contractor-only payroll:

- Full Service Payroll: $35 per month plus $6 per person paid per month. This plan supports all payroll features, including automatic payroll, off-cycle payments, multi-state payroll, and automated tax payments and filings.

- Payroll for contractors only: $6 per person with no monthly fee. This plan supports unlimited payments each month, but offers fewer features compared to the full-service payroll plan.

There are several add-ons available, including health insurance management, 401(k) retirement benefits, an employee handbook builder, and direct access to human resources experts.

For more information, check out our full Square Payroll review.

taste prices

Gusto offers three pricing plans to support growing businesses of all sizes, and HR features increase with each tier:

- Simple: $40 per month plus $6 per person paid per month. This plan offers full-service, single-state payroll, including W-2 and 1099, as well as basic recruiting and onboarding tools.

- Further: $80 per month plus $12 per person paid per month. This plan offers full-service multistate payroll, including W-2 and 1099 forms, as well as overnight direct deposit, time tracking, performance reviews, and more.

- Premium: The price of this plan is not disclosed; You must contact the sales team for a quote. This plan includes everything from Plus, plus a dedicated customer success manager, HR resource center, and compliance alerts.

- Payroll for contractors only: $6 per person with no monthly fee.

There are several add-ons available, including health insurance, workers' compensation, life and disability insurance, HSA and FSA accounts, and traveler benefits.

For more information, check out our full Gusto review.

Square Payroll vs. Gusto: Feature Comparison

Best for Unlimited Automatic Payroll: Both

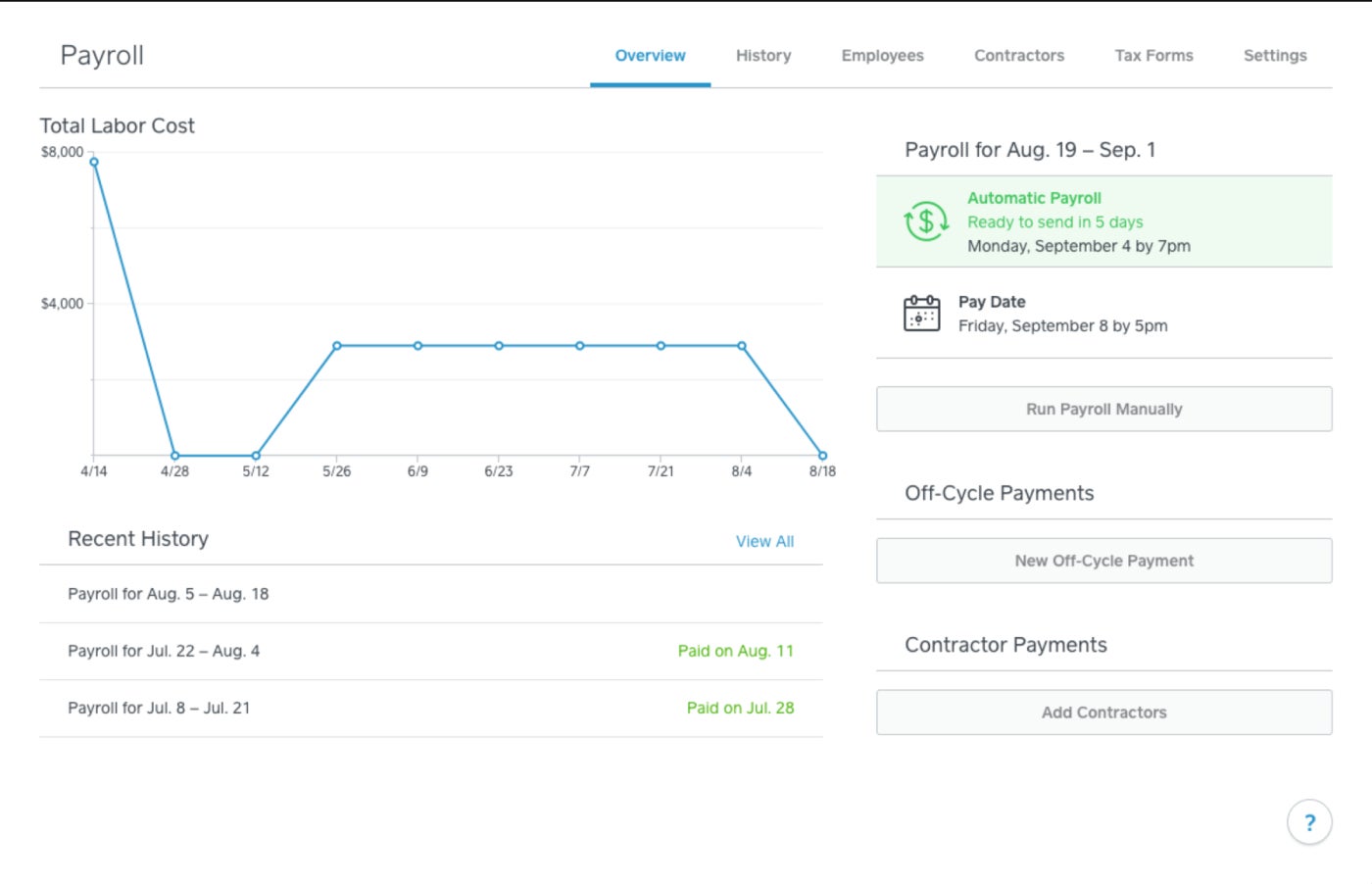

Both Nómina Square and Gusto (Figure A) offer unlimited payroll runs, which is a must-have feature of payroll software. Some competitors have a per-run pricing model where you are charged for each payroll run separately, which can be costly for organizations with frequent payroll runs.

Both Gusto and Square also offer the option to set up automatic payroll, although this feature is not available on Square's contractor-only plan.

Best for Automatic Tax Filing: Both

All federal, state, and local payroll taxes are automatically calculated, filed, and paid with Square Payroll (Figure B) and Taste. Both payroll software will file W-2 and 1099 forms and send them to employees and contractors.

However, Square's contractor-only plan does not support this feature. And if you need to manage payroll and file state taxes in multiple states, you'll need to upgrade to the Gusto's Plus plan.

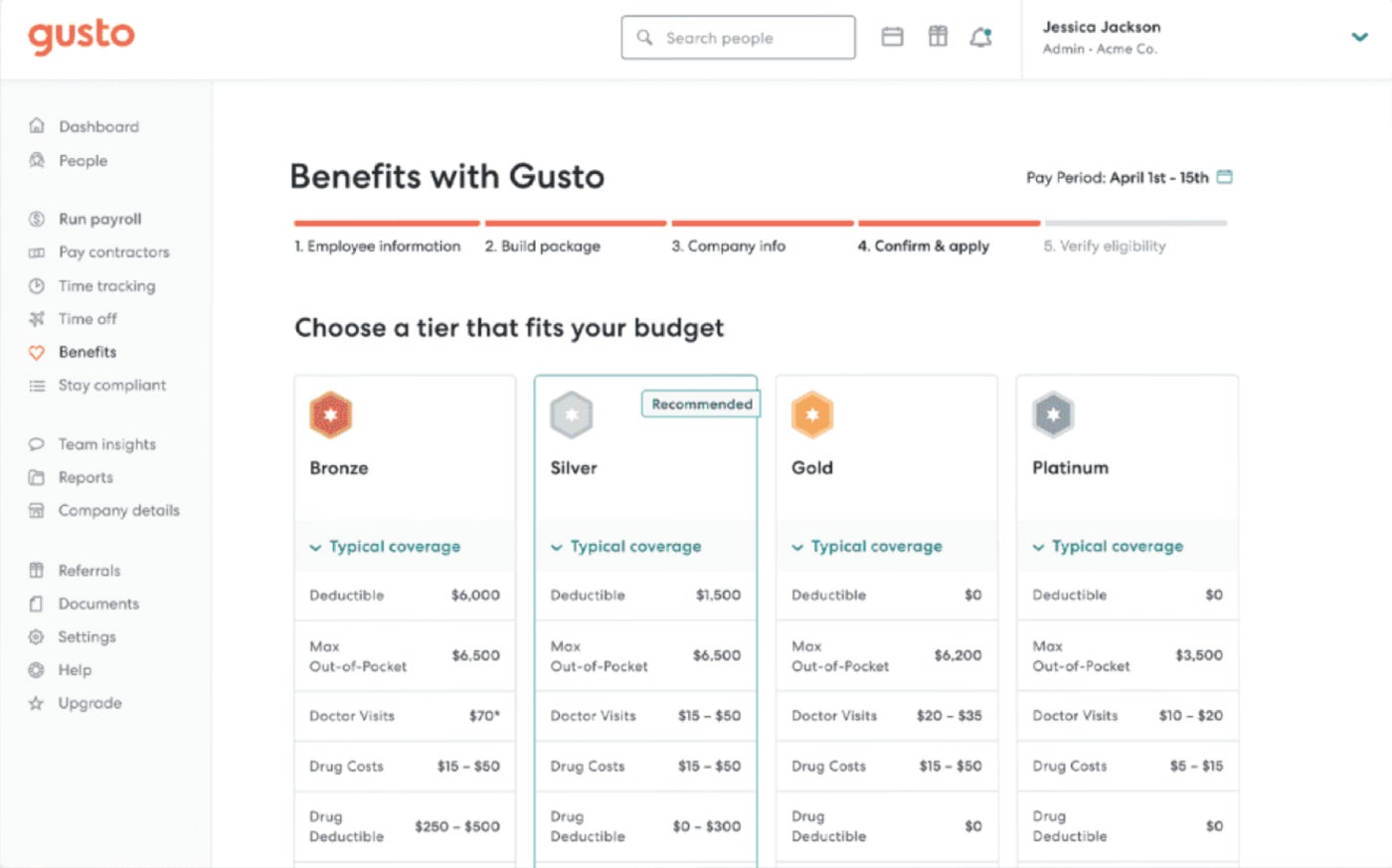

Best for benefits administration: Gusto

Square's full-service payroll plan lets you add optional health insurance and 401(k) retirement benefits, but it doesn't offer more robust benefits management beyond that.

On the other hand, Gusto offers all kinds of complementary benefits for employees. In addition to health insurance (Figure C) and retirement savings, you can manage workers' compensation, HSAs and FSAs, life and disability insurance, and even commuter benefits, all through Gusto. Please note that most of these features are add-ons and will increase the price accordingly.

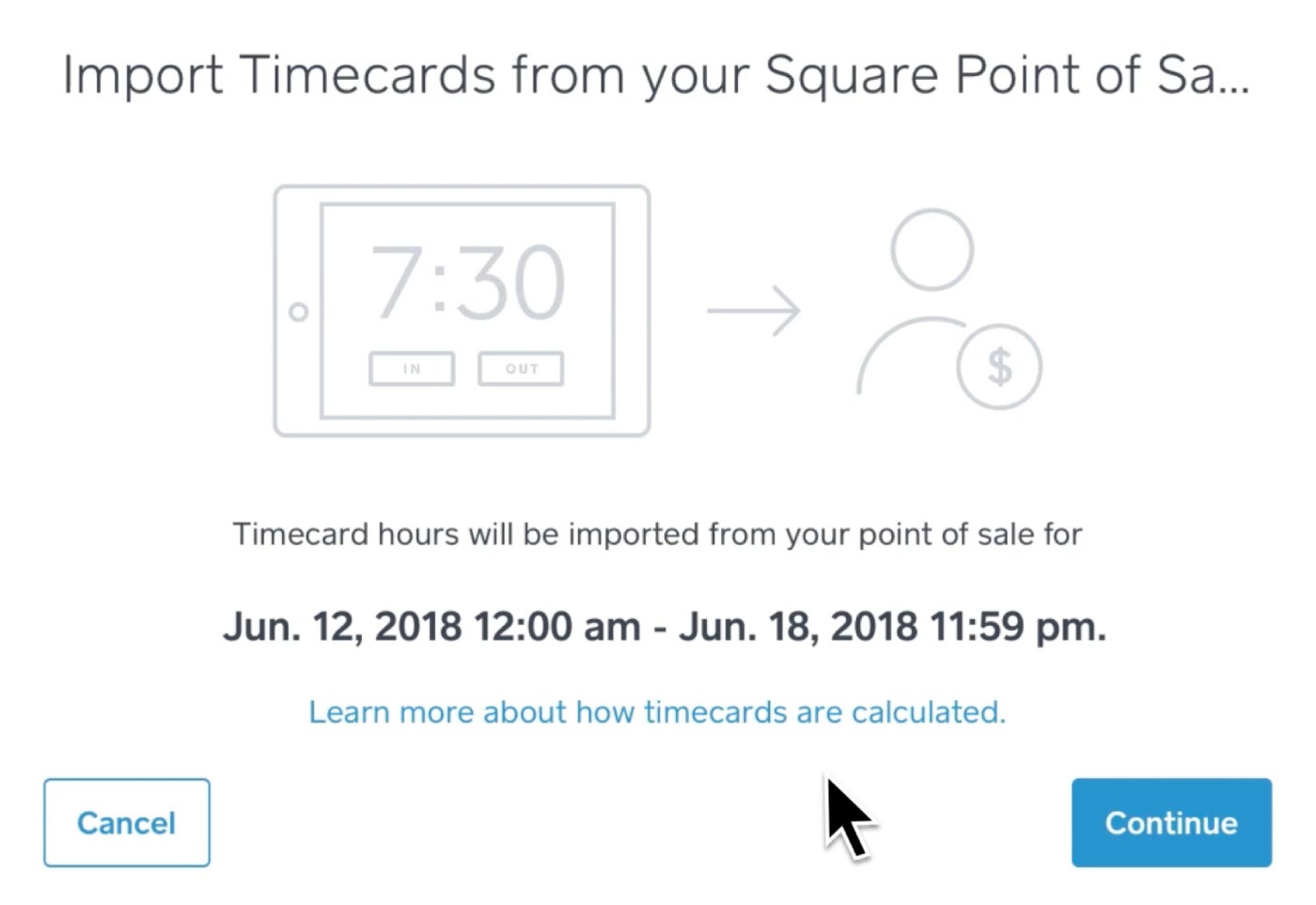

Best for Time Tracking and Scheduling: Gusto

Square Payroll offers scheduling and tracking tools for a limited time. Managers can import timecards from the Square Point of Sale system or the Square Team app (Figure D), and can create schedules up to 10 days in advance and also calculate overtime when necessary.

Meanwhile, Gusto offers much more robust tools not only for scheduling and time tracking, but also for PTO management. You can manage time off requests and approvals and create a time off calendar by syncing everything within Gusto, and you can even set up your own custom paid holidays.

Best for Hiring and Onboarding: Gusto

Square Payroll's more limited HR tools cover employee self-onboarding, but don't really go beyond that.

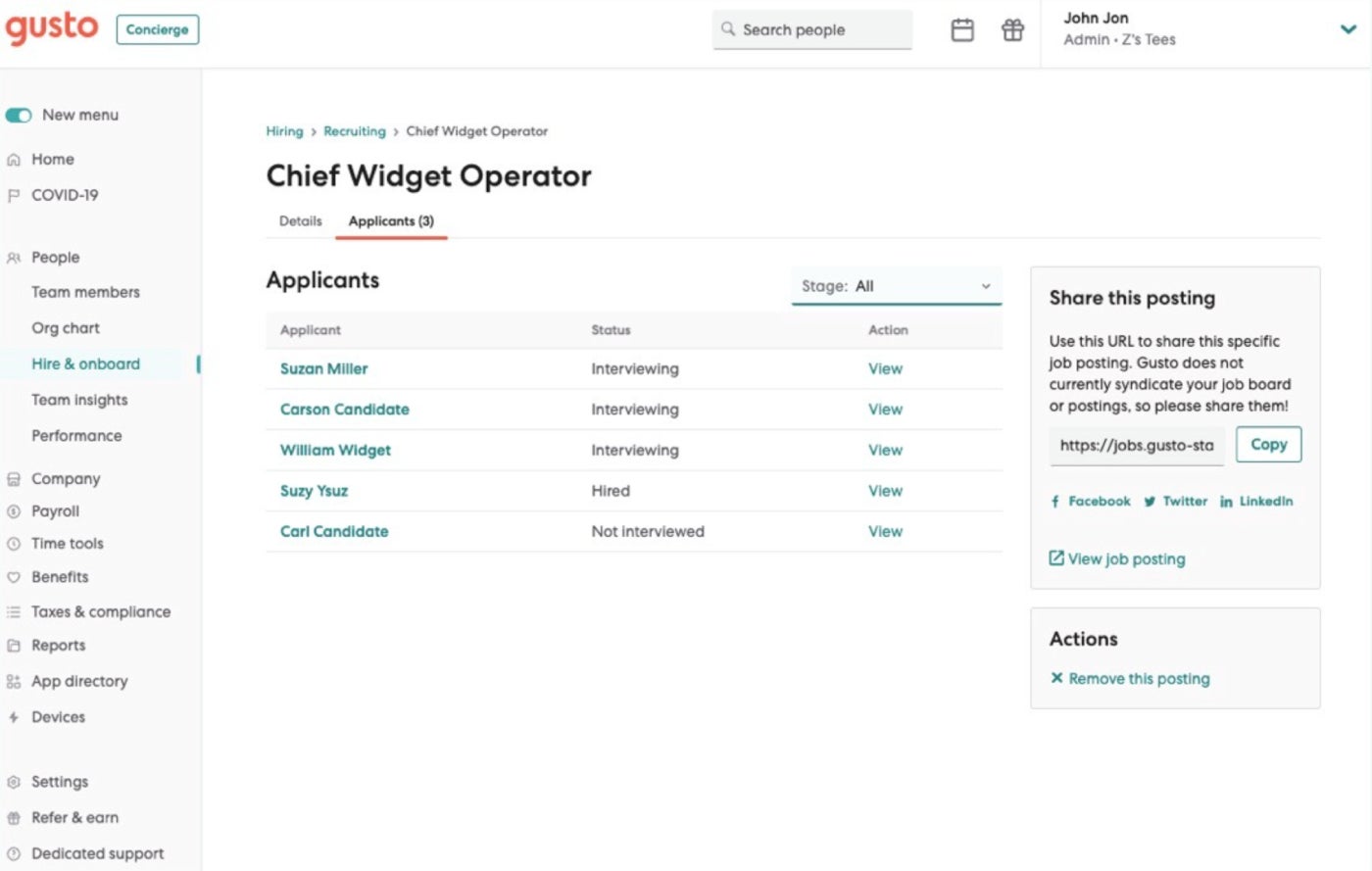

On the other hand, Gusto offers many different tools to support hiring and onboarding, including custom offer letter templates, background checks, email provisioning, and document storage. More advanced plans get access to job postings as well as an applicant tracking system (Figure E) to help your company advertise job openings and recruit the best candidates.

Best for integrations: Gusto

Gusto offers more integrations compared to Square Payroll. While you get deep integration with Square POS, Square Appointments, and other Square products, there is a limited scope of integrations with third-party apps for Square Payroll.

Pros and cons of Square Payroll

Advantages of Square Payroll

- Simple pricing plans.

- More affordable compared to Gusto.

- Integrates seamlessly with other Square products.

- Simple HR tools included.

Disadvantages of Square Payroll

- Fewer HR functions than Gusto.

- Scheduling and time tracking are limited.

Taste pros and cons

Advantages of taste

- Multiple pricing plans provide scalability.

- Intuitive user interface.

- PTO management and recruiting tools.

- Option to add many different types of benefits.

Cons of taste

- More expensive compared to Square Payroll.

- You must upgrade pricing plans to get access to many features.

Should your organization use Square Payroll or Gusto?

Choose Square Payroll yes. . .

- You want a simple and affordable pricing structure.

- You don't need advanced HR tools.

- You just want basic benefit add-ons.

- You already use the Square Point of Sale system.

- Just look for a simple payroll platform.

Choose Taste yes. . .

- You want multiple pricing plans that can scale with your business as it grows.

- You need more advanced HR tools, like PTO management and applicant tracking.

- You are looking for many different types of additional benefits.

- You need more advanced programming tools.

- You have a higher budget for payroll and HR software.

Need more help deciding between Square Payroll and Gusto? Check out our payroll services comparison tool for additional guidance for your payroll software search.

Methodology

To compare Square Payroll and Gusto, we looked at product documentation and user reviews. We considered features like payroll, taxes and compliance, benefits, time tracking and scheduling, HR resource libraries, and more. We also weigh factors such as price, user experience, customer service and transparency.