Reconciling your banking transactions with your business ledger is essential to the financial health of your business. However, if you've never reconciled your company's transactions before, the process may seem a little intimidating.

Continue reading to discover the essential steps in bank reconciliation and see several examples of what a bank reconciliation could look like.

1

quick books

Employees by company size

Micro (0-49), Small (50-249), Medium (250-999), Large (1000-4999), Business (5000+)

Micro (0-49 employees), small (50-249 employees), medium (250-999 employees), large (1000-4999 employees)

Micro, Small, Medium, Large

Characteristics

API, general ledger, inventory management

2

Acumatica Cloud ERP

Employees by company size

Micro (0-49), Small (50-249), Medium (250-999), Large (1000-4999), Business (5000+)

Micro (0-49 employees), small (50-249 employees), medium (250-999 employees), large (1000-4999 employees)

Micro, Small, Medium, Large

Characteristics

Accounts receivable/payable, API, departmental accounting and more

What is bank reconciliation?

A bank reconciliation statement compares the balance in a company's bank account with the balance in its accounting records. A bank reconciliation will show any discrepancies between the two accounts. Bank reconciliation helps companies detect both accidental errors and intentional fraud.

Why is bank reconciliation important?

Bank reconciliation benefits businesses in numerous ways. First, the bank reconciliation process will help you discover and correct errors in your books. It will also help you identify fraud, improper payments, excessive fees, and other improper payments that are costing your business money.

Bank reconciliation also helps you stay on top of your company's financial health. The bank reconciliation process allows you to track the profitability of your business over time. You'll be able to categorize tax-deductible expenses as you review your records, helping you get tax breaks and ensuring you're ready to file taxes.

Types of bank reconciliation

In addition to completing a general bank reconciliation, you may also want to perform a reconciliation only for certain types of transactions. Here are five types of bank reconciliation every business owner should know:

Supplier reconciliation

Vendor reconciliation helps you detect differences between vendor payments and the general ledger. It involves comparing supplier statements with transactions in the general ledger to ensure that the overall balance is accurate.

Customer reconciliation

If you allow customers to purchase your products or services on credit, you will need to perform a customer reconciliation. During this process, customer transactions made on credit are compared to the accounts receivable ledger, as well as the accounts receivable control account, which is part of the general ledger.

credit card reconciliation

Unlike customer reconciliation, credit card reconciliation involves purchases that your own company has made on credit. During this process, you will compare transactions made with company credit cards against receipts and expense reports to ensure that all purchases are accounted for and no bills are left unpaid.

Cash reconciliation

Businesses with retail establishments will be required to perform a cash reconciliation at the end of each business day. In a cash reconciliation, tellers verify that the amount of money remaining in the register matches the transactions made that day.

Balance Sheet Reconciliation

Balance sheet reconciliation confirms that all of a company's financial statements are accurate. During this process, balance sheet balances are compared to the general ledger, as well as other supporting documentation, such as bank statements and invoices.

How to do a bank reconciliation

Gather your documents

To perform a bank reconciliation, you will need your bank records for a set period of time, usually the last month. You can access this data by checking your latest bank statement or logging into your company's bank accounting online.

Some accounting apps will also automatically import your bank transactions, speeding up the reconciliation process. You'll also need access to your company's books for that same period of time, whether in a spreadsheet, logbook, or accounting software.

Compare your books and bank accounts

Once you have all your documents together, compare your books to your bank statements to identify discrepancies. For example, you may have recorded a payment to a supplier on your books, but that payment may not yet have reached your bank account. Create a list of all the discrepancies and try to determine the cause of each one.

Adjust the books and bank account.

Once you have a master list of discrepancies, you will need to add the missing accounting transactions to your bank account and the missing bank transactions to your books. Make sure all withdrawals and deposits are posted during the period you are reconciling.

Compare adjusted balances

Once you have done all the necessary addition and subtraction, it is time to compare the accounting balance with the bank balance. If you have done your calculations correctly, these two numbers should be exact and equal and you will be done with the bank reconciliation process.

Fix bugs if necessary

Common accounting errors will affect bank reconciliation. Some common errors to look out for include data entry errors, errors of omission, transposition errors, fraudulent transactions, and an incorrect beginning cash balance. Also, be careful about service fees you forgot to account for.

Bank reconciliation examples

Simple bank reconciliation example

Our first bank reconciliation comes courtesy of NetSuite, a business accounting software, and features a mock company called By the Bay Contracting. As you can see in this simple example, the company needs to add $13,000 total to its bank balance and subtract $200 in fees from its books to balance everything.

Complex Bank Reconciliation Example

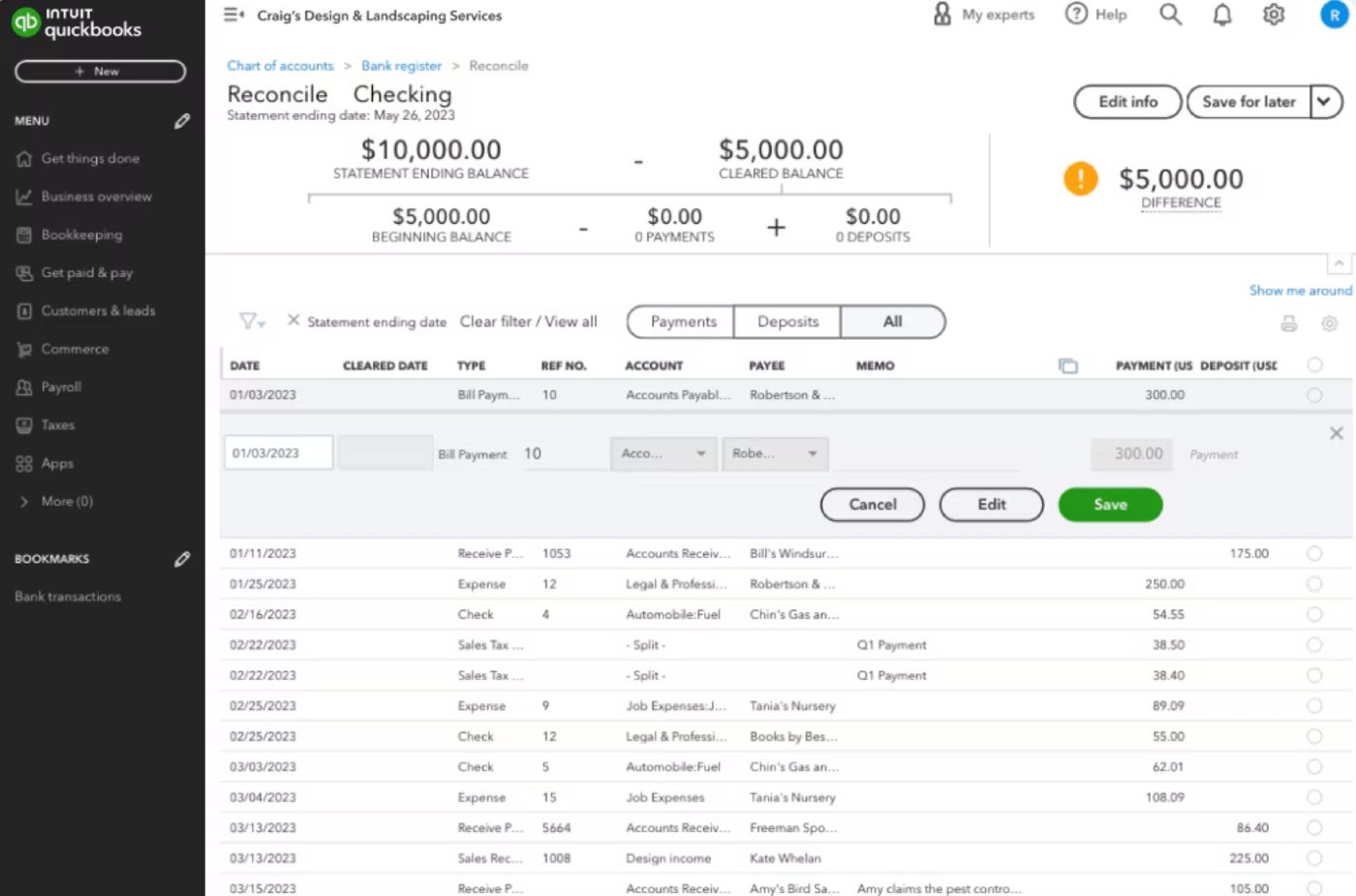

Our next example shows a more complicated bank reconciliation in QuickBooks. As you can see, there is a $5,000 discrepancy between the ending statement balance and the cleared balance for Drag's Design and Landscaping Services. The business owner must add up all outstanding payments and deposits until the two balances match.

Bank Reconciliation Software Example

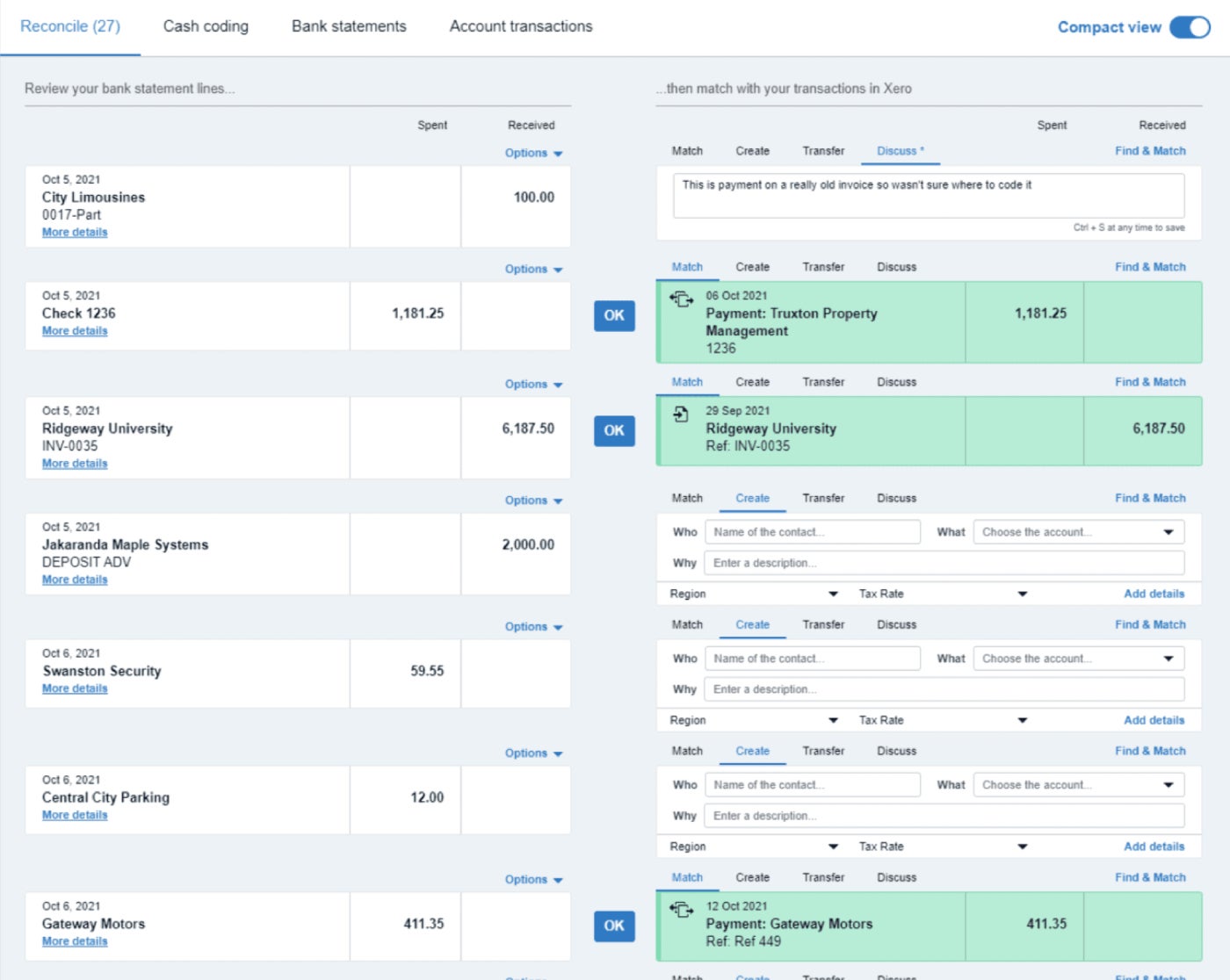

Our final bank reconciliation example demonstrates how software like Xero can import and classify bank transactions to speed up bank reconciliation. As seen in the example, the accounting software automatically matches bank statement links to transactions recorded in Xero and prompts you to add unrecorded bank transactions to your books.

Common Bank Reconciliation Questions

What is the meaning of bank reconciliation?

Bank reconciliation is the process of comparing the balance in a company's bank account with the balance in its accounting records to confirm that all transactions have been accounted for.

What is one of the purposes of bank reconciliation?

The purpose of a bank reconciliation is to review all the transactions that have been recorded on your bank statements and books. Creating bank reconciliations helps identify unrecorded transactions and fraudulent or erroneous charges.

What are the four steps of bank reconciliation?

After you gather your documents, the four main steps of bank reconciliation are to compare your books and bank statements, adjust the books and bank to correct discrepancies, compare the adjusted balances with each other, and correct any remaining errors if necessary.

What is an example of a bank reconciliation?

If a company's bank statements show it has $10,000 in cash, but the books only show it has $9,000, then the company must perform a reconciliation to identify the missing $1,000 in deposits.