The pair remains stable at around 154.30 amid global economic fluctuations and expectations of possible Japanese stimulus measures.

Japan's latest inflation data for October revealed a drop to 2.3%, marking the lowest level in nine months and potentially easing pressure on the Bank of Japan (BoJ) to raise rates immediately. However, BoJ Governor Kazuo Ueda has hinted at a possible rate hike in December due to prolonged weakness in the yen.

Japan's manufacturing sector contracted more than expected in November, while the services sector showed expansion, highlighting a mixed economic outlook.

Reports suggest that the Japanese government could introduce a major stimulus package worth $90 billion to mitigate the impact of inflation on households. While details remain undisclosed, the possibility of such measures has generated some optimism around the yen.

USD/JPY technical analysis

H4 Chart: USD/JPY is forming a consolidation pattern around 154.45. A break lower could lead to a further move towards 153.00, while a break higher could pave the way to 156.20, potentially extending to 157.60. The MACD indicator supports this outlook for USD/JPY, with its signal line positioned above zero but trending lower, suggesting that the pair is approaching a critical decision point.

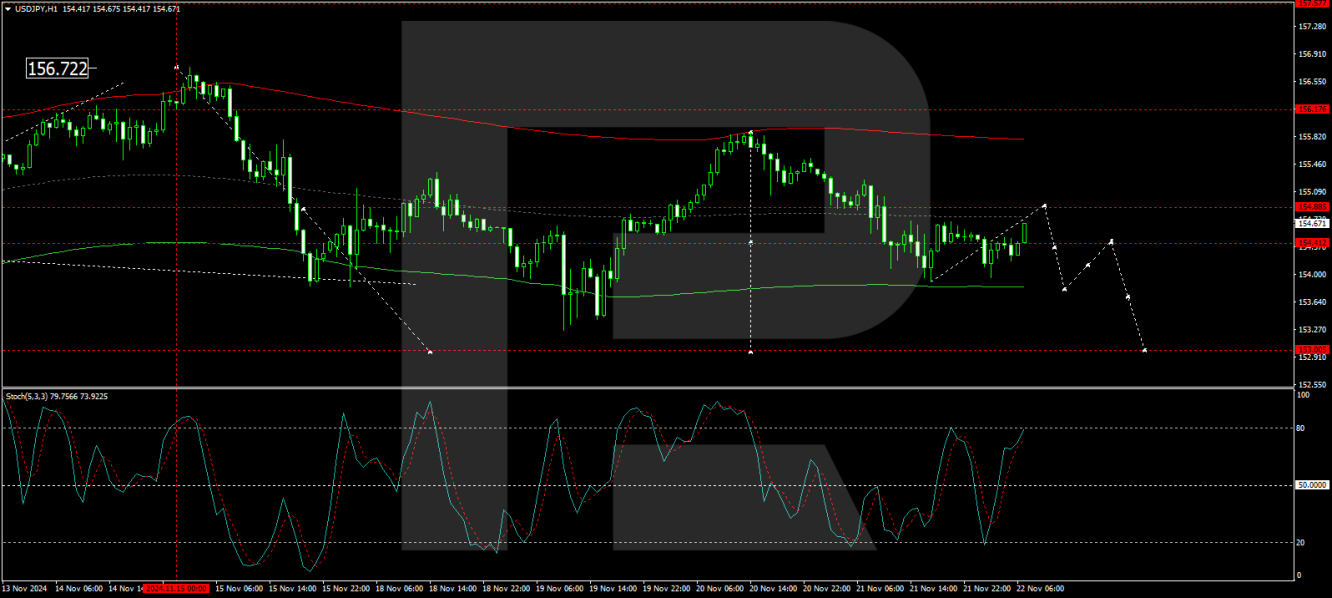

H1 Chart: A consolidation around 154.45, potentially extending to 154.88, sets the stage for possible corrective moves towards 153.00. A subsequent recovery could take the pair to 156.20, marking a new phase of growth. The stochastic oscillator, currently above 80, indicates overbought conditions, signaling a likely retracement to lower levels, aligning with the potential for a short-term correction.

By RoboForex Analysis Department

Disclaimer

Any forecast contained herein is based on the author's personal opinion. This analysis cannot be considered trading advice. RoboForex assumes no responsibility for trading results based on the trading recommendations and reviews contained herein.