The pair has seen a notable decline, currently stabilizing around 1.0648. Last week, the pair posted its most significant weekly gain since 2022, driven by anticipation of persistently high interest rates in the US and escalating conflicts in the Middle East.

The US dollar appreciated 1.6% over the week against a basket of six major currencies, hitting another 34-year high against the Japanese yen and experiencing its most substantial weekly rise against the British pound since July 2023.

Recent US inflation data and the Federal Reserve's cautious stance have tempered expectations for substantial interest rate cuts this year. Six cuts were initially planned at the beginning of the year, they were reduced to three at the beginning of April, and now only two cuts are planned. Instead, European monetary authorities have hinted at possible rate cuts in the coming months.

Market expectations for the Fed's first rate cut have changed from June to September, reflecting ongoing concerns about inflation and uncertainty over whether the economic environment will soon support an easing of monetary policies. Additionally, disputes in the Middle East have reinforced the safe-haven appeal of the US dollar, further supporting its strength.

EUR/USD technical analysis

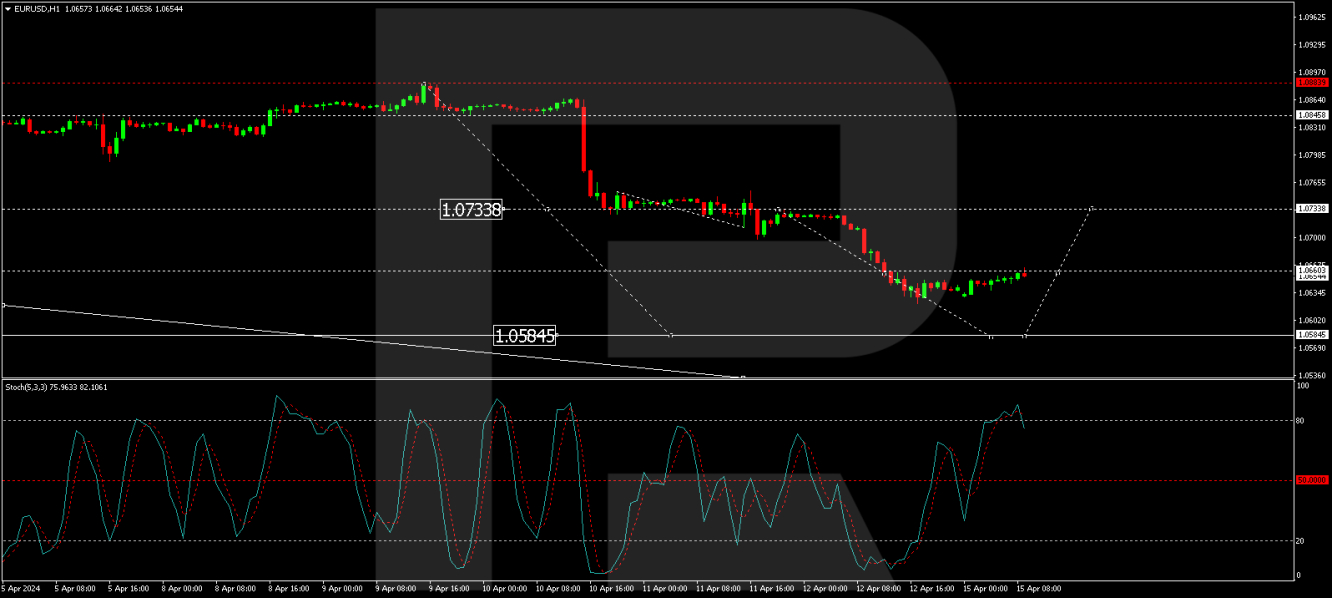

On the EUR/USD H4 chart, the pair formed a consolidation range around 1.0733 before starting a descending wave to 1.0622. A new consolidation range is currently forming above this level. An upside breakout from this range could lead to a corrective move towards 1.0733. On the contrary, a downward exit could indicate a continuation of the decline to 1.0585. The MACD indicator, with its signal line below zero and directed downwards, supports this bearish scenario.

The H1 chart shows the continued development of the bearish wave towards 1.0585. After completing a rally to 1.0622, the market is currently correcting to 1.0660. After this correction, a further drop to 1.0585 is expected. This bearish outlook is confirmed by the stochastic oscillator, currently above 80, with an expected drop to the 20 mark, indicating potential for further declines.

By RoboForex Analysis Department

Disclaimer

Any forecast contained herein is based on the author's personal opinion. This analysis cannot be considered trading advice. RoboForex assumes no responsibility for trading results based on the trading recommendations and reviews contained herein.