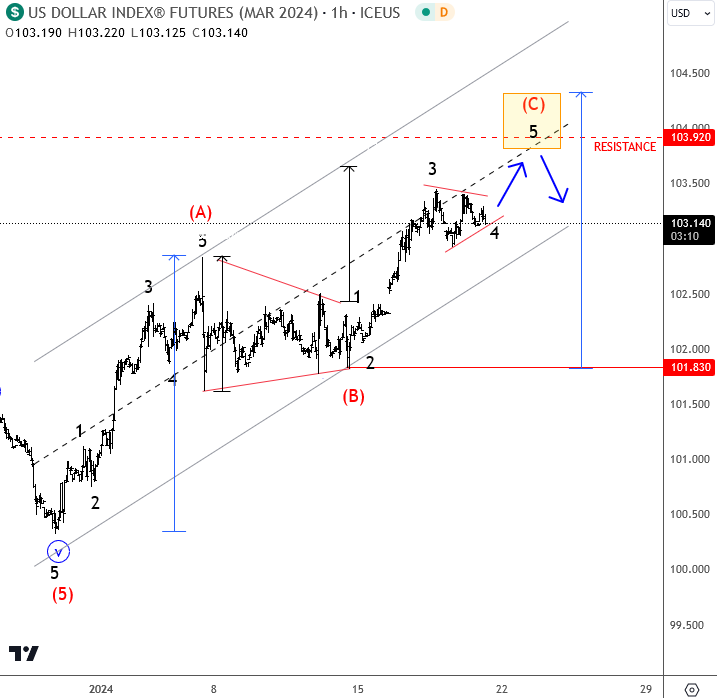

Yesterday, housing data and weekly jobless claims had some positive impact on the dollar, but then stocks rallied during the US session, keeping the dollar sideways with US yields still testing resistance. However, stocks look bullish in the short term, so I'm guessing DXY may not be too far from potential resistance, especially if stocks also end the week higher, which typically means continued risk for Monday. . Looking at the DXY hourly time frame, there may be a C wave underway, the final leg of a correction, but the sub-waves show room for further upward momentum, around the 104-104.30 area. So, ideally, there will be a new turn lower next week, when other currencies such as EUR, CAD and NZD can find new buyers.

If we look at today's calendar, in less than an hour we have ECB President Lagarde speaking, then retail sales in CAD, US consumer confidence, and existing home sales.