US Bank

Member FDIC.

offers a wide range of business checking accounts designed for startups, small businesses, and larger businesses. With several account options that meet various business needs, US Bank combines accessible in-branch services with a robust online platform, allowing businesses to streamline banking, minimize fees, and access a variety of financial management tools.

US Bank Quick FactsOur rating: 4.7 out of 5 Starting price: Business checking account options start with $0 monthly maintenance fees for basic accounts. Key Features:

|

US Bank Business Checking Account: A Versatile Solution for Businesses

Although choosing a bank for your business can be stressful, business owners who need flexible and reliable banking options should consider US Bank as a possible solution. US Bank offers accounts ranging from simple, fee-free options to more comprehensive plans for high-volume businesses.

With a nationwide network of branches and ATMs and access to advanced online banking tools for billing and expense management, US Bank appeals to both traditional and digital businesses. Additionally, businesses can benefit from relationship-based benefits such as reduced fees on select accounts and services, making them a strong competitor for growing businesses.

US Bank Business Check Reviews: User Opinions and Ratings

4.7/5

US Bank receives high praise from business customers for its flexible banking options and extensive branch network. Many appreciate the flexible options for managing accounts online, through the app, or in person. Small business owners, in particular, like the multi-tiered fee structure, which adapts to their growing business and transaction needs.

However, some customers note that specific account services, such as wire transfers and overdraft protection, may incur fees that vary by region, so it's important to first review the bank's fee schedule and determine your comfort level.

- Trusted pilot: 4.6 out of 5 stars

- Nerd Wallet: 4.5 out of 5 stars

- Forbes: 4.6 out of 5 stars

Customers frequently praise US Bank's robust digital tools and easy-to-use platform, citing the bank's efficient setup process and customer support.

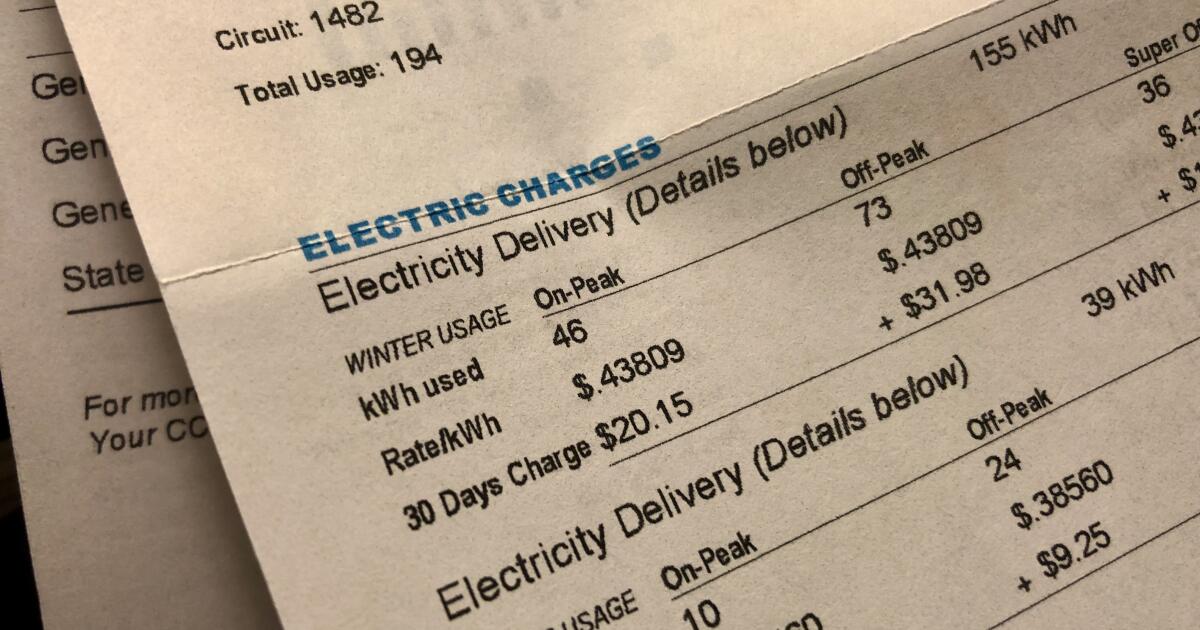

US Bank Business Check Pricing and Fee Structure

4.8/5

US Bank offers several checking account options to meet different business needs, from small startups to larger businesses that handle higher transaction volumes:

- Basic Business Checking Account: Starting price: $0 monthly maintenance fee, with up to 125 free transactions per statement period.

- Silver Business Check Package: Commission-free account with limited transactions and features suitable for new businesses.

- Gold Business Check Package: Starting at $20/month, this package offers 300 free transactions and cash deposit limits of up to $10,000 monthly.

- Platinum Business Checking Package: Ideal for high-volume businesses, starting at $30/month with 500 free transactions and higher deposit limits.

Each account offers features like free ACH transfers, online bill pay, and direct access to US Bank's extensive branch and ATM network. However, businesses that handle large cash transactions should review the bank's cash deposit limits, as additional fees may apply for higher amounts.

US Bank Key Features

4.7/5

US Bank offers several valuable features for businesses looking for an adaptable in-person banking solution with a robust online experience. Here's a closer look:

- Account Flexibility: Multiple merchant account options accommodate both smaller and larger businesses with tiered transaction and deposit limits.

- Wide access to ATMs and branches: Access to US Bank's extensive network for in-person services and fee-free ATM withdrawals.

- Digital and mobile banking: Intuitive online tools and a mobile app enable bill payment, account management, and expense tracking.

- Dedicated Customer Support: US Bank provides business support via phone, online chat, and in-person assistance.

Would our expert use US Bank?

5/5

For business owners who value in-person banking and digital tools, US Bank is a good option, especially for businesses that need tiered account options. The bank's flexibility, nationwide presence and customer service make it an attractive option, particularly for businesses anticipating growth and increased transaction needs in the near term.

However, businesses that require specific features, such as interest-bearing accounts or fee-free overdrafts, may find certain services expensive. It may be helpful to explore competitors like Novo or Bank of America for businesses that need additional benefits.

Advantages of the American bank

- Variety of account options: Suitable for both startups and larger companies with flexible limits.

- Access to branches and ATMs: Extensive national presence for in-person transactions and customer service.

- Comprehensive mobile platform: Includes mobile check deposit, bill pay, and budgeting tools.

Cons of US Bank

- Fee structure: Some fees for larger transaction volumes or bank transfers.

- Limited free options: Some features, such as overdraft protection, incur fees.

Alternatives to US Bank Business Checking Account

If US Bank Business Checking doesn't meet all your needs, here are some alternatives to consider:

| Starting price | Free | Free ($15/month waived fee) | Free |

| Key Features |

|

|

|

| Key distinctions | Benefits of earning interest for qualified accounts | Known for extensive in-person banking support | Optimized for technology-focused, digital-first businesses |

| More information |

Methodology

This review evaluates US Bank's business checking features based on fee structures, user reviews, account offerings, and customer service availability, with comparisons to other banks serving business needs.

Conclusion

US Bank Business Checking is a great option for businesses looking for a flexible and affordable banking solution. Its combination of in-person services and online tools makes it suitable for various business needs, from small startups to larger operations. While some fees apply, US Bank's adaptability and comprehensive support are clear advantages for business owners.

Frequently asked questions

Is US Bank a good bank to use?

Yes, US Bank is a solid choice for businesses due to its wide range of account options, extensive branch network, and strong customer service. It offers digital and in-person services, which benefits small and large businesses that need flexibility.

How long does it take for a business check to clear US Bank?

Generally, commercial checks at US Bank clear within 1 to 2 business days. However, factors such as the amount of the check and account history can affect this time frame.

How do I choose a bank account for my small business?

Consider factors such as monthly fees, transaction limits, online banking capabilities, customer support, and any additional services such as billing or cash management. US Bank offers several options to meet these needs, from basic, fee-free accounts to comprehensive packages for businesses with higher transaction volumes.

This article was reviewed by our banking expert Tricia Jones.