The UK Competition and Markets Authority has approved Meta’s new approach to managing advertiser data. This comes ahead of the implementation of a new competition regime in digital markets, which will give it more power to crack down on monopolistic behaviour by big tech companies.

In addition to approving Meta’s commitments, the CMA has also closed existing cases under the Competition Act concerning Google’s Play Store and Apple’s App Store, initiated in 2022 and 2021 respectively. The authority was concerned that requiring apps on these platforms to use Google’s and Apple’s respective billing systems for in-app purchases would harm competition.

Google proposed alternative payment options in response, but the CMA rejected them because they would still force developers to pay a high fee and could be off-putting to users due to the use of a pop-up screen.

The CMA said in a press release that its new regime, the Digital Markets, Competition and Consumer Act, will allow it to investigate potentially anti-competitive practices by Google, Apple and other tech companies “in a more comprehensive manner.”

The rules “will draw on and leverage its experience in areas it has already studied, such as mobile ecosystems, which include app stores.”

SEE: UK government investigates Amazon-Anthropic merger over competition concerns

How Meta's new commitments on advertising data came about

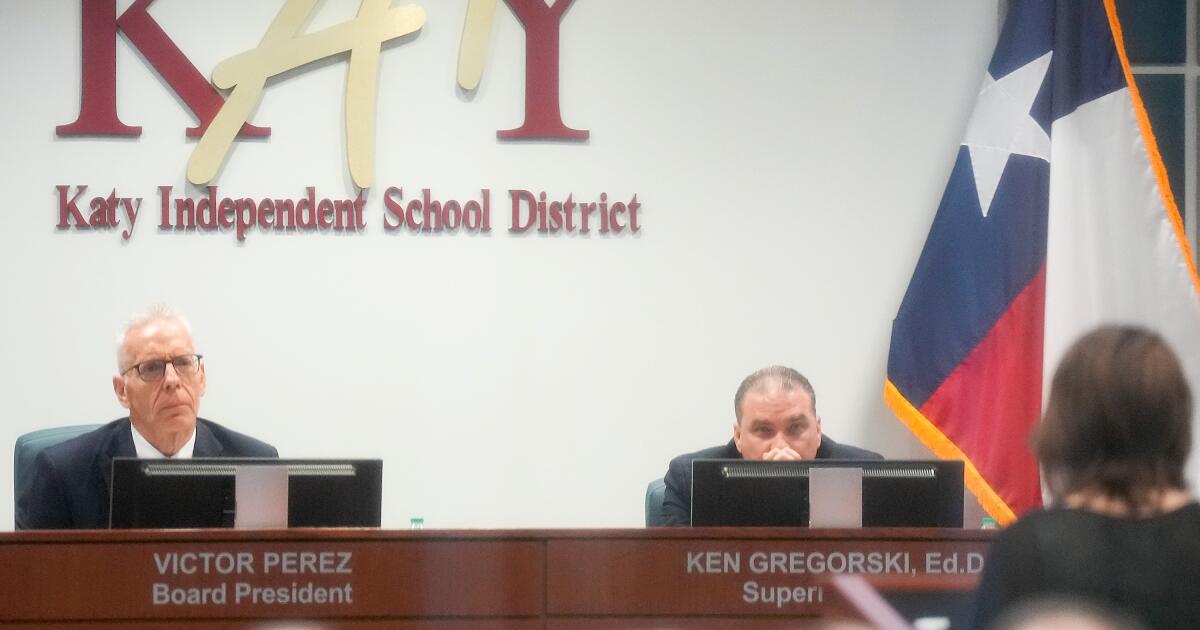

The investigation into Meta was launched in June 2021, when the CMA raised concerns about how the company’s data practices could be giving the platform an undue competitive advantage.

Originally, Mark Zuckerberg's company allowed advertisers to opt out of having their data used to improve Marketplace algorithms. However, the updated rules remove the need for this opt-in or opt-out process, ensuring a more level playing field for advertisers using Facebook Marketplace.

In 2022, Meta had over 10 million active advertisers across all its services. In 2021, the company earned between £4bn and £5bn from digital advertising in the UK, the company reported to the CMA, making it the largest provider of digital ads in the country. As such, it has a dominant position that it cannot abuse, as prohibited by Chapter II of the Competition Act 1998.

Meta collects data from its digital advertising services and from its single sign-on API for third-party websites, Facebook Login. The 2021 investigation was opened to determine whether Meta was using this data to give its own services, including Facebook Marketplace, an unfair advantage and breach the Competition Act.

“For example, data derived from users’ interaction with ads on Facebook could provide Meta with information about whether a user is interested in a particular product, such as sneakers, which in turn could contribute to the decision to show shoe listings to that same user when they open the Facebook Marketplace tab,” the CMA said in a press release.

In response to the CMA’s concerns, Meta submitted a series of commitments that would prevent it from “exploiting” its advertising clients’ data in May 2023. These included:

- Offer advertisers the ability to opt out of having their advertising data used in the development or operation of Facebook Marketplace. This includes data that illustrates how users interact with their ads and may tell Meta what products or services a user is interested in.

- Limit the use of advertising data that identifies advertisers to develop Meta products and confirm this commitment to advertisers through an official statement in its Code of Conduct.

In November 2023, the CMA accepted those commitments, but Meta voluntarily submitted a variation in April 2024. The proposed variation would allow Meta to limit the use of certain data from all advertisers that is used in the development or operation of the Marketplace.

WATCH: UK regulator investigates Microsoft and Inflection AI hiring over 'merger situation'

This would give the company an additional way to implement the data controls outlined in the original commitments, and all Marketplace advertisers can be confident that their data is not being used to benefit the platform without having to opt in or out.

The CMA consulted on the various commitments in May and June this year and announced its acceptance on 20 August.

Similarly, Amazon made a series of commitments to the CMA in 2023 after it concluded an investigation into whether it was abusing its power as the UK’s largest online marketplace. These included not using third-party sellers’ data to gain an unfair advantage.

While the dispute between Meta and the UK authority ended amicably, the same cannot be said for the EU and its investigation into Meta’s potentially anti-competitive practices. In July, the European Commission ruled that Meta’s ad-free subscription tiers created a “pay or consent” advertising model that violates the Digital Markets Act.

The “pay or consent” model “forces users to consent to the combination of their personal data and does not provide them with a less personalized but equivalent version of Meta’s social networks,” the Commission said.

The approach is also anti-competitive as it leverages Meta's dominance to limit consumer choice, making it harder for competitors without deep pockets of data to compete in offering targeted advertising services.

The DMA, established in 2022, is an EU regulation that aims to promote fairness and competition among digital products and services.

What is the Digital Markets, Competition and Consumers Act?

The DMCCA is a law designed to regulate the behaviour of large digital companies with significant market power. It was passed in 2020, but due to various delays, Parliament did not approve it until April 2023.

It gives the CMA new powers to impose requirements on technology companies with “strategic market status”, reminding “gatekeeper” organisations that they must comply with the EU WFD.

The fact that the CMA has not accepted Google's commitments in relation to the Play Store suggests that it will be one of the first to achieve such status. If it had accepted them, this would limit the actions the CMA could take against Google under the DMCCA.

While there are similarities, the new legislation is not as uniform as the DMA. Under the DMCCA, the CMA can apply tailored regulations, called “conduct requirements”, to companies with strategic status in the market to address their specific problems.

It is expected to come into force “later this year,” according to the CMA.