Mobile payments are transforming the way consumers and businesses interact. As more customers prefer to pay with their smartphones and other devices, small business owners must stay ahead. But what exactly are mobile payment services and how do they work?

In this guide, we'll explore the main mobile payment methods, how they work, and why they're important for your business. Whether you're a small business owner or looking to expand your payment options, understanding these technologies will help you stay competitive.

What are mobile payments?

Mobile payments refer to any financial transaction made through a mobile device, such as a smartphone or tablet. These payments can be made in person, online, or through an app. They use technologies such as short message service (SMS), mobile wallets, near field communication (NFC) and quick response (QR) codes.

This transaction method offers a faster and more convenient way for customers to complete transactions. Customers don't have to search for plastic bank cards and germ-laden cash.

For small businesses, accepting mobile payments can increase revenue, reduce wait times, and make the checkout process easier. Furthermore, it indicates the adoption of the newest technology. This factor can attract people to look for a more sophisticated shopping experience.

Here's a breakdown of six of the most popular mobile payment methods:

1. Send text messages to make payments

The traditional text message also works as a cash transfer vehicle. SMS payments (short message service) or text to pay allow customers to make purchases via text messages. These transactions are typically completed through the customer's mobile wallet, which we will discuss later.

While convenient, texting to pay is not ideal for point-of-sale transactions that need to be completed and verified quickly.

how it works

The company sends the customer an invoice, bill, or payment request via text message. The text usually includes an encrypted secure payment link for added security.

Why it is important for small businesses

SMS payments are ideal for businesses that need a simple, easy-to-use option. It is convenient for collecting invoices or recurring payments.

Considerations

The simplicity of SMS payments is attractive from the customer's point of view. However, they are more vulnerable to fraud and chargebacks. Additionally, some mobile operators charge per text message.

2. Mobile wallets

Mobile wallets like Apple Pay, Google Wallet, and Samsung Pay are well-known tools. These applications store payment information digitally. This pre-loaded data allows users to make transactions with a simple touch.

how it works

Customers enter their credit or debit card details into a mobile wallet app. When they are ready to pay, they take out the application. From there, a person can tap their smartphone to a contactless payment terminal or select their stored card for online purchases.

For most smaller purchases, no signatures or security details are required. Still, with bank-grade encryption, one-time security tokens, and other anti-fraud measures, mobile wallets are considered very secure tools.

Why it is important for small businesses

Mobile wallets allow customers to pay in a fast, secure and contactless way. For businesses, accepting mobile wallets can reduce friction in the checkout process, which can increase customer satisfaction and sales. Additionally, mobile wallets use encryption and tokenization for security purposes, making them a safe option for both businesses and customers.

Considerations

Businesses should ensure their point of sale (POS) system is NFC enabled. While most modern systems support mobile wallets, some older terminals may require an update.

3. Peer-to-peer (P2P) payment applications

Peer-to-peer (P2P) payment apps like Venmo, PayPal, and Cash App allow people to send and receive money quickly. Although these apps are designed for person-to-person transactions, many small businesses, freelancers, and service providers use them regularly.

how it works

Customers transfer money directly from their app account to a company's account. Unlike tap to pay, this method usually involves manually searching for the recipient's account in the app. As a result, people are asked to create a username or provide their email address.

Why it is important for small businesses

P2P payment apps are ideal for low-volume businesses or pop-up stores, freelancers, and service providers. They're easy to set up, typically have minimal fees, and offer fast payment transfers. But they are intended for more personal cases, hence the use of screen names and transaction notes.

Considerations

While P2P apps are convenient, they are not designed for high-volume business transactions. Many of these platforms limit the amount of money that can be sent or received in a given period of time. Additionally, payments are treated like cash, meaning there is less protection against fraud and errors.

4. Banking apps

Mobile banking apps offered by financial institutions allow customers to transfer money, pay bills, and sometimes make purchases directly from their bank accounts. These apps can also support payments through services like Zelle.

how it works

Customers use their bank's mobile app to transfer money or complete payments. Some banking apps allow businesses to set up a payment link, allowing customers to pay directly through their bank.

Why it is important for small businesses

Banking apps are a cost-effective way for small businesses to accept payments. Since transactions are made directly between banks, they typically have lower fees than credit card processing.

Considerations

While mobile banking apps are secure and efficient, they do not offer the same convenience as other payment methods. Not all customers use the same bank and, therefore, the same application. Additionally, the payment process may be slower compared to other mobile payment technologies.

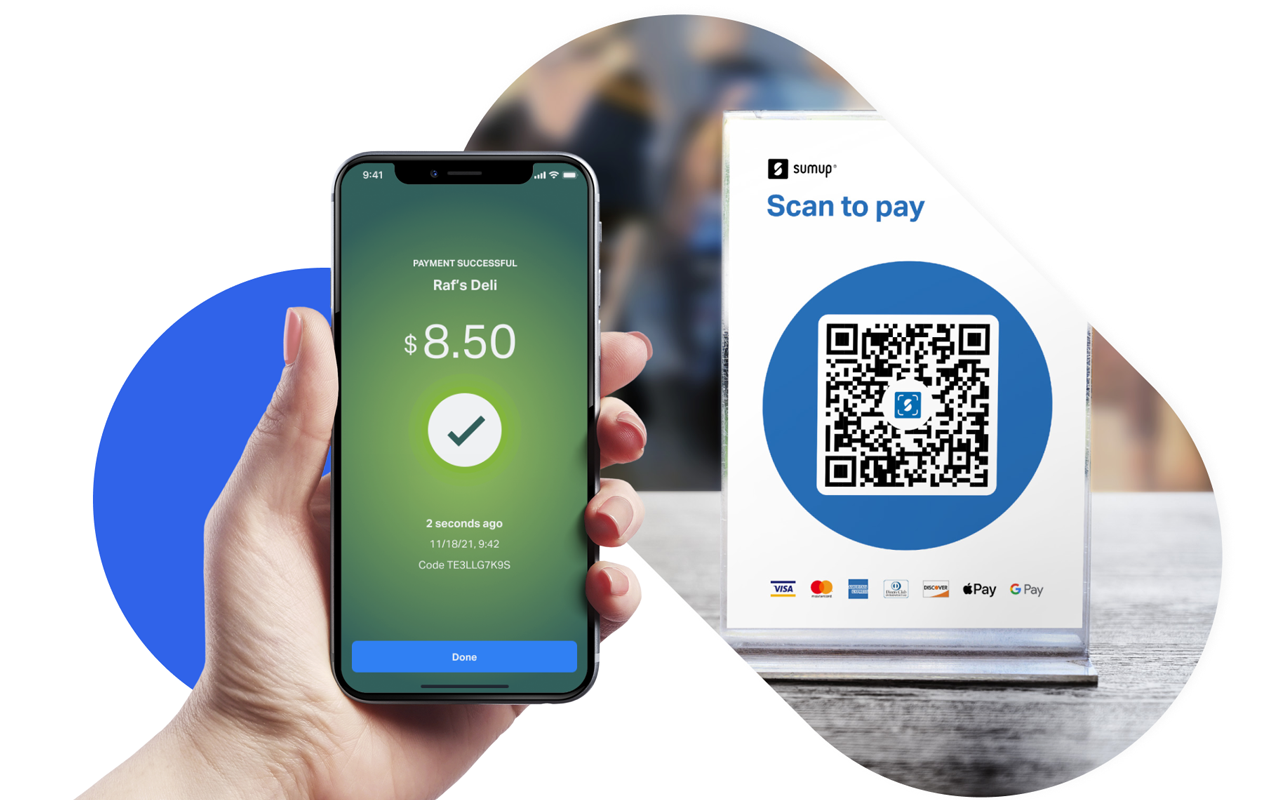

5. Payments with QR codes

QR code payments are appreciated for their simplicity and low implementation cost. They are a great combination of comfort and safety. But they largely depend on the customer's technological skills and Internet connection.

how it works

A company generates a QR code that links to a payment gateway. The customer scans the code with their smartphone, which opens a payment interface. From there, the customer completes the transaction by selecting their payment method.

Why it is important for small businesses

This payment method is easy to set up. You can project the QR code on anything from a napkin to a computer screen. This simplicity is ideal for all types of situations, from pop-up events to restaurant table payments.

Considerations

QR code payments require an internet connection and a newer smartphone model. Therefore, if cell reception is spotty or a customer is still using a flip phone, this method may have a drawback. And even with the right equipment, the cryptic appearance of a code means some people may be puzzled about how to pay.

You'll also need to make sure your QR code leads to the right place. A dead link kills transactions.

6. NFC contactless payments

NFC (near field communication) technology enables contactless payments. This concept allows customers to tap their mobile device or card on a terminal to pay. This method is most commonly used with mobile wallets. But it is also the technology behind credit or debit cards.

how it works

Customers bring their NFC-enabled device (such as a phone or wearable) to a payment terminal equipped to support this technology. The transaction is completed wirelessly in a couple of seconds. There is generally no need for signatures or other practical steps.

Why it is important for small businesses

NFC contactless payments stand out for their convenience, speed and security. For businesses with large transaction volumes, this method dramatically reduces transaction times. It also offers a hygienic and contactless payment option.

Considerations

Businesses will need a POS system that supports NFC technology. While this purchase involves a budget, the benefits of faster, more secure transactions can quickly recoup costs.

Frequently asked questions

What are the benefits of mobile payments for small businesses?

Mobile payments offer small businesses faster payment processes, less reliance on cash, lower transaction costs, and the ability to accept payments remotely or on the go. All of these factors can increase revenue and improve customer satisfaction. They also project a more tech-savvy image of your company, which improves public perception.

How are mobile payment methods different from traditional payment methods?

Mobile payment methods rely on smartphones and apps like Google Pay and Apple Pay. These tools move money through near-field communications, QR codes, or text messages. This dependence on technology separates it from traditional, tangible forms of payment, such as cash. Additionally, mobile payments are generally faster, more convenient and secure due to features such as tokenization and biometric authentication.

How do I check if my phone supports mobile payments?

To ensure compatibility, check that your device supports near field communication (NFC) or Bluetooth for contactless payments. Most modern smartphones have this technology built-in. Some mobile payments involve a QR code, which only requires the camera app on your phone.