The publication of US inflation data from last October was a real success for the markets, generating powerful unidirectional movements.

Consumer prices rose 0.3% in January, while annual inflation slowed from 3.4% to 3.1% instead of the expected 2.9%. The core CPI rose 0.4%, the highest level since May last year, and the index's annual growth rate remained at 3.9% instead of the expected slowdown to 3.7%.

Tuesday's release was the third in a row that exceeded expectations and the second time the default was more than 0.1 percentage point, which is considered significant for this indicator. The publication triggered a stunning reassessment of monetary policy expectations, which affected many market sectors.

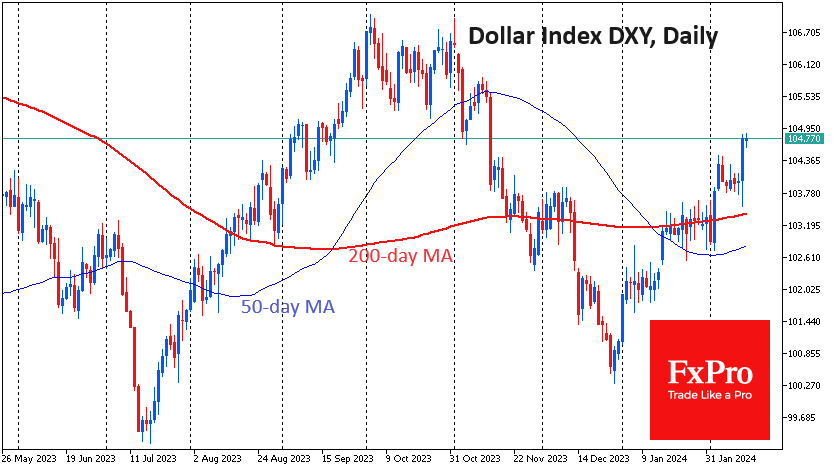

It has gained more than 1% from the lows immediately after publication. Its current level of 104.7 was last seen on November 14, during another inflation release.

Some observers point to the “January effect”, in which prices can vary sharply, but this is not indicative. We observe, however, that since last October we can speak of a slowdown in the slowdown in annual inflation, with a rebound in monthly growth rates. This is especially evident in the underlying index, while commodities and energy continue to make a negative net contribution to the total.

A month earlier, a similar data surprise was largely ignored by markets, which were then 80% sure of a rate cut on March 20. Following impressive management of expectations by the Federal Reserve and a strong employment report, the odds of such an outcome are now 9%.

Additionally, January inflation figures cast doubt on a rate cut in May. The odds have fallen from 64% to 33%. Such a marked revaluation is favorable for the dollar. It also lays the groundwork for the technical signals on dollar growth that emerged in early February.

Technically, the dollar index now has a direct path to 105.50. A return to this level would erase the drop in the November inflation release just after the Fed's dovish turn. A more ambitious target for dollar bulls could be the 106.5 zone, which would take the dollar back to its October highs. However, further progress will require much more effort and a qualitative change in fundamentals.

The FxPro Analyst Team