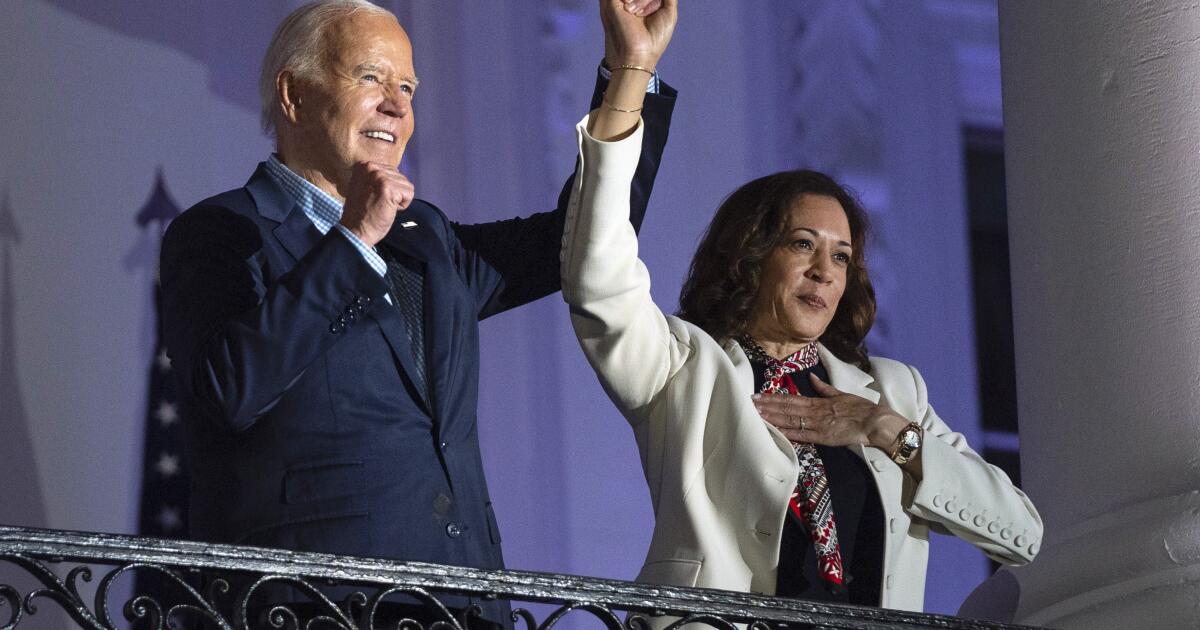

Free and fair elections, the foundation of our democracy, face a series of unprecedented threats as the next one approaches. While some of these threats are well known, others go largely unnoticed and have potentially serious consequences. Among the latter is a dangerous attempt to persuade one of our financial regulators to essentially authorize gambling on election results.

The Federal Election Commission, the agency with the experience, history and authority to regulate elections, might be expected to answer that question. But in fact, a financial services company asked an obscure financial regulatory agency to allow betting on elections through the commodities market, a prospect that could unleash a torrent of misinformation and harm investors for no discernible purpose. .

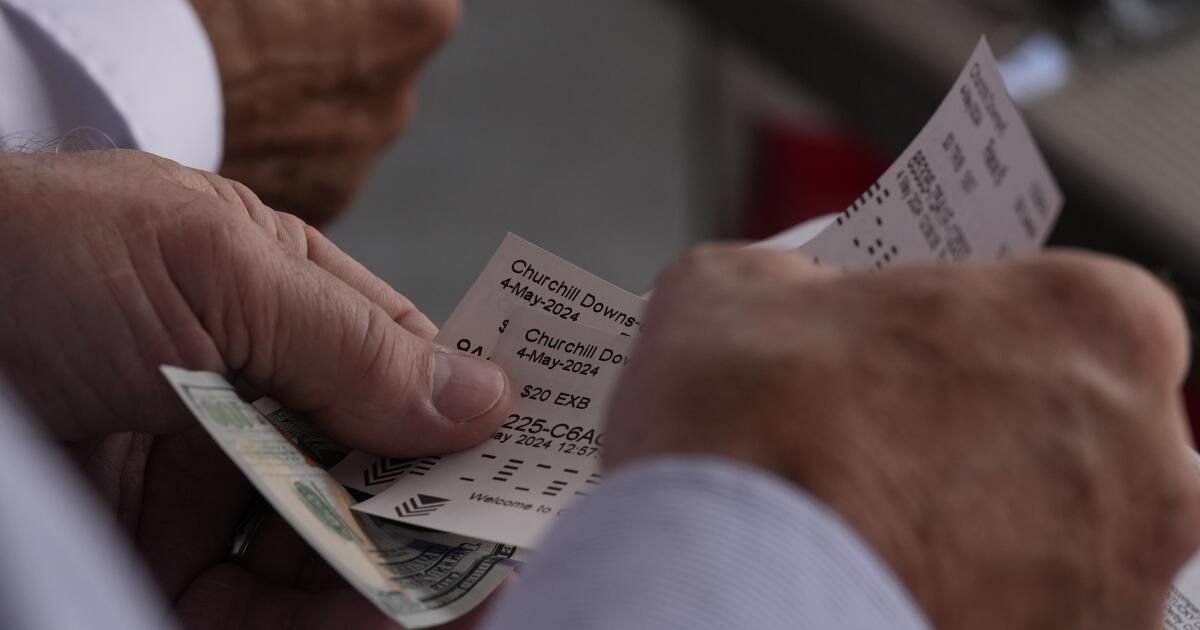

The company, Kalshi, asked the Commodity Futures Trading Commission to approve public trading of a so-called event contract that would allow investors to bet up to $100 million on which party would win control of the House and Senate. from the United States in November. The commission rightly rejected the proposal last fall, but the saga is barely over. In accordance with the financial industry standard manual, the company has sued the financial regulatorhoping a court will overrule the agency's experts and allow it to open a virtual election casino.

The stakes are high in the case, which is expected to be heard in federal court in Washington this week. First, the ability to “win” tens or hundreds of millions of dollars by betting on elections would create powerful new incentives for bad actors to influence voters and manipulate results to favor their bets. Artificial intelligence “deepfakes” and other technological tools to do so are available, increasingly cheaper and ready for distribution through social networks.

Just a few months ago, AI Robocalls Impersonating President Biden targeted New Hampshire primary voters in an effort to suppress turnout. We will undoubtedly see more such tactics before November, and allowing huge financial investments in the outcome would only enhance them, with potentially dire consequences for our democracy.

The idea of betting on elections is not new. Before the 2012 race between President Obama and Mitt Romney, betting on the outcome through the Ireland-based Intrade site led many observers to believe the Republican challenger was the favorite to win. However, upon closer examination, it turned out that a single gambler had wagered large sums of money to falsely prop up Romney.

Beyond the threat to democracy, electoral betting has the potential to harm investors on a large scale. The increasing prevalence of constant access to markets through game-like smartphone apps, advertising campaigns filled with celebrity faces, and false misinformation will entice more Americans to place risky bets. These technologies have the potential to generate speculative investment madness that costs investors dearly, as we saw during the “meme values“2021 frenzy.

The growing addiction to cryptocurrency trading and sports betting shows the danger of expanding these types of activities. And the threat to investors would grow as betting options inevitably expanded from congressional control to other federal, state and local races.

Electoral gambling contracts pose additional financial risks. Untethered to any fundamental values, these markets would be exceptionally easy to manipulate and difficult to control, further endangering unwary investors. The information that determines the price of contracts would be a hodgepodge of non-scientific, opaque and unregulated sources, such as surveys and media reports, that vary widely in rigor and reliability. The odds “house” and others bent on profit could likely compile, skew, and selectively deploy data to manipulate prices.

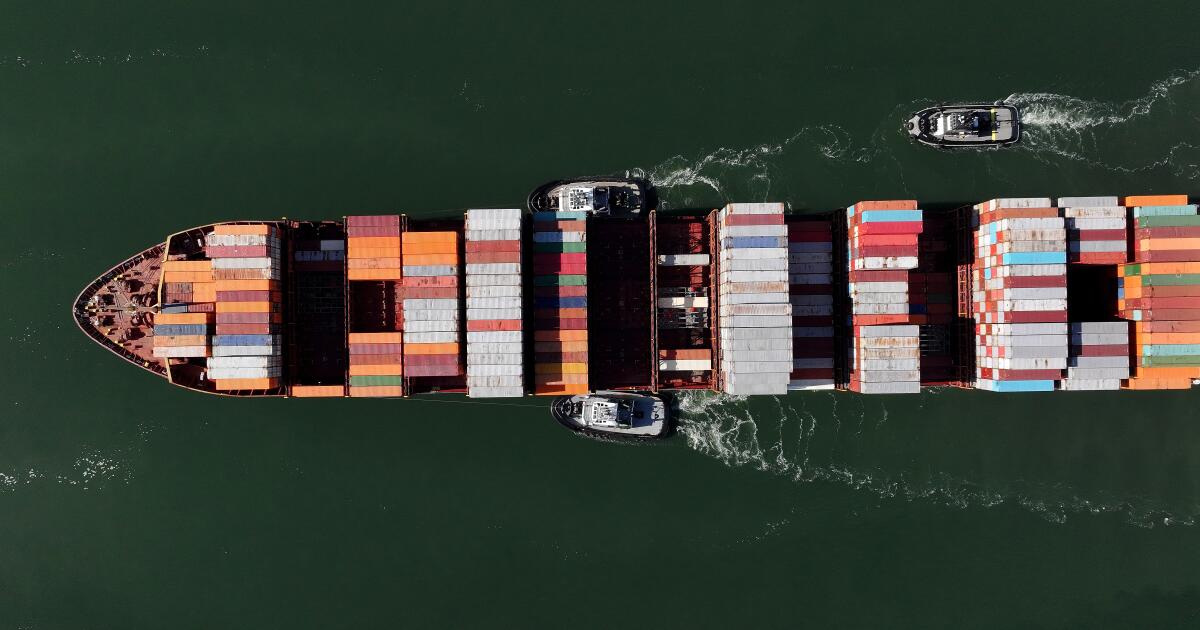

And all for what? These contracts would serve no useful purpose. Commodity markets, originally limited to trading futures contracts on traditional commodities such as crops, livestock and precious metals, have steadily grown to encompass more abstract “commodities” such as stock index futures. Event contracts are the latest phase of this evolution, and while some of them serve a useful function in the markets, the political gaming contracts at issue in this case simply do not.

Contracts are not reliable tools to protect against price fluctuations or fix the price of essential goods that Americans depend on, which is what the commodity commission is supposed to regulate. As the smallest and least funded U.S. financial regulatory agency, the commission should continue to focus on policing the multitrillion-dollar commodity and derivatives markets, without attempting to oversee the electoral process.

For more than 200 years, the courts have been emphatically and consistently warned of the unique social damage that corruption of the electoral process through gambling could entail. Congress has also recognized the extraordinary danger this idea poses, which is no doubt why it authorized the commodity commission to ban such contracts. The commission was right to say no, and for the sake of our democracy, the federal courts should too.

Dennis Kelleher is co-founder, president and CEO of Better Markets. Lisa Gilbert is the executive vice president of Public Citizen.