A key report from the Lloyds Banking Business Barometer (LON:) indicates a notable drop in hiring prospects among firms. The spread between companies looking to hire and those planning cuts fell to 27% from a high of 36% in February. This level is only slightly above the long-term average of 22%. Additionally, there has also been a marginal decline in the proportion of companies anticipating salary increases for next year.

Despite these trends, data from the Bank of England (BoE) offers a somewhat optimistic outlook and shows that British borrowers are managing the high interest environment relatively well. The incidence of problem debt remains significantly lower than levels seen after the 2008 financial crisis, underlining the resilience of the UK economic system and indicating signs of GDP recovery.

Catherine Mann, a member of the Bank of England's Monetary Policy Committee, has called for a more realistic assessment of monetary policy expectations, suggesting that market predictions of substantial interest rate cuts by the Bank of England could be too much. optimistic. Current market sentiment suggests a high probability of a rate cut at the Bank of England's August meeting.

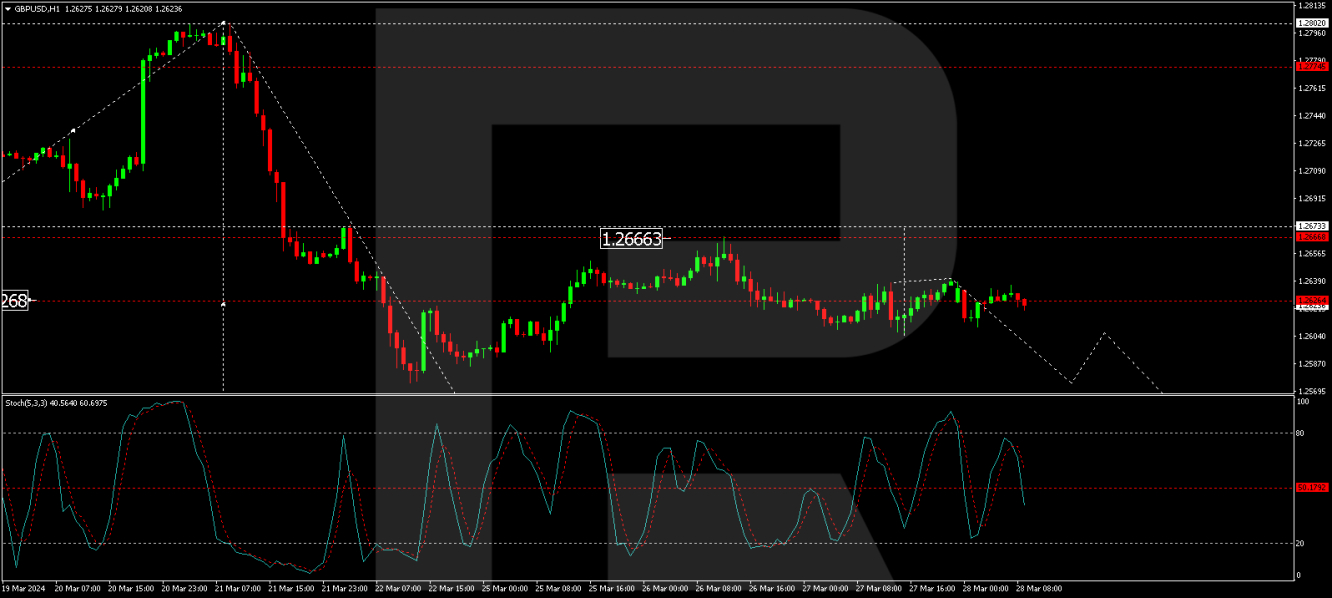

GBP/USD Technical Analysis

H4 chart analysis for GBP/USD shows ongoing consolidation around 1.2626. A break above this range could indicate a possible corrective rise to 1.2700. On the contrary, a move below this level may indicate a downward trend towards 1.2450 as the initial target. A possible correction to 1.2626 could follow, with a possible further decline to 1.2355. The MACD oscillator's position below zero supports the possibility of a continued bearish move.

On the H1 chart, the pair is forming a consolidation range around 1.2626, with no definite trend. A bullish break could lead to a corrective move towards 1.2676, while a bearish break could signal a continuation of a decline to 1.2545 and potentially 1.2450. The stochastic oscillator, currently below 80 and trending lower, aligns with the probability of a continued decline.

By RoboForex Analysis Department

Disclaimer

Any forecast contained herein is based on the author's personal opinion. This analysis cannot be considered trading advice. RoboForex assumes no responsibility for trading results based on the trading recommendations and reviews contained herein.